Volvo 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20/21

Business Areas

Volvo Aero

Volvo Aero develops and manufactures

high-technology components for commer-

cial aircraft and rocket engines. Volvo

Aero also develops, manufactures and

maintains military engines. Volvo Aero

offers a wide range of services, including

sale of parts for aircraft engines and air-

craft, sale and leasing of aircraft engines

and aircraft, overhaul and repair of aircraft

engines, and asset management. In add-

ition, Volvo Aero develops, produces and

provides aftermarket services for gas-tur-

bine engines and systems.

The company’s businesses are based

on close cooperation with partners and

on selective specialization. Volvo Aero

operates world-wide but production is

located in Sweden and Norway.

Tot a l market

For the first eleven months of 2002 world

airline passenger traffic declined by 1.7%

compared with the corresponding period

in the preceding year. However, traffic

was 6% below the same period in 2000.

Total US traffic was down by 4% and

European international traffic by about

5% through November. However, the

Asia-Pacific region has its own dynamics

and international traffic increased by 5%.

Political and economic uncertainties

continue to impact the airline industry

worldwide and airlines are under intense

pressure. The market collapse following

the terrorist attacks of September 11,

2001 is still causing severe stress, espe-

cially for those reliant on the depressed

US market.

Business environment

The reduced airtravel and lower fares in

2002 have caused a deteriorating finan-

cial situation for the airlines. Two leading

US airlines, United Airlines and US

Airways, entered into Chapter 11 bank-

ruptcy protection during the second part

of 2002. According to Air Transport

World, the larger American airlines posted

total losses exceeding USD 11 billion in

2002. The demand for new aircraft has

been reduced significantly. The two air-

craft manufacturers Airbus and Boeing

delivered 684 new aircraft during the year,

down 20%. The decline continues, result-

ing in reduced order bookings for new air-

craft. Boeing reported a decline of 25%.

The decline is expected to continue in

2003 to a level about 15% lower than in

2002. No upturn is expected until 2005.

Market development

The decline in aircraft production and the

lower demand for overhaul of engines

and spare parts affect Volvo Aero. The

order intake in 2002 was down 50%, and

order backlog was 18% lower than in the

preceding year.

Financial performance

As a result of the continued downturn in

the aviation industry, Volvo Aero’s net

sales declined 25% to SEK 8,837 M

(11,784). Operating income deteriorated

to SEK 5 M (653), and operating margin

was 0.1%, compared with 5.5% in the

year-earlier period.

The weak earnings were attributable

primarily to the sharp decline in the after-

market, in which Volvo Aero was hit by the

reduced need for engine overhauls and new

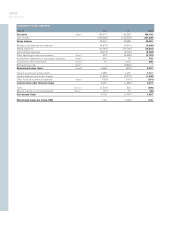

98 99 00 01 02

8.6 10.0 10.711.88.8

Net sales, SEK bn

98 99 00 01 02

527 584 621 653 5

Operating income, SEK M

98 99 00 01 02

6.1 5.9 5.8 5.5 0.1

Operating Margin, %

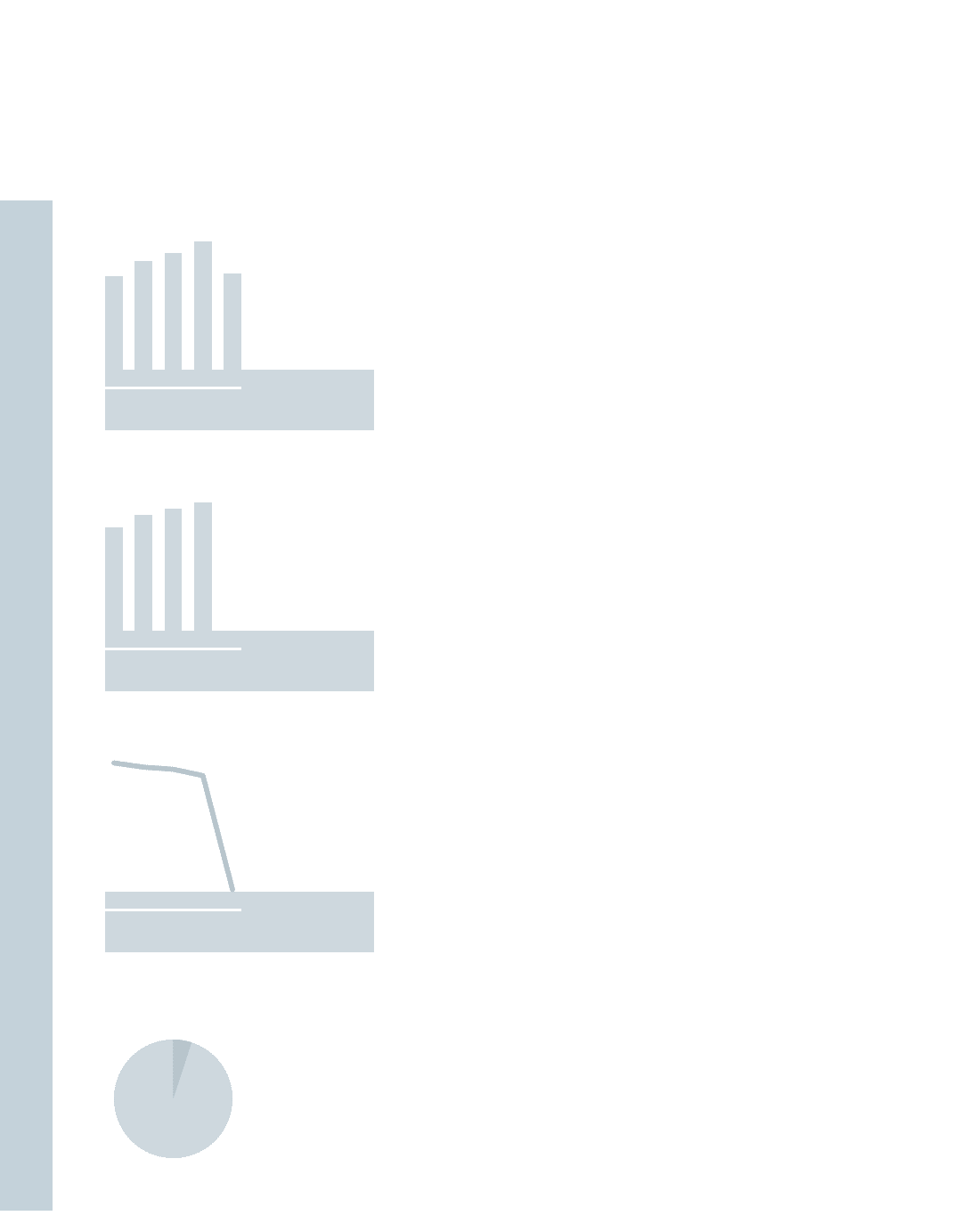

Net sales as percentage of Volvo Group sales, %

5%