Volvo 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36/37

The Volvo Group

Notes to consolidated financial statements

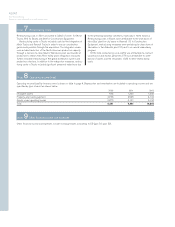

appropriate cases by write-downs, and estimated useful lives.

Capitalized type-specific tools are generally depreciated over 2 to 8

years. The depreciation period for assets under operating leases is

normally 3 to 5 years. Machinery is generally depreciated over 5 to

20 years, and buildings over 25 to 50 years, while the greater part of

land improvements are depreciated over 20 years. In connection with

its participation in aircraft engine projects with other companies,

Volvo Aero in certain cases pays an entrance fee. These entrance

fees are capitalized and depreciated over 5 to 10 years.

The difference between depreciation noted above and depreci-

ation allowable for tax purposes is reported by the parent company

and in the individual Group companies as accumulated accelerated

depreciation, which is included in untaxed reserves. Consolidated

reporting of these items is described below under the heading

Deferred taxes, allocations and untaxed reserves.

Goodwill is included in intangible assets and amortized over its

estimated useful life. The amortization period is 5 to 20 years. The

goodwill pertaining to Renault V.I., Mack Trucks, Volvo Construction

Equipment, Champion Road Machinery, Volvo Aero Services, Prévost,

Nova BUS, Volvo Bus de Mexico, Volvo Construction Equipment

Korea and Volvo Aero Norge are being amortized over 20 years due

to the holdings’ long-term and strategic importance.

If, at a balance sheet date, there is any indication that a tangible

or intangible non-current asset has been impaired, the recoverable

amount of the asset is estimated. If the recoverable amount is less

than the carrying amount, an impairment loss is recognized and the

carrying amount of the asset is reduced to the recoverable amount.

Inventories

Inventories are stated at the lower of cost, in accordance with the

first-in, first-out method (FIFO), or net realizable value. Provisions are

made for obsolescence.

Marketable securities

Marketable securities are stated at the lower of cost or market value

in accordance with the portfolio method.

Liquid funds

Liquid funds include cash and bank balances and marketable securi-

ties. Marketable securities to some extent consist of interest-bearing

securities with maturities exceeding three months. However, these

securities have high liquidity and can easily be converted to cash.

Post-employment benefits

Most of the Volvo Group’s pension commitments are met through

continuous payments to independent authorities or bodies that

administer the plans. Pension expense corresponding to the fees

paid for these defined-contribution pension plans is reported continu-

ously. In certain of Volvo’s subsidiaries, mainly in Sweden and the

US, there are defined benefit plans covering pensions and health-

care benefits. For these plans, a provision and annual pension

expense are calculated based on the current value of the earned

future benefits. Provisions for pensions and annual expenses related

to defined pension and healthcare benefits are reported in Volvo’s

consolidated balance sheet and income statement by applying the

local rules and directives in each country.

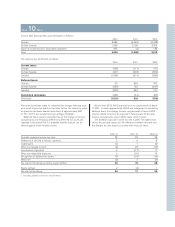

Provisions for residual value risks

Residual value risks are attributable to operational lease contracts

and sales transactions combined with buy-back agreements or re-

sidual value guarantees. Residual value risks are the risks that Volvo

in the future would have to dispose used products at a loss if the price

development of these products is worse than what was expected

when the contracts were entered. Provisions for residual value risks

are made on a continuing basis based upon estimations of the used

products’ future net realizable values. The estimations of future net

realizable values are made with consideration of current prices,

expected future price development, expected inventory turnover

period and expected variable and fixed selling expenses. If the re-

sidual value risks are pertaining to products that are reported as tan-

gible assets in Volvo’s balance sheet, these risks are reflected by

depreciation or write-down of the carrying value of these assets.

If the residual value risks are pertaining to products which are not

reported as assets in Volvo’s balance sheet, these risks are reflected

under the line item provisions.

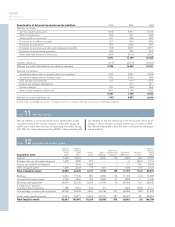

Deferred taxes, allocations and untaxed reserves

Tax legislation in Sweden and other countries sometimes contains

rules other than those identified with generally accepted accounting

principles, and which pertain to the timing of taxation and measure-

ment of certain commercial transactions. Deferred taxes are provided

for on differences which arise between the taxable value and report-

ed value of assets and liabilities (temporary differences) as well as

on tax-loss carryforwards. However, with regards to the valuation of

deferred tax assets (the value of future tax deductions), these items

are recognized provided that it is probable that the amounts can be

utilized in connection with future taxable income.

Tax laws in Sweden and certain other countries allow companies

to defer payment of taxes through allocations to untaxed reserves.

These items are treated as temporary differences in the consolidated

balance sheet, that is, a division is made between deferred tax liabil-

ity and equity capital (restricted reserves). In the consolidated income

statement an allocation to, or withdrawal from, untaxed reserves is

divided between deferred taxes and net income for the year.

Application of estimated values

In preparing the year-end financial statements in accordance with

generally accepted accounting principles, company management

makes certain estimates and assumptions that affect the value of

assets and liabilities as well as contingent liabilities at the balance

sheet date. Reported amounts for income and expenses in the

reporting period are also affected. The actual results may differ from

these estimates.