Volvo 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

04/05

The Volvo Group year 2002

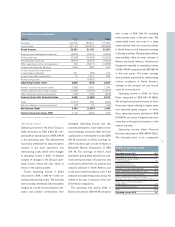

Net sales by market area

SEKM 200012001 2002 %2

Western Europe 61,942 93,147 92,331 (1)

Eastern Europe 3,676 6,383 7,437 +17

North America 38,029 54,630 50,206 (8)

South America 4,730 6,018 4,667 (22)

Asia 8,765 10,862 12,644 +16

Other markets 3,250 9,575 9,795 +2

Volvo Group 120,392 180,615 177,080 (2)

12000 figures exclude Mack Trucks and Renault Trucks.

2Percentage change pertains to 2002/2001.

Net sales by business area

SEKM 2000 2001 2002 %2

Trucks159,075 116,568 118,752 +2

Buses 17,187 16,675 14,035 (16)

Construction

Equipment 19,993 21,135 21,012 (1)

Volvo Penta 6,599 7,380 7,669 +4

Volvo Aero 10,713 11,784 8,837 (25)

Other 6,825 7,073 6,775 (4)

Volvo Group 3120,392 180,615 177,080 (2)

12000 figures refer to Volvo Trucks.

2Percentage change pertains to 2002/2001.

3Adjusted for changes in group structure and foreign currency

exchange rates, net sales increased by 2%.

Operating margin 1

%2000 2001 2002

Trucks 22.4 0.9 1.0

Buses 2.6 (3.1) (0.7)

Construction Equipment 8.0 4.2 1.9

Volvo Penta 7.3 8.9 8.4

Volvo Aero 5.8 5.5 0.1

Volvo Group 5.5 1.8 1.6

1Excluding restructuring costs.

22000 figures refer to Volvo Trucks.

Operating income (loss) by business area

SEKM 2000 2001 2002

Trucks 11.414 1.040 1,189

Buses 440 (524) (94)

Construction

Equipment 1,594 891 406

Volvo Penta 484 658 647

Volvo Aero 621 653 5

Financial Services 1,499 325 490

Other 616 143 194

Operating income 26,668 3,186 2,837

Restructuring costs – (3,862) –

Operating income

(loss) 6,668 (676) 2,837

1 2000 figures refer to Volvo Trucks.

2 Excluding restructuring costs.

Financial

performance

Net sales

Net sales in 2002 amounted to SEK

177,080 M (180,615), a decrease of 2%

compared with the preceding year.

Adjusted for changes in group structure

and foreign currency exchange rates, net

sales increased by 2%.

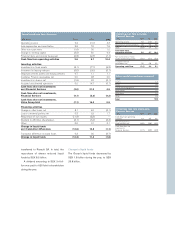

Net sales of Volvo’s truck operations

amounted to SEK 118,752 M, an increase

of 5% adjusted for changes in currency

exchange rates. The increase in sales

related mainly to higher deliveries in North

America, Asia and Eastern Europe. In

North America, the total market for heavy

trucks increased 5% mainly as a result of

a peak in demand during the middle of the

year before new emission regulations

(EPA02) became effective during the last

quarter of the year. In Western Europe, the

Volvo Group’s deliveries of trucks were

3% lower than in the preceding year. The

reduction related primarily to Volvo Trucks

and limited production capacity during the

first quarter in connection with the intro-

duction of the new Volvo FH and FM

series. During the remaining part of the

year, the demand was high for the new

product range and the production capaci-

ty was increased successively. The

demand in the southern part of Europe

continued to be high and Renault Trucks’

deliveries in Western Europe remained

unchanged at a high level.

In Buses, net sales decreased 16%

compared to 2001. The decrease was

largely explained by proportionate consol-

idation of Prévost and Nova Bus as from

the fourth quarter 2001 as well as

changes in currency exchange rates.

Adjusted for these effects, net sales

decreased 1% pertaining mainly to lower

deliveries in North and South America par-

tially offset by favorable volumes in China

and the Nordic countries. In spite of a

decreasing world market, net sales of

Construction Equipment rose 3%, adjusted

for changes in currency rates, driven by a

wider product range and improved market

shares. Also in Volvo Penta, a weakening

total market was compensated by

increased market shares and net sales

increased by 7% excluding impact of cur-

rency translation. Volvo Aero’s net sales

suffered heavily from the crisis in the air-

line industry and net sales dropped 23%,

adjusted for changes in currency rates.

During 2002, the Group’s net sales in

Western Europe decreased 1% com-

pared with 2001. Lower deliveries of

trucks and significantly lower sales in

Volvo Aero were partially compensated by

higher volumes of Buses. In North

America, the Group’s net sales decreased

8% mainly as a result of the devaluation of

the US dollar and proportionate consoli-

dation of Prévost and Nova Bus. This was

partially offset by increased deliveries of

trucks during the second and third quar-

ters. Volvo’s net sales in Eastern Europe

and Asia showed strong growth rates

whereas net sales in South America

declined substantially as result of weak

market conditions. The distribution of net

sales by market is further specified in the

adjoining table.