Volvo 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for Mack Trucks. Expressed as an aver-

age, VFS financed approximately 19% of

the units sold in the markets where

financing is offered.

Total assets as of December 31, 2002

amounted to SEK 69.4 billion (73.5), of

which SEK 61.3 billion (64.0) was in the

credit portfolio. Adjusted for the effects of

foreign exchange movements, the credit

portfolio growth in 2002 was 8% (9%).

The credit portfolio consists of 59% Volvo

Trucks, 15% Construction Equipment,

11% Buses, 8% Renault Trucks and 5%

Mack Trucks. The remaining 2% is mainly

related to Volvo Aero and Volvo Penta.

From a currency perspective, 37% of the

portfolio was denominated in USD, 34%

in Euro, 12% in GBP, and 7% in AUD

and CAD. The remaining 10% is primarily

denominated in other European and Latin

American currencies.

Volvo Treasury, the in-house bank of

the Volvo Group, coordinates the global

funding strategy of VFS. Volvo Treasury

also manages all interest-bearing assets

and liabilities of the Group. This includes

maintenance and further development of

an optimal financial infrastructure for li-

quidity management and payments.

Execution of foreign exchange, currency

hedging, loan transactions, bank relations

and other treasury related services further

underscores Volvo Treasury’s role as an

in-house bank. These activities enhanced

the interest net of the Volvo Group and

added good value to the performance of

VFS during 2002.

Danafjord, VFS’s real estate unit, saw

a further expansion in 2002. The opera-

tion mainly covers the letting and devel-

opment of commercial real estate in

Göteborg, Sweden. In total, including the

real estate related to Volvo Cars, the

operation encompasses about 2 million

square meters. The occupancy rate at the

end of the year was 99.9% (98), and

59% (61) of the total leasing was for

tenants outside of the Volvo Group. 77%

(70) of the lease agreements run for five

years or more.

Volvo’s insurance operations provide a

wide array of transport-related insurance

products and services to support Volvo

customers and dealers. In most cases,

these products are available at the point

of sale, and premiums can often be financed

along with the vehicles. In the US, Volvo

Action Service offers an integrated claims

process which minimizes the customer’s

downtime in case of accidents.

Financial performance

Operating income amounted to SEK 490

M (325) corresponding to a return on

equity of 4.8% (4.2). Operating income in

the established customer-financing com-

panies was stable, but continued to be

adversely affected by high level of provi-

sions for expected losses from financing

in North America. Operations in South

America and Eastern Europe continued to

perform well, with operating income high-

er than in previous years. Mainly due to

higher claims, the insurance operation

had a disappointing year, with much lower

operating income than in 2001. Income

from real estate and treasury was higher

than in the preceding year.

Provision is made for credit risks on an

up-front basis, where the level of reserves

placed on each contract is related to the

expected risk for that class of transaction.

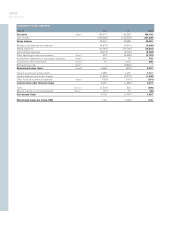

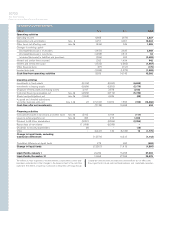

Condensed income statement

SEKM 2000 2001 2002

Net sales 9,678 9,495 9,925

Income after

financial items 1,499 325 490

Taxes (471) 10 (134)

Net income 1,028 335 356

Distribution of credit portfolio, net

%2000 2001 2002

Commercial products

Operational leasing 23 23 22

Financial leasing 28 27 25

Installment contracts 34 36 37

Dealer financing 14 14 16

Other customer credits 1 0 0

For customers not expected to fulfil their

contractual obligations, specific reserves

are allocated based on an individual

assessment of each contract.

At the end of December, total credit

reserves amounted to 2.6% (2.9) Total

write-offs for 2002 amounted to SEK 893

M (823) whereof SEK 175 M (0) was

related to the judicial portfolio in Latin

America.

Ambitions for 2003

With an improved customer finance

model and a streamlined organization in

place, VFS next intends to refine its sys-

tems and processes through operational

excellence initiatives that focus on effi-

ciencies, customer satisfaction and con-

trols. In addition, new business solutions

such as credit syndications and risk diver-

sification will be explored. A strategy will

be developed to meet the Volvo Group’s

growing need for financial services in the

Asian and Eastern European markets.

Finally, the economic climate will continue

to be monitored so that financial risks and

opportunities can be managed.