Western Union 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

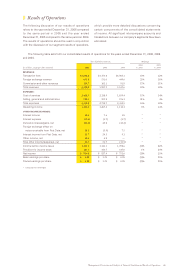

Management’s Discussion and Analysis of Financial Condition and Results of Operations 51

Operating income

For the year ended December 31, 2006, operating income

increased at a slower rate than revenue growth over the

same period in 2005. The shift in the United States to

electronic-based products, which have lower operating

margins compared to cash-based products that have higher

operating margins, negatively impacted operating income.

Also negatively impacting operating income were increased

costs associated with being a stand alone company, stock

compensation expenses incurred in connection with the

adoption of SFAS No. 123R, and higher employee incentive

compensation expenses in 2006 than in 2005.

The slight increase in operating income from 2004 to

2005 was due to transaction growth, offset by increased

corporate overhead allocations from First Data. Recent

trends in consumer-to-business operating margins are

impacted by the shift in the United States from cash-based

services to electronic payment services.

Other

The following table sets forth other results for the years ended December 31, 2006, 2005, and 2004.

Years Ended December 31, % Change

2006 2005

(in millions) 2006 2005 2004 vs. 2005 vs. 2004

Revenues $90.0 $113.7 $115.6 (21)% (2)%

Operating income $18.4 $ 0.9 $ 6.1 * *

* Calculation not meaningful

Revenues

Our money order and prepaid services businesses accounted

for 94%, 70%, and 64% of “Other” revenue in 2006, 2005,

and 2004, respectively. These two businesses are the only

businesses classified in “Other” with expected future

recurring revenue. We previously operated internet auction

payments, messaging and international prepaid cellular

top-up businesses, which were shut down or disposed of

in 2005 and early 2006. The decrease in the year ended

December 31, 2006 is due to declines in revenue from

such shut down and disposed of businesses while revenues

from our money order and prepaid services businesses

remained consistent. We do not believe the recent

announcement of First Data of its plan to exit its official

check and money order business will have a significant

impact on us, as First Data has indicated it will honor its

contract with us through the initial contract term of 2011.

We believe this provides us with adequate time to replace

the services currently provided by First Data.

Operating Income

For the year ended December 31, 2006, the increase in

operating income was driven by the money order business

and the elimination of operating losses of the businesses

shut down or disposed of primarily in 2006, partially offset

by recruiting and relocation expenses associated with hiring

senior management positions new to our company and

consulting costs used to develop ongoing processes, all

in connection with the spin-off from First Data. Aggregate

operating income/(losses) related to the shut down or

disposed of businesses for the years ended December

31, 2006, 2005 and 2004 were $0.1 million, $(16.2) million

and $(8.2) million, respectively.

The decrease in operating income during the year

ended December 31, 2005 from the year ended December

31, 2004 was due primarily to a goodwill impairment charge

recognized in 2005 of $8.7 million due to a change in

strategic direction relating to our majority interest in

EPOSS, our international prepaid top-up business.

Further financial information relating to each of our

segments’ external revenue, operating profit measures

and total assets is set forth in Note 17 to our Consolidated

Financial Statements.

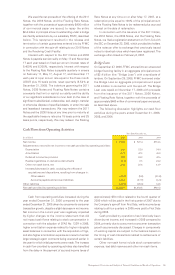

|| Capital Resources and Liquidity

Historically, our source of liquidity was cash generated

from our operating activities. Cash flows provided from

operating activities during 2006 was $1,108.9 million. We

expect 2007 cash flows generated from operations to be

lower than in 2006 due to significantly higher interest

payments and incremental public company expenses

as well as other anticipated working capital fluctuations,

including the expected payment of fourth quarter accrued

United States federal income taxes in the first quarter of

2007. Dividends paid to public stockholders going forward

are likely to be significantly less than those previously

paid to First Data. Taking into account the above factors,

estimated additional annual costs associated with being

a stand alone company, projected debt service in

2007, projected capital expenditures and projected stock

repurchases, we believe our cash flows will provide us

with an adequate source of liquidity to meet the needs of

our business.

Cash and Cash Equivalents

Highly liquid investments (other than those included

in Settlement assets) with original maturities of three

months or less (that are readily convertible to cash)

are considered to be cash equivalents and are stated

at cost, which approximates fair market value. At

December 31, 2006 and 2005, we held $1,421.7 million

and $510.2 million in cash and cash equivalents,

respectively.