Volvo 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44/45

The Volvo Group

Notes to consolidated financial statements

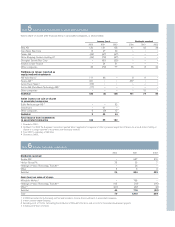

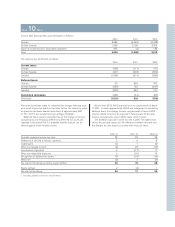

The Volvo Group has transactions with some of its associated com-

panies. As of December 31, 2002, the Group’s net receivables from

associated companies amounted to 230 (31; 358).

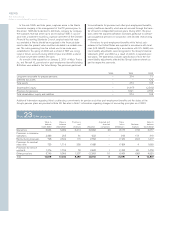

The market value of Volvo’s holdings of shares and participations

in listed companies as of December 31, 2002 is shown in the table

below. No write-downs have been made since the fair value of the

investments is considered to be higher than the quoted market price

of these investments.

Book value Market value

Scania AB 24,026 15,276

Bilia AB 710 965

Deutz AG 670 104

Henlys Group 524 157

Total holdings

in listed companies 25,930 16,502

Holdings in non-

listed companies 1,562

Total shares and

participations 27,492

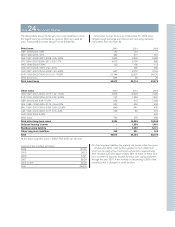

Scania AB

During 1999, Volvo acquired 43,5% of the capital and 28,6% of the

voting rights in Scania, one of the world’s leading manufacturers of

trucks and buses. As from 2000, Volvo’s holding in Scania is 45,5%

of the capital and 30,6% of the voting rights. As a concession in

connection with the European Commission’s approval of Volvo’s

acquisition of Renault V.I. and Mack Trucks Inc., Volvo undertook to

divest its holding in Scania within a time period of three years follow-

ing approval of the transaction by the United States Department of

Justice. The United States Department of Justice formally approved

Volvo’s acquisition of Renault V.I. and Mack Trucks Inc. during April

2001. The book value amounts to SEK 264 per share, which largely

corresponds to the average acquisition value. At year-end 2002, the

price of the Scania B share was SEK 168.50 per share and the

average price during 2002 was SEK 177. If Scania would be valued

at the year-end price, a write-down of SEK 8,750 M would be nec-

essary. For U.S. GAAP, see further note 33.

Volvo intends to divest the holding in Scania, and discussions are

held with a number of industrial buyers. Volvo’s assessment is that a

combined block of shares represents a higher value than the listed

price on the stock exchange. Combined with valuations based on

external assessments of Scania’s future earnings capacity, this indi-

cates a value at a level corresponding to the reported value. The

value of the item is difficult to assess, but Volvo considers that the

above factors combined justify that the book value is retained

unchanged.

Eddo Restauranger AB

In 2002, Volvo divested its entire holding in Eddo with a capital gain

of 32.

Mitsubishi Motors Corporation (MMC)

In 2001, Volvo divested its holding and all rights and obligations

relating to MMC, which resulted in a capital gain of 574, net of ter-

mination costs of 194.

AB Volvofinans

In 2001, Volvo divested its entire holding in Volvofinans for a total

purchase price of 871 and with a capital gain of 61.

Arrow Truck Sales

In 2001, Volvo increased its holding to 100% and Arrow thereby

became a subsidiary of Volvo.

SM Motors Pte Ltd

In 2001, Volvo divested its entire holding in SM Motors with a capital

loss of 13.

Shanghai Sunwin Bus Corporation

In 2000, Volvo and the Chinese vehicle manufacturer, Shanghai

Automotive Industry Corporation, signed agreeements covering

establishment in Shanghai of a joint-venture company, Shanghai

Sunwin Bus Corporation, for the manufacture and sale of city and

commuter buses. Each party owns 50% of the company.

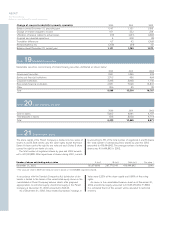

Changes in the Volvo Group’s holdings of shares and participations: 2000 2001 2002

Balance sheet, December 31, preceding year 29,213 30,481 27,798

Acquisitions and divestments, net 1,641 (2,844) 97

New issue of shares and shareholders’ contributions 122 94 89

Share of income in associated companies, after tax 208 8 76

Dividends (741) (74) (64)

Write-downs (60) (11) (9)

Previously equity method companies, now consolidated – – (210)

Translation differences 92 97 (203)

Other 647(82)

Balance sheet, December 31 30,481 27,798 27,492

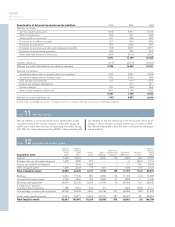

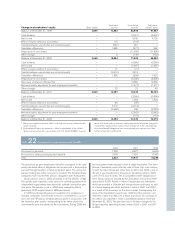

Note 14 Long-term customer-financing receivables

2000 2001 2002

Installment credits 12,115 13,668 14,239

Financial leasing 10,082 11,534 10,341

Other receivables 712 873 627

Total 22,909 26,075 25,207