Volvo 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38/39

The Volvo Group

Notes to consolidated financial statements

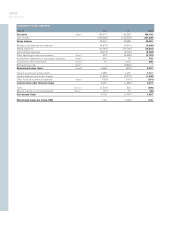

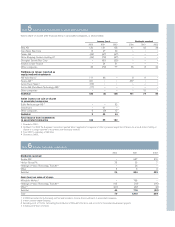

Note 3Net sales

Net sales per business and market area are shown in tables on page 85.

Note 4Other operating income and expenses

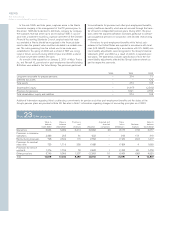

The effects during 2002, 2001 and 2000 on the Volvo Group’s bal-

ance sheet and cash flow statement in connection with the divest-

ment of subsidiaries and other business units are specified in

the following table:

2000 2001 2002

Intangible assets (17) (354) –

Property, plant and equipment (132) (288) (5)

Shares and participations 7 – –

Inventories (69) (939) (23)

Other receivables (93) (12,139) (43)

Liquid funds (7) (1,824) (13)

Minority interests 10 176 –

Provisions 158 2,922 –

Loans 38 420 –

Other liabilities 172 583 52

Divested net assets 67 (11,443) (32)

Liquid funds received 506 11,860 32

Liquid funds, divested

companies (7) (1,824) (13)

Effect on Group

liquid funds 499 10,036 19

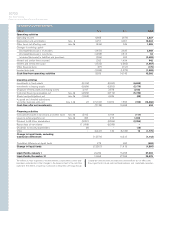

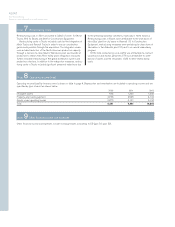

The effects during 2002, 2001 and 2000 on the Volvo Group’s bal-

ance sheet and cash flow statement in connection with the acquisi-

tion of subsidiaries and other business units are specified in

the following table:

2000 2001 2002

Intangible assets 125 8,914 135

Property, plant and equipment 68 9,126 95

Assets under operating lease – 10,195 286

Shares and participations (9) 433 (214)

Inventories 348 9,361 234

Current receivables 300 8,774 382

Liquid funds 2 4,059 105

Other assets 1 7,674 3

Shareholders’ equity – (10,356) –

Minority interests – – 119

Provisions (7) (14,524) (33)

Loans (89) (2,543) (247)

Liabilities (237) (30,020) (582)

Acquired net assets 502 1,093 283

Liquid funds paid (502) (1,093) (283)

Liquid funds according to

acquisition analysis 2 4,059 105

Effect on Group

liquid funds (500) 2,966 (178)

The effects during 2002 includes wholly owned subsidiaries that

previously were accounted for according to the equity method.

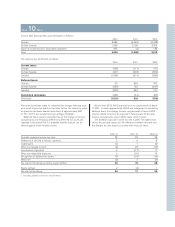

2000 2001 2002

Losses on forward and options contracts (700) (2,044) (195)

Exchange rate differences on trade receivables and payables 436 411 (266)

Amortization of goodwill (491) (1,058) (1,094)

Change in allowances for doubtful receivables, customer financing (397) (1,326) (1,018)

Change in allowances for doubtful receivables, other (172) (415) (362)

Surplus funds from Alecta (previously SPP) 683 43 –

Gain on sale of Volvia’s securities portfolio 610 – –

Gain on sale of Volvia’s insurance operations – 562 –

Adjustment of the gain on sale of Volvo Cars 520 90 –

Other income and expenses 133 (359) (1,217)

Total 622 (4,096) (4,152)