Volvo 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74/75

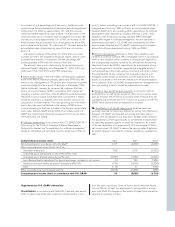

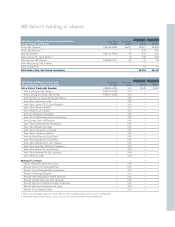

Parent Company AB Volvo

Notes to financial statements

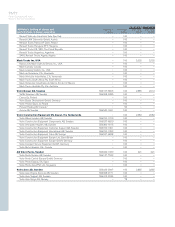

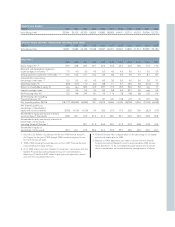

Note 21 Contingent liabilities

Of the contingent liabilities amounting to 133,330 (150,295;

133,856), 133,298 (149,829; 133,548) pertained to Group companies.

Guarantees for various credit programs are included in amounts

corresponding to the credit limits. These guarantees amount to

129,471 (147,246; 130,691), of which guarantees on behalf of Group

companies totaled 129,446 (146,786; 130,686). At the end of each

year, the utilized portion amounted to 69,672 (72,804; 58,448)

including 69,640 (72,793; 58,140) pertaining to Group companies.

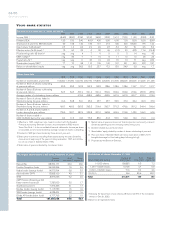

Note 20Other current liabilities

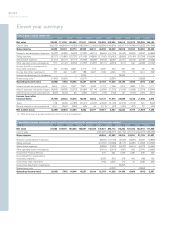

2000 2001 2002

Income tax liabilities – – 6

Wages, salaries and withholding taxes 30 30 38

Other liabilities 95 50 93

Accrued expenses and prepaid income 55 99 146

Total 180 179 283

No collateral is provided for current liabilities.

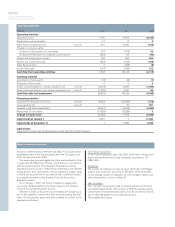

Note 22Cash flow statements

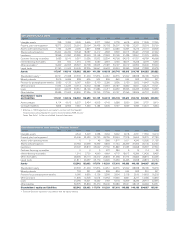

2000 2001 2002

Other items not affecting cash

Write-downs of shareholdings 400 12,237 557

Dividends and Group contributions 507 5,119 (1,408)

Gain on sale of shares (227) (1,047) (32)

Other (49) – 68

Total 631 16,309 (815)

Further information is provided in Note 3–5.

Shares and participations in Group companies, net

Investments (6,675) (7,671) (1,616)

Disposals 411 23,520 72

Net investments in shares and participations in Group companies (6,264) 15,849 (1,544)

Shares and participations in non-Group companies, net

Investments (1,328) (1) 25

Disposals 119 3,182 41

Net investments in shares and participations in non-Group companies (1,209) 3,181 66

Increase/decrease in loans

New loans 14,434 104 1,054

Amortization – (15,763) (1,829)

Change in loans, net 14,434 (15,659) (775)

Loans granted, net

New loans granted –(40) –

Amortization received –100 891

Change in loans granted, net –60891

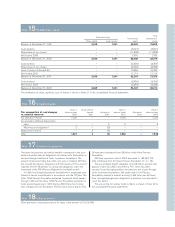

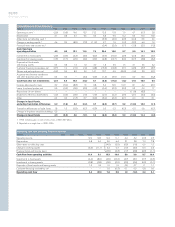

Note 19 Non-current liabilities

Long-term debt matures as follows:

2004 4,258

2005 –

2006 or later 72

Total 4,330

Long-term liabilities to Group companies include loans of 1,054

(–; 3,104) from Volvo Treasury and 3,204 (3,329; –) from Renault V.I.

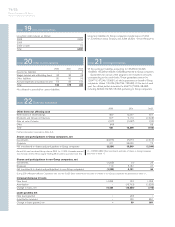

Renault V.I. was transferred Group-internal 2001 for 10,700. Proceeds received

from the sale of Volvo Personvagnar Holding AB resulted in a positive cash flow

of – (12,539; 382). Other investments and sales of shares in Group companies

are shown in Note 11.

During 2001 Mitsubishi Motors Corporation was sold for 3,182. Other investments and sales of shares in non-Group companies are presented in Note 11.