Volvo 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

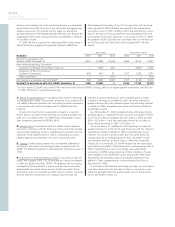

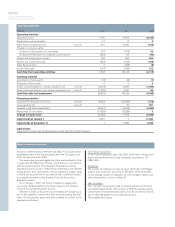

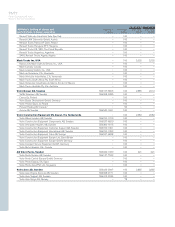

Note 1Administrative expenses

Administrative expenses include depreciation of 2 (17; 17) of which 2 (3; 4) pertain to machinery and equipment, – (1; –) to buildings and

–(13; 13) to rights in the Volvo Ocean Race.

Note 2Other operating income and expenses

Other operating income and expenses include surplus funds of – (3; 89) from Alecta.

Note 3Income from investments in Group companies

Of the income reported, 770 (24,814; 589) pertained to dividends

from Group companies. Group contributions delivered totaled a net

of 3,835 (3,450; received 928). Divestments of shares resulted in

capital loss of 3 (gains 452; 413). Write-downs of shareholdings

amounted to 531 (12,217; 372).

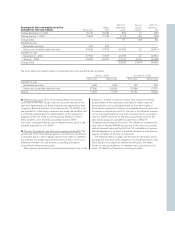

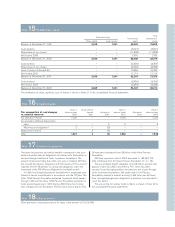

In 2001 Herkules VmbH, a subsidiary and the holder of shares in

Mitsubishi Motors Company, was sold to DaimlerChrysler, thus result-

ing in a capital gain of 172 in AB Volvo.

Income in 2000 included an additional capital gain of 382, per-

taining to the sale of shares in Volvo Personvagnar Holding AB to

Ford Motor Company.

Note 4Income from investments in associated companies

Dividends from associated companies that are reported in the Group

accounts in accordance with the equity method amounted to 44 (42;

49). The participation in Blue Chip Jet HB amounted to a loss of 25

(20; 28). Sale of shares in Eddo Restauranger AB resulted in a cap-

ital gain of 35. Income in 2000 included a net loss of 187 pertaining

to sale of shares. This was mainly attributable to the sale of shares in

AB Volvofinans.

Note 5Income from other investments

Of the income reported, 326 (663; 662) pertained to dividends from

other companies. The dividend from Scania AB was 319 (637; 637)

and from Henlys Group Plc 7 (26; 23). In 2001 transfer of shares

together with rights and obligations relating to Mitsubishi Motors

Corporation to a subsidiary, Herkules VmbH, resulted in a capital

gain of 595.

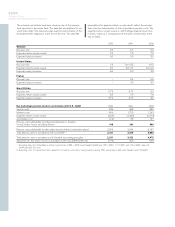

Note 6Interest income and expenses

Interest income and similar credits amounting to 503 (455; 266)

included interest in the amount of 503 (420; 141) from subsidiaries

and interest expenses and similar charges totaling 261 (467; 353),

included interest totaling 221 (451; 340), paid to subsidiaries.

Note 7Other financial income and expenses

Other financial income and expenses include guarantee commis-

sions from subsidiaries, unrealized gains (losses) pertaining to a

hedge for a program of personnel options, costs for confirmed credit

facilities as well as costs of having Volvo shares registered on vari-

ous stock exchanges. In 2001 additional financial expenses attribut-

able to a tax audit previously carried out are included.