Western Union 2006 Annual Report Download - page 70

Download and view the complete annual report

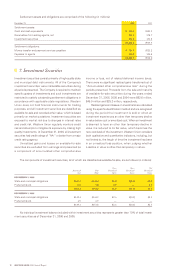

Please find page 70 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION 2006 Annual Report 68

|| 1. Formation of the Entity and

Basis of Presentation

The spin-off by First Data Corporation (“First Data”) of its

money transfer and consumer payments business to The

Western Union Company (“Western Union” or the

“Company”) became effective on September 29, 2006

through a distribution of 100% of the common stock

of The Western Union Company to the holders of record

of First Data’s common stock (the “Distribution”). The

Distribution was pursuant to a separation and distribution

agreement by which First Data contributed to The Western

Union Company the subsidiaries that operated its money

transfer and consumer payments businesses and its interest

in a Western Union money transfer agent, as well as related

assets, including real estate. The Company has received

a private letter ruling from the Internal Revenue Service

and an opinion from tax counsel indicating that the spin-

off was tax free to the stockholders, First Data and

Western Union.

The Western Union business consists of the following

segments:

||

CONSUMER-TO-CONSUMER

—

provides money transfer

services between consumers, primarily through

a global network of third-party agents using its multi-

currency, real-time money transfer processing

systems. This service is available for both

international cross-border transfers—that is, the

transfer of funds from one country to another and

intra-country transfers—that is, money transfers

from one location to another in the same country.

|| CONSUMER-TO-BUSINESS

—

focuses on payments from

consumers to businesses and other organizations

that receive consumer payments, including utilities,

auto finance companies, mortgage servicers, financial

service providers and government agencies, through

Western Union’s network of third-party agents and

various electronic channels. While the Company

continues to pursue international expansion of its

offerings in select markets, as demonstrated by the

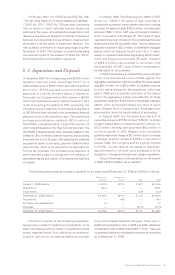

December 2006 acquisition of Servicio Electrónico

de Pago S.A. and related entities (“SEPSA”, see

Note 3), substantially all of the segment’s 2006

revenue was generated in the United States.

All businesses that have not been classified into the

consumer-to-consumer or consumer-to-business segments

are reported as “Other” and include the Company’s money

order and prepaid services businesses. The Company’s

money order business sells Western Union branded money

orders issued by Integrated Payment Systems Inc. (“IPS”),

a subsidiary of First Data, to consumers at non-bank retail

locations primarily in the United States and Canada. Western

Union’s prepaid service business markets a Western Union

branded prepaid card sold through its agent network primar-

ily in the United States and the Internet, and provides

top-up services for third parties that allow consumers to

pay in advance for mobile phone and other services. Also

included in “Other” are certain expenses incurred by

Western Union to effect the spin-off.

The primary entities providing the services described

above are Western Union Financial Services, Inc. and its

subsidiaries (“WUFSI”), Vigo Remittance Corp. (“Vigo”),

Orlandi Valuta, E Commerce Group, Paymap, Inc and SEPSA.

There are additional legal entities included in the

Consolidated Financial Statements of The Western Union

Company, including First Financial Management Corporation

(“FFMC”), WUFSI’s immediate parent company.

Various aspects of the Company’s services and

businesses are subject to U.S. federal, state and local

regulation, as well as regulation by foreign jurisdictions,

including banking regulations in certain foreign countries.

In addition, there are legal or regulatory limitations on

transferring certain assets of the Company outside of the

countries where the respective assets are located, or

because they constitute undistributed earnings of affiliates

of the Company accounted for under the equity method

of accounting. However, there are no limitations on the

use of these assets within those countries. As of December

31, 2006, the amount of assets subject to these limitations

totaled approximately $75 million.

As of December 31, 2006, Western Union has two

four-year labor contracts (both expiring August 6, 2008)

with the Communications Workers of America, AFL-CIO

representing approximately 960 employees.

Spin-off from First Data

In order to effect the spin-off from First Data, on September

27, 2006, prior to being contributed to the Company, FFMC

entered into a $2.4 billion bridge financing facility with a

syndicate of lenders and declared and paid a $2.4 billion

dividend to First Data, as sole stockholder in FFMC, by

execution and delivery of a promissory note to First Data.

On September 29, 2006, FFMC borrowed an aggregate

amount of $2.4 billion under the bridge facility and used

the proceeds to settle the outstanding promissory note

issued to First Data.

On September 27, 2006, the Company entered into

an unsecured, revolving credit facility with a syndicate of

lenders. On September 29, 2006, the Company borrowed

$100 million on such revolving credit facility and transferred

the proceeds to First Data, issued notes to First Data of

$1.0 billion and issued 765.3 million shares of its common

stock to First Data, all in consideration for the contribution

of First Data’s money transfer and consumer payments

businesses and related subsidiaries, including FFMC.

Immediately following completion of the spin-off, First

Data exchanged the $1.0 billion in notes with two financial

institutions for indebtedness of First Data that these

two financial institutions held at that time. The financial

institutions then received the proceeds from the subsequent

sale of the notes in a private offering. Refer to Note 15 for

more information on the borrowings of the Company.

As the money transfer and consumer payments

businesses, which were contributed by First Data to the

Company, have already been reflected in the Company’s

historical financial statements as if such businesses had

always been a part of the Company, the total amount of

the cash and debt securities transferred to First Data of

$3.5 billion, including the $2.4 billion dividend declared by

FFMC, has been reflected as a dividend to First Data in

the consolidated financial statements.