Volvo 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

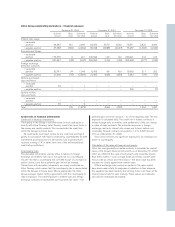

to these pensions and an additional SEK 1,966,100 for family pen-

sion. The pensionable salary is the sum of 12 times the current

monthly salary, Volvo’s internal value for company car, and a five-year

rolling annual average of earned bonus which is limited to a maxi-

mum of 50% of the annual salary. Leif Johansson has twelve months

notice of termination from AB Volvo and six months on his own

initiative. If Leif Johansson’s employment is terminated by AB Volvo,

he is entitled to a severance payment equal to two years’ salary, plus

variable salary. The severance payment will be adjusted for any

income after the termination of his contract with Volvo.

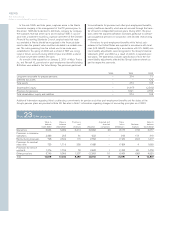

Leif Johansson, the Group Executive Committee, members of the

executive committees of subsidiaries and a number of key executives

receive variable salaries in addition to fixed salaries. Variable salaries

are based on operating income and cash flow of the Volvo Group

and/or of the executive’s company, in accordance with a system

established by the Volvo Board in 1993 and reviewed in 2000 and

2001. A variable salary may amount to a maximum of 50% of an

executive’s fixed annual salary. The Group Executive Committee con-

sisted of 15 members in addition to Leif Johansson, the total fixed

salaries for these top executives amounted to SEK 53 M, variable

salaries amounted to SEK 11 M and other benefits totaled SEK 5 M.

The employment contracts of the Group Executive Committee and

certain other senior executives contain provisions for severance pay-

ments when employment is terminated by the Company, as well as

rules governing pension payments to executives who take early

retirement. The rules governing severence payments provide that,

when employment is terminated by the Company, an employee is

entitled to severance pay equal to the employee’s monthly salary for

a period of 12 or 24 months, depending on age at date of severance.

In certain contracts, replacing contracts concluded earlier, an

employee is entitled to severance payments amounting to the

employee’s monthly salary for a period of 30 to 42 months. In agree-

ments concluded after the spring of 1993, severance pay is reduced,

in the event the employee gains employment during the severance

period, in an amount equal to 75% of income from new employment.

An early-retirement pension may be received when the employee

reaches the age of 60. A pension is earned gradually over the years

up to the employee’s retirement age and is fully earned at age 60.

From that date until reaching the normal retirement age, the retiree

will receive a maximum of 70% of the qualifying salary. From the age

of normal retirement, the retiree will receive a maximum of 50% of

the qualifying salary.

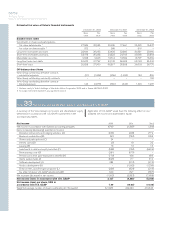

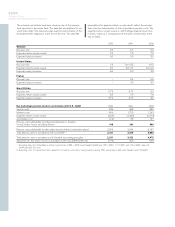

Volvo currently has two option programs for senior executives, one

call option program and one program for employee stock options.

The option programs have no dilutive effect on Volvo’s outstanding

shares. The options may only be exercised if the holder is employed

by Volvo at the end of the vesting period. However, if the holder’s

employment with Volvo is terminated for any reason other than dis-

missal or the holder’s resignation, the options may be exercised in

part in relation to how large part of the vesting period the holder has

been employed. If the holder retires during the vesting period, he or

she may exercise the full number of options.

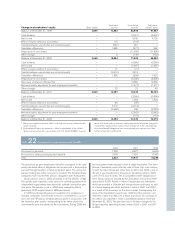

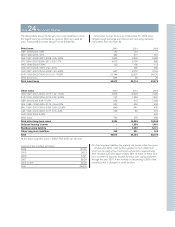

In October 1998, Volvo announced a call option program with two

subscriptions, one in 1999 and one in 2000. For the first subscrip-

tion in May 1999, options were subscribed to approximately 100

senior executives. For the second subscription in April 2000, options

were subscribed to approximately 60 senior executives.

