Western Union 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION 2006 Annual Report 48

Transaction Fees and Foreign Exchange Revenue

Consumer-to-consumer money transfer revenue growth

for the year ended December 31, 2006 over the same

period in 2005 was driven by international revenue

growth and the acquisition of Vigo, which was completed

in October 2005. Vigo contributed $140.5 million and

$24.2 million in total revenue for the years ended

December 31, 2006 and 2005, respectively. The anniversary

date of the acquisition of Vigo occurred in October 2006,

which will have an impact on reported revenue growth

rates in the future. Excluding Vigo, growth in international

consumer-to-consumer revenue partially offset the slowing

of Mexico and domestic revenue growth in the year ended

December 31, 2006 compared to the same period in 2005.

During 2006, the United States to Mexico and United

States domestic businesses, and to a lesser extent United

States outbound businesses, were adversely impacted by

the immigration debate and related activities in the United

States. This controversy around the subject of immigration

and the changes in the approach of various government

entities to the regulation of businesses that employ or sell

to immigrants has created fear and distrust among some

consumers in the United States. As a result, the frequency

of money transfer transactions involving these consumers

has decreased and some competitors have lowered prices

and foreign exchange spreads in certain markets. In 2006,

Western Union was also a party in two sets of legal disputes

pending in Arizona. The first set concerns the authority of

the Arizona Attorney General to request bulk data regarding

money transfers sent from states other than Arizona to

Sonora, Mexico. The data disputes are still pending. The

other dispute concerns the Attorney General’s authority

to seize money transfers sent from states other than

Arizona to Sonora, Mexico. In early January 2007, an Arizona

state court ruled on the latter proceeding, finding that the

State of Arizona did not have the authority to seize money

transfers sent from states other than Arizona to Sonora,

Mexico. In February 2007, the Arizona Attorney General

filed an appeal to this ruling. We continue to take measures

to address the data disputes and we believe that any impact

of these proceedings will not be material to our consumer-

to-consumer business. These and other issues adversely

affected our Mexico and United States domestic

businesses, and to a lesser extent our U.S. outbound

business in 2006, and we expect them to continue to

impact our businesses in the future.

In response to some of the challenges surrounding

the immigration debate and in line with our strategic

objective of building the Western Union brand, we have

continued to invest in targeted pricing actions taking into

account local market and competitive factors. Pricing

decreases generally reduce margins, but are done in

anticipation that they will result in increased transaction

volumes. Such pricing decreases have averaged

approximately 3% of our annual revenues over the last

three years, a trend that is expected to continue.

International revenue growth in the year ended

December 31, 2006 compared to the same period in 2005

resulted from growth in money transfer transactions

and the acquisition of Vigo. International money transfer

transaction growth in the year ended December 31, 2006

compared to the prior year period was driven most

significantly by growth in the United States and European

outbound businesses. The key inbound markets of India

and China continued to grow, with transactions in India

more than doubling and China transaction growth rates

exceeding 35% for the year ended December 31, 2006.

The international transaction growth rate excluding Vigo

for the year ended December 31, 2006 of 24% was

directionally consistent with the 26% growth rate for

the comparable period in 2005. Although international

intra-country transaction growth remained strong in 2006,

the overall international transaction growth rate during

2006 was impacted by high transaction growth rates

experienced in the intra-country business in the second

half of 2005, particularly in the Philippines.

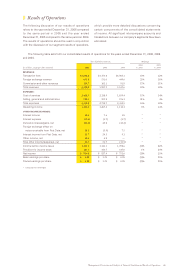

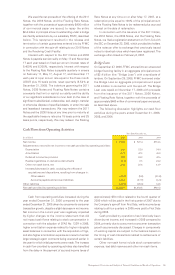

During the year ended December 31, 2006 international, domestic and Mexico revenue represented approximately

74%, 16% and 10% of our consumer-to-consumer revenue, respectively (or approximately 62%, 14% and 8% of total

consolidated revenue, respectively). The table below sets forth performance indicators for the consumer-to-consumer

segment for the years ended December 31, 2006, 2005 and 2004.

Years Ended December 31,

2006 2005

2006 (excluding Vigo) 2005 (excluding Vigo) 2004

Consumer-to-consumer transaction growth:

International

(a) 29% 24%

27% 26% 24%

Domestic

(b) (1)% (2)%

5% 5% 8%

Mexico

(c) 35% 6%

28% 21% 16%

Consumer-to-consumer revenue growth:

International

(a) 17% 15%

16% 15% 21%

Domestic

(b) (3)% (3)%

4% 4% 8%

Mexico

(c) 29% 7%

33% 27% 6%

(a) Represents transactions between and within foreign countries (excluding Canada and Mexico), transactions originated in the United States or Canada paid in foreign countries and

foreign country transactions paid in the United States or Canada. Excludes all transactions between or within the United States and Canada and all transactions to and from Mexico

as reflected in (b) and (c) below.

(b) Represents all transactions between and within the United States and Canada.

(c) Represents all transactions to and from Mexico.