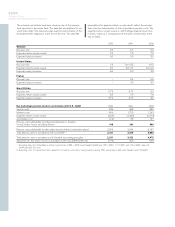

Volvo 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

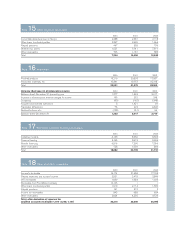

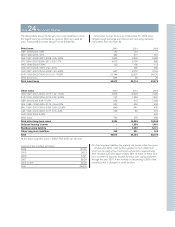

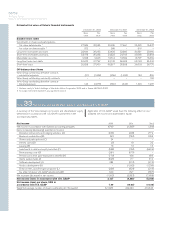

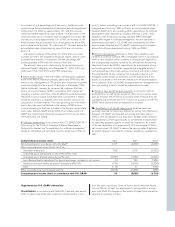

Volvo Group’s outstanding derivative contracts pertaining to commercial exposure, December 31, 2002

The table shows forward contracts and option contracts to hedge future flows of commercial payments.

Other Fair

Currencies currencies value 2

Inflow Inflow Inflow

SEKM USD GBP EUR Net SEK

Due date 2003 amount 538 200 613 1,089

rate19.56 14.50 9.22

Due date 2004 amount 154 3 437 (409)

rate110.23 14.47 9.07

Due date 2005 amount 99 (3) – (316)

rate110.23 15.01 –

Total 791 200 1,050 364

of which, option contracts 87 – 391 (405)

Fair value of forward

contracts 2633 60 34 128 855

1Average forward contract rate.