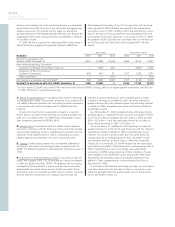

The call options subscribed in May 1999, which can be exercised

from May 18, 1999 until May 4, 2004, give the holder the right to

acquire 1.03 Series B Volvo shares for each option held from a third

party. The exercise price is SEK 290.70. The price of the options is

based on a market valuation and was fixed at SEK 68.70 by Trygg-

Hansa Livförsäkrings AB. The number of options corresponds to

apart of the executive’s variable salary earned. A total of 91,341

options were subscribed. The options were financed 50% by the

Company and 50% from the option-holder’s variable salary.

The second subscription took place in April 2000. These options

can be exercised from April 28, 2000 until April 27, 2005, and give

the holder the right to acquire one Series B Volvo share for each

option held from a third party. The exercise price is SEK 315.35. The

price of the options is based on market valuation by UBS Warburg

and was fixed at SEK 55.75. The number of options corresponds to

a part of the executive’s variable salary earned. A total of 120,765

options were subscribed. The options were financed 50% by the

Company and 50% from the option holder’s variable salary.

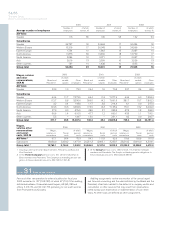

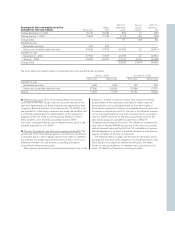

In January 2000, a decision was made to implement a new incen-

tive program for senior executives within the Volvo Group in the form

of so-called employee stock options. The decision covers allotment

of options for 2000 and 2001. In January 2000, a total of 595,000

options were allotted to 62 senior executives, including President

and CEO Leif Johansson, who received 50,000 options. The exe-

cutives have not made any payment for the options. The employee

stock options allotted in January 2000 give the holders the right,

from March 31, 2002 through March 31, 2003, to exercise their

options or alternatively receive the difference between the actual

price at that time and the exercise price determined at allotment. The

exercise price is SEK 239.35, which is equal to 110% of the share

price at allotment. The theoretical value of the options at allotment

was set at SEK 35, using the Black & Scholes pricing model for

options. Volvo has hedged the committments (including social costs)

relating to a future increase in share price, through a Total Return

Swap. Should the share price be lower than the exercise price at the

closing date, Volvo will pay the swap-holder the difference between

the actual share price and the exercise price at that time for each

outstanding option.

In May, 2001, the second allotment within the employee stock

option program took place. The allotment which was based on the

fulfillment of financial goals, covered a total of 163,109 options to

71 senior executives, including President and CEO Leif Johansson,

who received 13,600 options. The executives have not made any

payment for the options. These employee stock options give the

holders the right, from May 4, 2003 through March 31, 2004, to

exercise their options or alternatively receive the difference between

the actual price at that time and the exercise price determined at

allotment. The exercise price is SEK 159, which is equal to 100% of

the share price at allotment. The theoretical value of the options at

allotment was set at SEK 22, using the Black & Scholes pricing

model for options. Volvo has hedged the committments (including

social costs) relating to a future increase in share price, through a

Total Return Swap. Should the share price be lower than the exer-

cise price at the closing date, Volvo will pay the swap-holder the dif-

ference between the actual share price and the exercise price at that

time for each outstanding option.

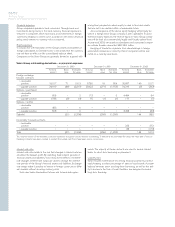

All obligations related to the employee stock option plans, includ-

ing the Total Return Swaps, are marked to market on a continuing

basis, any change in the obligation is recorded in the income state-

ment. In 2002 the cost for the employee stock option plans amount-

ed to SEK 36 M (income 15, cost 50), at December 31, 2002 the

provision related to these options amounted to 70.

No employee stock options were allocated in 2002 due to the

fact that the targets for 2001 were not achieved.

There were no payments for profit-sharing to employees for 2002,

2001 and 2000.