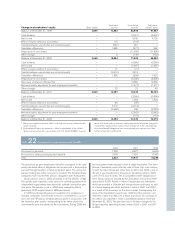

Volvo 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

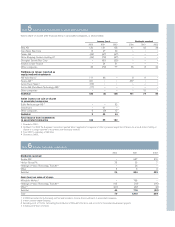

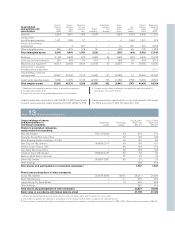

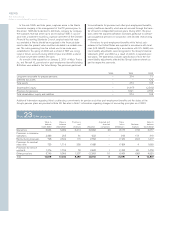

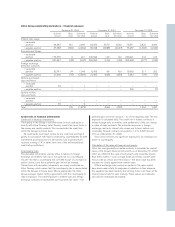

Other loans 2000 2001 2002

USD 1997–2001/2003–2017 1.42–13.0% 4,905 10,023 7,280

EUR 1990–2002/2004–2014 3.22–9.59% 747 1,453 1,841

GBP 2002/2005 4.44–7.18% 858 915 1,028

SEK 1988–1999/2009–2013, 4.3–6.15% 822 650 224

BRL 1998–2001/2004–2009 7.85–21.64% 849 641 435

CAD 1996–2002/2008–2017 3.55–4.0% 558 80 972

AUD 2002/2006 5.32% – – 400

Other loans 795 274 369

Total other long-term loans 9,534 14,036 12,549

Deferred leasing income – 1,898 1,481

Residual value liability – 7,250 5,121

Other long-term liabilities 265 231 102

Total 40,670 54,130 53,123

Of the above long-term loans, 1,358 (1,703; 693) was secured.

Long-term loans mature as follows:

2004 15,732

2005 9,813

2006 4,227

2007 8,624

2008 or later 8,023

Total 46,419

Of other long-term liabilities the majority will mature within five years.

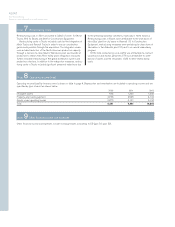

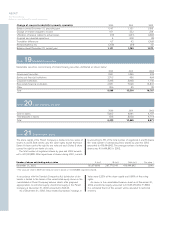

At year-end 2002, credit facilities granted but not utilized and

which can be used without restrictions amounted to approximately

SEK 18 billion (22; 23). Approximately SEK 16 billion of these facil-

ities consisted of stand-by facilities for loans with varying maturities

through the year 2007. A fee normally not exceeding 0.25% of the

unused portion is charged for credit facilities.

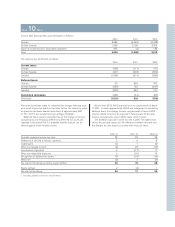

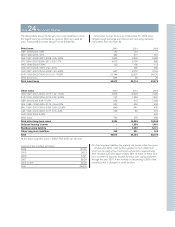

Note 24Non-current liabilities

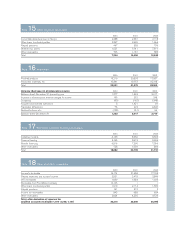

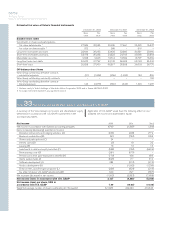

Bond loans 2000 2001 2002

GBP 1999/2003, 4.6% 142 154 –

DKK 1998/2005, 4.0% 389 317 310

SEK 1997–2002/2004–2008, 4.05–9.8% 2,952 2,502 5,950

JPY 1999–2002/2004–2011, 0.3–1.7% 4,812 2,130 888

HKD 1999/2006 7.99% 122 136 113

CZK, 2001/2004–2007, 2.92–6.5% – 466 306

USD 1997–2001/2004–2008, 1.42–6.0% 667 2,070 2,154

EUR 1995–2002/2004–2010, 0.1–7.62% 21,144 22,907 24,120

Other bond loans 644 33 29

Total bond loans 30,872 30,715 33,870

The listing below shows the Group’s non-current liabilities in which

the largest loans are distributed by currency. Most are issued by

Volvo Treasury AB and Volvo Group Finance Europe BV.

Information on loan terms is as of December 31, 2002. Volvo

hedges foreign-exchange and interest-rate risks using derivative

instruments. See also Note 32.