Volvo 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66/67

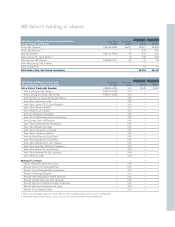

Parent Company AB Volvo

Board of Directors’ report

Corporate registration number 556012-5790.

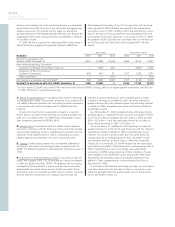

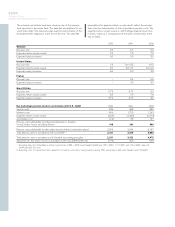

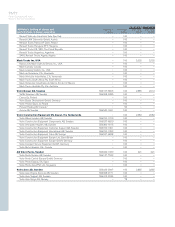

Income from investments in Group companies includes dividends in

the amount of 770 (24,814; 589), write-down of shares of 531

(12,217; 372) and net group contributions delivered totaling 3,835

(3,450; received 928). Income from other shares and participations

includes a dividend from Scania AB of 319 (637; 637) and in 2001

a capital gain of 595 from the sale of shares in Mitsubishi Motors

Corporation.

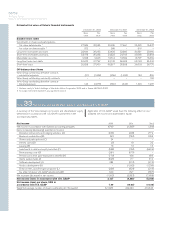

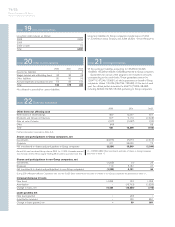

The book value of shares and participations in Group companies

amounted to 38,950 (38,140; 39,729), of which 38,537 (37,725;

39,314) pertained to shares in wholly owned subsidiaries. The corres-

ponding shareholders’ equity in the subsidiaries (including equity in

untaxed reserves but excluding minority interests) amounted to

49,657 (39,752; 63,636).

Shares and participations in non-Group companies included 628

(659; 679) in associated companies that are reported in accordance

with the equity method in the consolidated accounts. The portion of

shareholders’ equity in associated companies accruing to AB Volvo

totaled 861 (844; 616). Shares and participations in non-Group

companies included listed shares in Scania AB, Bilia AB, Deutz AG

and Henlys Group Plc with a book value of 26,131. The market

value of these holdings amounted to 16,502 at year-end. No write-

downs have been made since the fair value of the investments is

considered to be higher than the quoted market price of these

investments. Further information regarding the holding in Scania is

provided in Note 11 on page 72.

Financial net assets amounted to 3,281 (12,207; debt 5,178).

AB Volvo’s risk capital (shareholders’ equity plus untaxed

reserves) amounted to 67,841 corresponding to 85% of total assets.

The comparable figure at year-end 2001 was 82%.

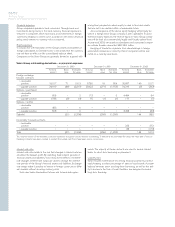

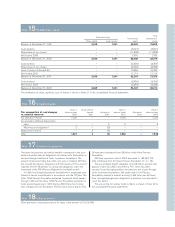

Income statements

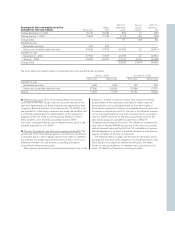

SEK M 2000 2001 2002

Net sales 377 500 441

Cost of sales (377) (500) (441)

Gross income –––

Administrative expenses Note 1 (393) (424) (560)

Other operating income and expenses Note 2 93 0 16

Income from investments in Group companies Note 3 1,558 9.599 (3,599)

Income from investments in associated companies Note 4 (166) 22 54

Income from other investments Note 5 663 1,258 326

Operating income 1,755 10,455 (3,763)

Interest income and similar credits Note 6 266 455 503

Interest expenses and similar charges Note 6 (353) (467) (261)

Other financial income and expenses Note 7 (44) (163) (34)

Income after financial items 1,624 10,280 (3,555)

Allocations Note 8 (133) 2 –

Taxes Note 9 (115) 832 1,070

Net income 1,376 11,114 (2,485)

Parent Company