Volvo 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

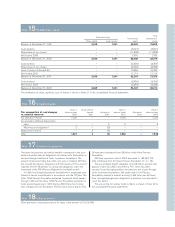

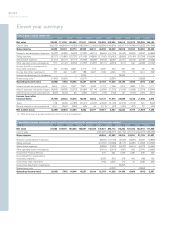

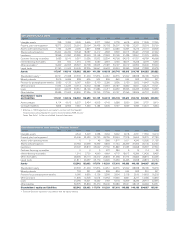

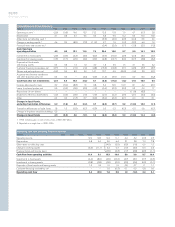

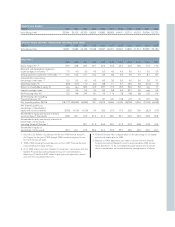

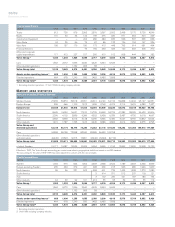

Key ratios 5

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Gross margin, % 1, 2 20.3 22.8 26.2 25.1 22.3 24.4 23.2 20.3 19.3 17.2 17.9

Research and development expenses

as percentage of net sales 1, 2 7.5 4.0 3.0 4.3 5.3 4.9 4.9 3.9 4.1 3.0 3.3

Selling expenses as percent of net sales 1, 2 10.5 10.3 10.1 10.2 9.5 9.4 9.0 7.0 7.7 8.1 8.7

Administration expenses as

percentage of net sales 1, 2 5.0 5.5 4.9 4.3 4.3 3.9 3.9 4.0 3.9 3.6 3.1

Operating margin, % (3.6) (0.7) 11.0 8.0 8.8 7.1 5.7 29.3 5.5 (0.4) 1.6

Return on shareholders’ equity, % neg neg 36.5 19.3 23.7 17.2 13.0 34.9 5.0 neg 1.7

Interest coverage, times 0.2 0.6 5.5 4.6 5.5 5.8 9.6 23.1 4.5 neg 2.2

Self-financing ratio, % 3122 148 247 151 73 115 78 108 89 125 176

Self-financing ratio excluding

Financial Services, % 3190 87 181 108 127 72 137 196

Net financial position, SEK M (18,117) (20,592) (6,999) 201 10,672 16,956 12,232 28,758 9,392 (7,042) (6,063)

Net financial position as

percentage of shareholders’

equity and minority interests (53.9) (61.0) (15.9) 0.4 18.3 27.0 17.4 29.3 10.6 (8.2) (7.7)

Shareholders’ equity and minority interests

as percentage of total assets 28.8 25.1 31.9 37.4 41.4 38.1 34.1 50.2 44.3 32.8 32.8

Shareholders’ equity and minority interests as

percentage of total assets,

excluding Financial Services 435.1 41.9 49.4 53.1 51.2 67.3 60.8 41.8 42.4

Shareholders’ equity as

percentage of total assets 25.4 20.1 31.3 36.9 41.0 37.6 33.7 49.9 44.0 32.6 32.7

1Key ratios are stated in accordance with the new 1997 Annual Accounts

Act. Figures for the years 1992 through 1996 have been adjusted to con-

form with the new principle.

21992–1996 including Financial Services. As from 1997 Financial Services

is accounted by the equity method.

3As of 1999, Volvo’s cash flow statement is presented in accordance with the

Swedish Financial Accounting Standards Council’s recommendation,

Reporting of Cash Flow, RR7. Values in prior years are adjusted in accord-

ance with the new presentation form.

4Financial Services had a marginal effect on the percentage of risk capital

and minority capital prior to 1994.

5Effective in 1997, adjustment was made to conform with the Swedish

Financial Accounting Standard Council’s recommendation, RR9, Income

Taxes. See Note 1, to the consolidated financial statements. Income per

share is calculated as net income divided by average number of shares.

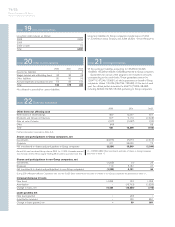

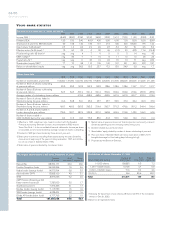

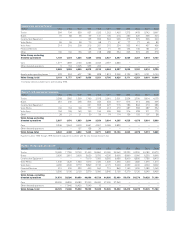

Salaries, wages and other remuneration (including social costs)

SEKM 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Volvo Group, total 16,857 19,489 24,156 27,248 25,997 26,951 30,064 19,832 21,510 33,453 34,136

Exports from Sweden

SEKM 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Volvo Group, total 30,344 36,130 43,330 56,059 54,589 58,569 64,401 52,719 46,251 50,394 52,730