Volvo 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48/49

The Volvo Group

Notes to consolidated financial statements

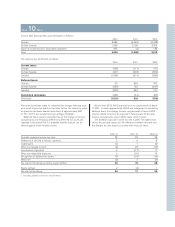

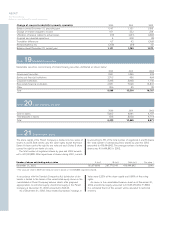

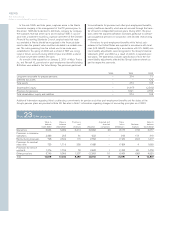

Note 23Other provisions

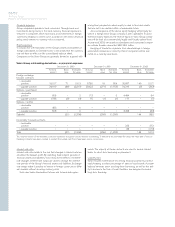

In the mid-1990s and later years, surpluses arose in the Alecta

insurance company in the management of the ITP pension plan. In

December 1998 Alecta decided to distribute, company by company,

the surpluses that had arisen up to and including 1998. In accord-

ance with a statement issued by a special committee of the Swedish

Financial Accounting Standards Council, surplus funds that were

accumulated in Alecta should be recognized in the financial state-

ments when the present value could be calculated in a reliable man-

ner. The rules governing how the refund was to be made were

established in the spring of 2000 and a refund of 683 was recog-

nized in Volvo’s accounts during 2000. At year-end 2002, a refund

of 2 had not yet been settled with cash.

As a result of the acquisition on January 2, 2001 of Mack Trucks

Inc. and Renault V.I., provisions for post-employment benefits totaling

8.3 billion were added in the Volvo Group. The provisions pertained

to commitments for pensions and other post-employment benefits,

mainly healthcare benefits, which are not secured through the trans-

fer of funds to independent pension plans. During 2001, the provi-

sions within the acquired operations increased, partly due to contract-

ual occupational pensions in conjunction with decided restructuring

measures.

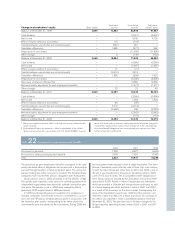

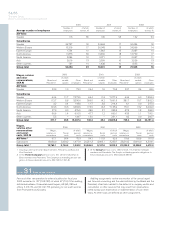

Provisions for post-employment benefits within Volvo’s sub-

sidiaries in the United States are reported in accordance with local

rules (U.S. GAAP). Consequently in accordance with U.S. GAAP, min-

imum liability adjustments were recognized in the Group’s financial

statements 2001 and 2002 as a result of deficits in separate pen-

sion plans. The table below includes specification of how the min-

imum liability adjustments affected the Group’s balance sheets as

per the respective year-ends.

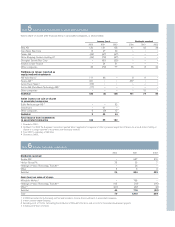

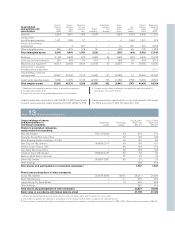

Value in Value in Provisions Acquired and Trans- Value in

balance balance and divested lation Reclassi- balance

sheet 2000 sheet 2001 reversals Utilization companies differences fications sheet 2002

Warranties 3,644 5,989 6,414 (5,829) (6) (517) (74) 5,977

Provisions in insurance

operations 2,488 265 61 (62) – (18) 173 419

Restructuring measures 798 2,342 115 (782) – (196) (62) 1,417

Provisions for residual

value risks 725 1,716 355 (188) – (189) 4 1,698

Provisions for service

contracts 1,276 1,705 78 (262) 1 (109) 65 1,478

Other provisions 3,745 5,366 1,337 (1,250) 10 (545) (98) 4,820

Total 12,676 17,383 8,360 (8,373) 5 (1,574) 8 15,809

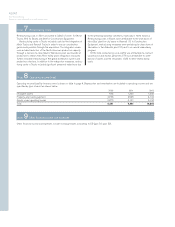

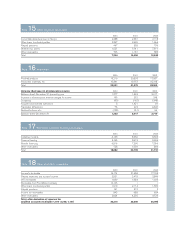

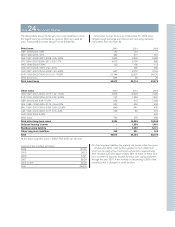

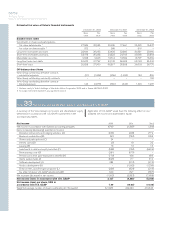

2000 2001 2002

Long-term receivable for prepaid pensions – 274 71

Deferred tax assets ––122

Total assets –274 193

Shareholders’ equity –(1,417) (2,542)

Provision for pensions –1,691 2,735

Total shareholders’ equity and liabilities – 274 193

Additional information regarding Volvo’s outstanding commitments for pension and other post-employment benefits and the status of the

Group’s pension plans are provided in Note 33. See also in Note 1 information regarding changes of accounting principles as of 2003.