Volvo 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72/73

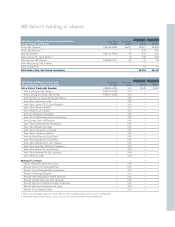

Parent Company AB Volvo

Notes to financial statements

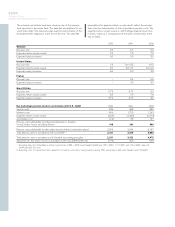

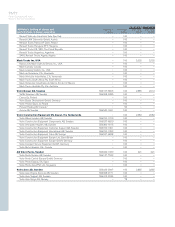

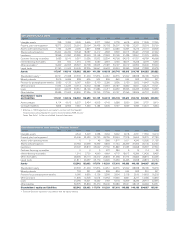

Shareholder contributions were made to Volvo Holding Sverige

AB, 4,900, Volvo Aero AB, 299, Volvo Parts AB, 200, Volvo Holding

Mexico, 159 and Volvo Technology Transfer AB, 100.

Write-downs were carried out on holdings in Sotrof AB, 6,966 and

VFHS Finans, 3,460.

2000: Newly issued shares were subscribed for in VNA Holding

Inc for 411, Volvo Truck & Bus Ltd, 211 and in Volvo China

Investment Co Ltd for 194.

Shares in Eddo Restauranger AB were acquired group internal,

whereafter shares with a book value of 6 were sold to Amica AB.

The remaining holding with a book value of 6 is then accounted for

as shares in non-Group companies.

Shareholder contributions were made to VFHS Finans AB, 3,460,

Volvo Bussar AB, 1,054, Volvo Holding Sverige AB, 767 and Volvo

Aero AB, 302.

Shares and participations in non-Group companies

The acquisition costs for Scania shares bought previous years have

decreased by 25.

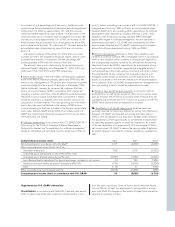

During 1999, AB Volvo acquired 43,5% of the capital and 28,6%

of the voting rights in Scania, one of the world’s leading manufactur-

ers of trucks and buses. As from 2000, AB Volvo’s holding in Scania

is 45,5% of the capital and 30,6% of the voting rights. As a conces-

sion in connection with the European Commission’s approval of AB

Volvo’s acquisition of Renault V.I. and Mack Trucks Inc., AB Volvo

undertook to divest its holding in Scania within a time period of three

years following approval of the transaction by the United States

Department of Justice. The United States Department of Justice for-

mally approved AB Volvo’s acquisition of Renault V.I. and Mack

Trucks Inc. during April 2001. The book value amounts to SEK 267

per share, which corresponds to the average acquisition value. At

year-end, the price of the Scania B share was SEK 168.50 per

share and the average price during 2002 was SEK 177. If Scania

would be valued at the year-end price, a write-down of SEK 9,049 M

would be necessary.

AB Volvo intends to divest the holding in Scania and discussions

are held with a number of industrial buyers. AB Volvo’s assessment

is that a combined block of shares represents a higher value than

the listed price on the stock exchange. Combined with valuations

based on external assessments of Scania’s future earnings capacity,

this indicates a value at a level corresponding to the reported value.

The value of the item is difficult to assess, but AB Volvo considers

that the above factors combined justify that the book value is

retained unchanged.

The participations in Blue Chip Jet HB were written down by 25,

corresponding to the share of the year’s income.

The remaining shares in Eddo Restauranger AB were divested to

Amica AB.

2001: Total shares in Mitsubishi Motors Corporation, with a book

value of 2,344, were transferred to a wholly-owned German sub-

sidiary, which was then divested to DaimlerChrysler.

2000: Protorp Förvaltnings AB, with a book value of 12, was liquid-

ated.

Shares in Bilia AB with a book value of 29 were sold when Bilia

repurchased some of its outstanding shares.

Total shares in AB Volvofinans, with a book value of 253, were

sold to the Group company Volvo Finance Holding AB.

10% of the participations in Blue Chip Jet HB were sold to

Försäkringsaktiebolaget Skandia and Volvo Personvagnar AB.

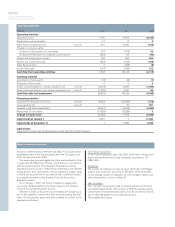

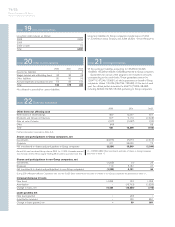

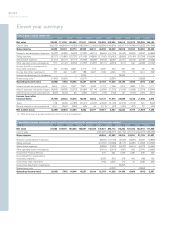

Note 12 Other long-term receivables

2000 2001 2002

Loans to external parties 137 – –

Deferred tax assets 118 1,230 2,351

Other receivables 11 52 11

Total 266 1,282 2,362

As of 2001, deferred tax assets are reported as long-term receivables.

Note 13 Other short-term receivables

2000 2001 2002

Income tax receivables 74 258 –

Accounts receivable 20 27 45

Prepaid expenses and accrued income 407 52 48

Other receivables 12,570 187 157

Total 13,071 524 250

In 2000 other receivables pertained mainly to a receivable from Ford Motor Company which was settled during 2001. The reserve for doubtful

receivables amounted to 5 (5; 5) at the end of the year.

Note 14 Short-term investments in Group companies

Short-term investments in Group companies comprise deposits of 9,045 (17,873; –) in Volvo Treasury.