2 Outstanding forward contracts valued to market rates.

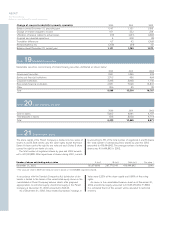

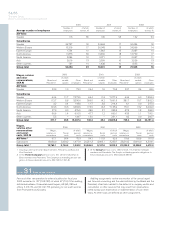

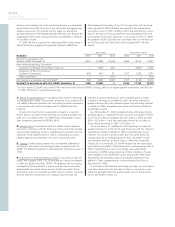

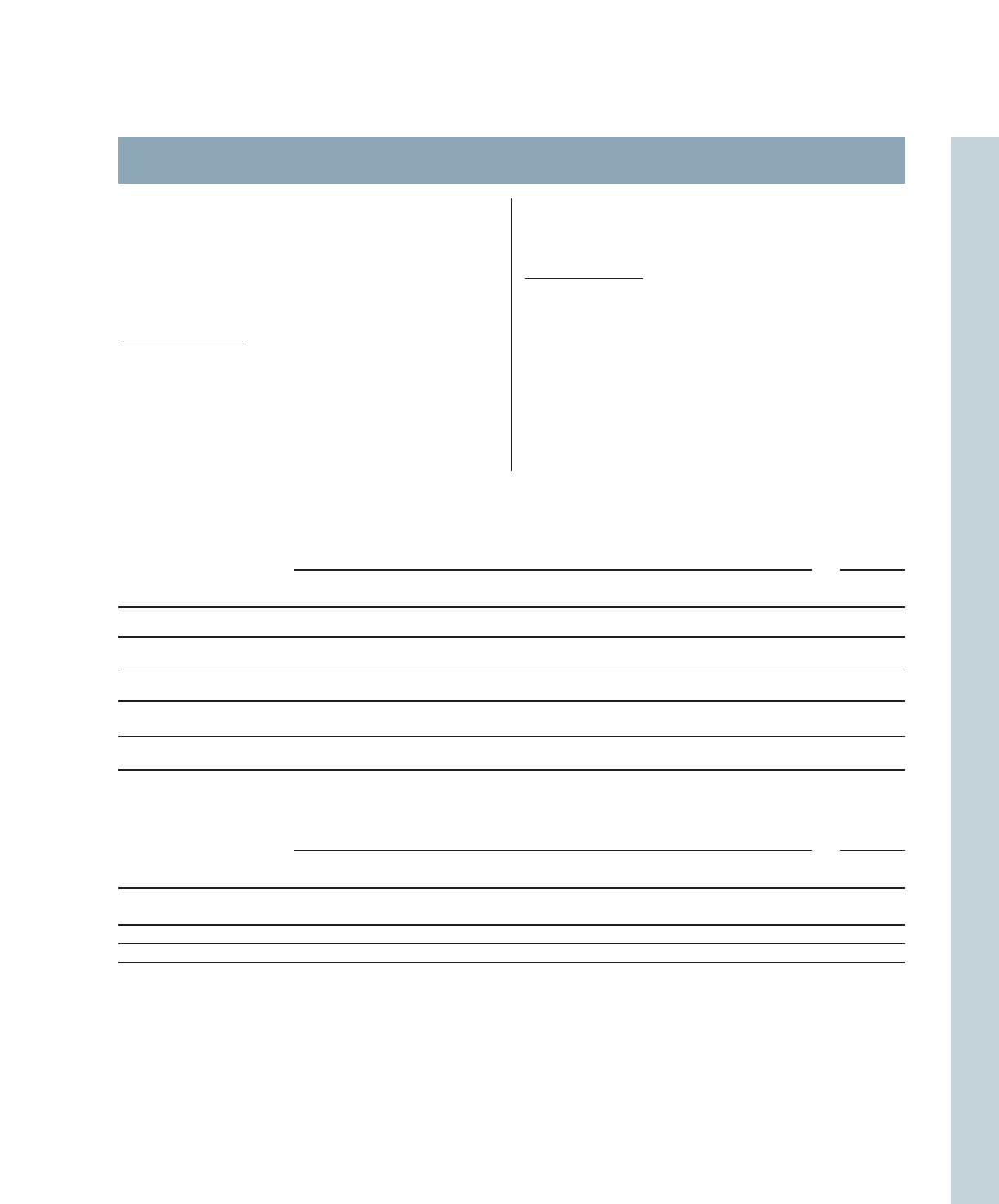

Volvo Group’s net flow per currency Other

Currencies Currencies Total

Inflow Inflow Inflow

SEKM USD GBP EUR Net SEK

Net flow 2002 amount 735 369 1,057

rate 39.7287 14.5816 9.1596

Net flow SEK, 37,100 5,400 9,700 6,600 28,800

Hedged portion, % 473 54 58

3Average exchange rate during the financial year.

4Outstanding currency contracts, regarding commercial exposure due in 2003, percentage of net flow 2002.

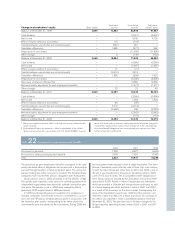

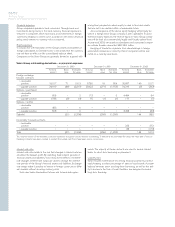

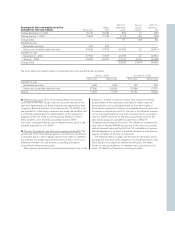

Note 32Financial risks

The Volvo Group is exposed to various types of financial risks. The

Volvo Group Financial Risk Policies form the basis for each Group

company’s action program. Monitoring and control is conducted con-

tinuously in each company as well as centrally. Most of the Volvo

Group’s financial transactions are carried out through Volvo’s in-

house bank, Volvo Treasury, which conducts its operations within

established risk mandates and limits.

Foreign exchange risks

Volvo’s currency risks are related to changes in contracted and pro-

jected flows of payments (commercial exposure), to payment flows

related to loans and investments (financial exposure), and to the

translation of assets and liabilities in foreign subsidiaries (equity

exposure). The objective of the Volvo Group Currency Policy is to

minimize the short-term impact of adverse exchange rate fluctu-

ations on the Volvo Group’s operating income, by hedging the

Group’s forecasted transaction exposure, including firm flows.

The objective is also to reduce the Group’s balance sheet expos-

ure to a minimum. Volvo Group Companies individually should not

assume any currency risk.

Commercial exposure

According to the Volvo Group Currency Policy, forecasted currency

flows representing firm exposure and forecasted exposure with a

pre-fixed price in local currency should be hedged. Volvo uses for-

ward exchange contracts and currency options to hedge these flows.

In accordance with the Group’s currency policy, between 50% and

80% of the net flow in each currency is hedged for the coming

6months, 30% to 60% for months 7 through 12 and firm flows

beyond 12 months should normally be fully hedged. The notional

value of all forward and option contracts as of December 31, 2002

was SEK 20.9 billion (12.1; 16.7).