Volvo 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In applying the transition rules as a consequence of the afore-

mentioned accounting standards, there were no retroactive effects

on Volvo’s earlier financial statements. In applying the new standards

during fiscal year 2001, RR1:00 Consolidated Financial Statements

and Business Combinations, RR14 Joint Ventures, RR15 Intangible

Assets, RR16 Provisions, Contingent Liabilities and Contingent

Assets resulted in a change in Volvo’s accounting principles.

RR1:00 Consolidated Financial Statements

and Business Combinations

In accordance with RR1:00 Consolidated Financial Statements and

Business combinations, when a subsidiary is acquired through the

issue of own shares, the purchase consideration is determined to the

market price of the issued shares at the time of the transaction. In

accordance with Volvo’s previous accounting principles, such a pur-

chase consideration was determined based on the average market

price of the issued shares during ten days prior to the public disclos-

ure of the transaction.

RR14 Joint Ventures

In accordance with RR14 Joint ventures, a joint venture should

either be reported by use of the proportionate consolidation method

or the equity method. Effective in 2001, the proportionate consolida-

tion method is the preferred method under Volvo’s accounting prin-

ciples. In previous years, all joint ventures have been reported by use

of the equity method.

RR15 Intangible Assets

In accordance with RR15 Intangible Assets, the expenditures for

development of new products, production and information systems

shall be reported as intangible assets if such expenditures with a

high degree of certainty will result in future financial benefits for the

company. The acquisition value for such intangible assets shall be

amortized over the estimated useful life of the assets. Volvo’s appli-

cation of the new rules means that very high demands are estab-

lished in order for these development expenditures to be reported as

assets. For example, it must be possible to prove the technical func-

tionality of a new product prior to this development being reported as

an asset. In normal cases, this means that expenditures are capital-

ized only during the industrialization phase of a product development

project. In accordance with Volvo’s previous accounting principles, all

costs for the development of new products, production and informa-

tion systems were expensed on a current basis.

RR16 Provisions, Contingent Liabilities

and Contingent Assets

In accordance with RR16 Provisions, Contingent Liabilities and

Contingent Assets, a provision for decided restructuring measures is

reported first when a detailed plan for the implementation of the

measures is complete and when this plan is communicated to those

who are affected. In accordance with Volvo’s previous accounting

principles, a provision for restructuring measures was reported in

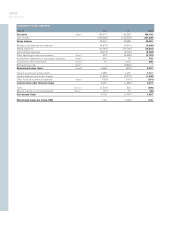

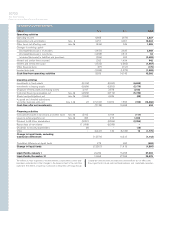

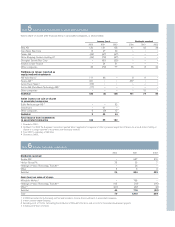

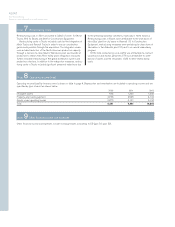

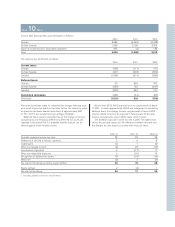

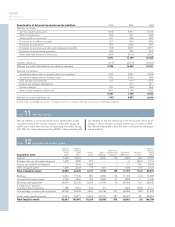

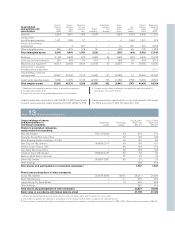

Notes to consolidated financial statements

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the two preceding years; the first figure is for 2001

and the second for 2000.

Note 1Accounting principles

Volvo’s operations

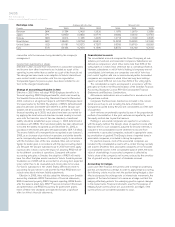

The Volvo Group’s operations are focused on transport solutions for

commercial use and include development, manufacturing and sales

of vehicles, machinery and power systems and also transport-related

services such as service adapted to customer requirements, finan-

cing, insurance and transport information systems. Volvo is, after the

acquisition of Renault V.I. and Mack Trucks at the beginning of 2001,

the world’s second largest manufacturer of heavy trucks and also

one of the world’s largest producers of heavy-diesel engines. Volvo is

also one of the world’s largest manufacturers of buses and construc-

tion equipment, a successful supplier of marine and industrial power

systems, and a key partner to the foremost companies in the aircraft

and aerospace industries.

Operating structure

As of 2002, the Volvo Group’s operations are organized in eight

business areas: Volvo Trucks, Renault Trucks, Mack Trucks, Buses,

Construction Equipment, Volvo Penta, Volvo Aero and Financial

Services. In addition to the eight business areas, there are other

operations consisting mainly of business units that are designed to

support the business areas’ operations. The business units include

Powertrain, Volvo IT, Logistics and Parts.

Each business area, except for Financial Services, has total

responsibility for its operating income, operating capital and operat-

ing cash-flow. The Financial Services business area has responsibility

for its net income and total balance sheet within certain restrictions

and principles that are established centrally. In Volvo’s external finan-

cial reporting, sales and operating income are reported by product

area. Operating income within the business units Powertrain and

Parts are distributed to the respective product areas.

The supervision and coordination of treasury and tax matters is

organized centrally to obtain the benefits of a Group-wide approach.

The legal structure of the Volvo Group is based on optimal handling

of treasury, tax and administrative matters and, accordingly, differs

from the operating structure.

The consolidated financial statements for AB Volvo (the Parent

Company) and its subsidiaries are prepared in accordance with

Swedish GAAP. These accounting principles differ in significant

respects from U.S. GAAP, see Note 33.

Changes in accounting principles

As of 2001, Volvo is applying the following new accounting stand-

ards issued by the Swedish Financial Accounting Standards Council:

RR1:00 Consolidated Financial Statements and Business

Combinations, RR12 Tangible Assets, RR13 Associates, RR14 Joint

Ventures, RR15 Intangible Assets, RR16 Provisions, Contingent

Liabilities and Contingent Assets, RR17 Impairment of Assets, RR18

Income Per Share, RR19, Discontinuing Operations and RR20

Interim Financial Reporting. All accounting standards conform in all

significant respects with the corresponding accounting standard

issued by the International Accounting Standards Committee (IASC).