Volvo 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

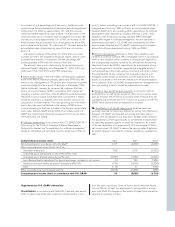

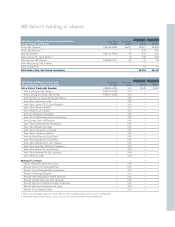

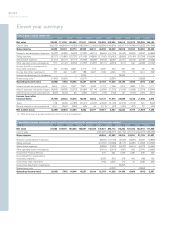

Note 15 Shareholders’ equity

Total

Restricted equity Unrestricted shareholders’

Share capital Legal reserve equity equity

Balance at December 31, 1999 2,649 7,241 66,009 75,899

Cash dividend – – (3,091) (3,091)

Repurchase of own shares – – (11,808) (11,808)

Net income 2000 – – 1,376 1,376

Balance at December 31, 2000 2,649 7,241 52,486 62,376

Cash dividend – – (3,356) (3,356)

Repurchase of own shares – – (8,336) (8,336)

Issue of shares to Renault SA – – 10,356 10,356

Net income 2001 – – 11,114 11,114

Balance at December 31, 2001 2,649 7,241 62,264 72,154

Cash dividend – – (3,356) (3,356)

Net income 2002 – – (2,485) (2,485)

Balance at December 31, 2002 2,649 7,241 56,423 66,313

The distribution of share capital by class of shares is shown in Note 21 to the consolidated financial statements.

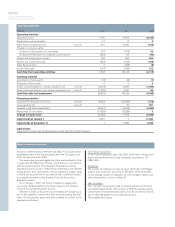

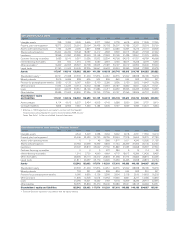

Note 16 Untaxed reserves

Value in Group internal Value in Value in

The composition of, and changes balance sheet transfer Allocations balance sheet Allocations balance sheet

in, untaxed reserves: 2000 2001 2001 2001 2002 2002

Tax allocation reserve 1,525 – – 1,525 – 1,525

Accumulated additional depreciation

Land – – 3 3 – 3

Machinery and equipment 2 – (2) – – –

Replacement reserve – 3 (3) – – –

Total 1,527 3 (2) 1,528 – 1,528

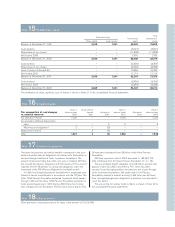

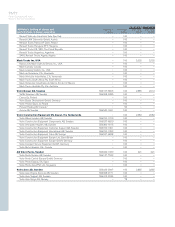

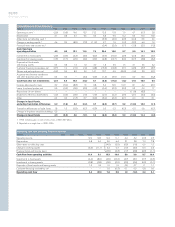

Note 17 Provisions for pensions

Provisions for pensions and similar benefits correspond to the actu-

arially calculated value of obligations not insured with third parties or

secured through transfers of funds to pension foundations. The

amount of pensions falling due within one year is included. AB Volvo

has insured the pension obligations with third parties. Of the amount

reported, 60 (10; 0) pertains to contractual obligations within the

framework of the PRI (Pension Registration Institute) system.

In 1996, two Groupwide pension foundations for employees were

formed to secure commitments in accordance with the ITP plan. The

Volvo 1995 Pension Foundation pertained to pension funds earned

through 1995 and the Volvo 1996 Pension Foundation pertained to

funds earned beginning in 1996. During 2000 these two founda-

tions merged into one foundation. Pension funds amounting to 0 (0;

0) have been transferred from AB Volvo to the Volvo Pension

Foundation.

AB Volvo’s pension costs in 2002 amounted to 168 (93; 70),

after withdrawal from the Volvo Pension Foundation of – (–; 24).

The accumulated benefit obligation of all AB Volvo’s pension obli-

gations at year-end 2002 amounted to 761, which has been

secured in part through provisions for pensions and in part through

funds in pension foundations. Net asset value in the Pension

Foundation, marked to market, accruing to AB Volvo was 60 lower

than corresponding pension obligations. A provision was recorded to

cover this deficit.

The accounting for surplus funds in Alecta is shown in Note 22 to

the consolidated financial statements.

Note 18 Other provisions

Other provisions comprise provisions for taxes in the amount of 21 (24; 68).