Volvo 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the Nordic region. A positive develop-

ment was noted for Volvo in China and

Southeast Asia. Volvo has lost some mar-

ket share in North America due to the

withdrawal from the US city bus market

and a reduced penetration in Mexico.

The order intake during the second half

of 2002 weakened. At year-end the order

book was 10% lower than in the preced-

ing year. Volvo’s order book improved for

Mexico, Shanghai and Nova/St Eustache.

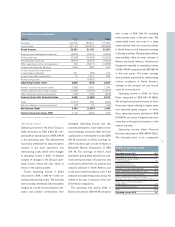

Financial performance

Net sales in 2002 declined to SEK

14,035 M (16,675). The decrease was

largely explained by proportionate

consolidation of Prévost and Nova Bus as

from the fourth quarter 2001 as well as

changes in currency exchange rate.

Adjusted for these effects, net sales was

down 1% pertaining mainly to decreased

deliveries in North and South America

partially offset by favorable volumes in

China and the Nordic countries.

The operating loss was SEK 94 M

compared with an operating loss of SEK

524 M in 2001. The improvement com-

pared with the year-earlier period is to a

large extent due to turn-around activities

in North America and improvements in

Europe and Asia. These positive effects

were partly offset by lower volumes in

Mexico and South America.

Production and investments

During the year Volvo produced 9,113

(10,167) buses and bus chassis, of which

35% were complete buses. The degree

of utilization in the production system in

Europe and North America was affected

by the downturn in the market.

The introduction of the TX-platform

provides Volvo with one of the most mod-

ern product ranges in the bus industry.

This include complete buses and chassis

for city and intercity traffic as well as

coaches, which meet customers and en-

vironmental demands as well as internal

requirements for production efficiency.

Ambitions for 2003

To cope with the developments in the

industry and the market, the process of

optimizing existing strengths and building

for the future continues. Internal produc-

tivity and management programs are

introduced. Cash flow management is a

priority. Product development is focused

on enhanced environmental performance

of the buses.

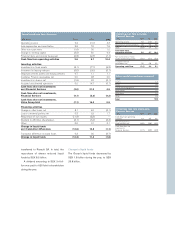

Largest markets Buses

Registered Market share,

buses %

2001 2002 2001 2002

Mexico 1,660 1,101 16.1 12.2

USA and Canada 11,110 1,319 n/a 20

China with

Hong Kong1783 1,004 n/a 5,7

Great Britain 890 1,124 38.7 46.9

Iran 600 600 n/a 60

1 Deliveries from factory.

Number of vehicles invoiced Buses

2000 2001 2002

Western Europe 3,870 2,899 3,076

Eastern Europe 124 216 337

North America 3,869 3,128 1,945

South America 980 1,009 495

Asia 1,659 2,209 2,639

Other markets 513 492 567

Total 11,015 9,953 9,059

Net sales per market Buses

SEKM 2000 2001 2002

Western Europe 6,767 6,263 6,695

Eastern Europe 182 373 409

North America 7,723 6,847 3,838

South America 732 757 366

Asia 1,269 1,839 2,022

Other markets 514 596 705

Total 17,187 16,675 14,035