Volvo 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68/69

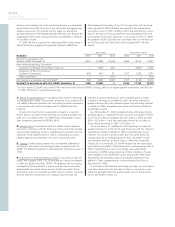

Parent Company AB Volvo

Notes to financial statements

Notes to financial statements

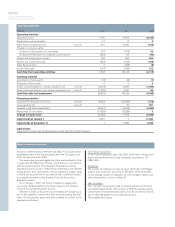

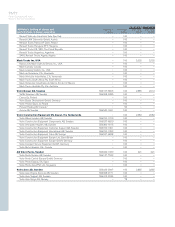

Amounts in SEK M unless otherwise specified. The amounts within

parentheses refer to the two preceding years; the first figure is for

2001 and the second for 2000.

The accounting principles applied by Volvo are described in Note

1, pages 33–36. Reporting of Group contributions is in accordance

with the pronouncement of the Swedish Financial Accounting

Standards Council issued in 1998. Group contributions are reported

among Income from investments in Group companies. Surplus funds

in Alecta are accounted for in accordance with a statement issued

by a special committee of the Swedish Financial Accounting

Standards Council.

As of January 1, 2001, the Parent Company is applying the

accounting standard, RR9 Income Taxes, issued by the Swedish

Financial Accounting Standards Council.

Effective in 2002, all Income from investments are included as a

part of the operating income rather than as earlier among financial

items. The two previous years have been restated to conform to the

changed classification.

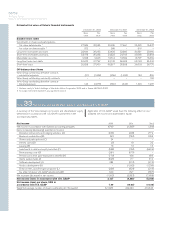

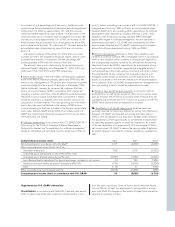

Cash-flow statements

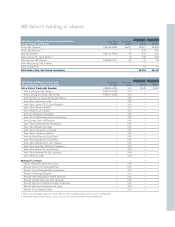

SEK M 2000 2001 2002

Operating activities

Operating income 1,755 10,455 (3,763)

Depreciation and amortization 17 17 2

Other items not affecting cash Note 22 631 16,309 (815)

Changes in working capital:

Increase (–)/decrease (+) in receivables 207 (219) 50

Increase (+)/decrease (–) in liabilities and provisions (620) 65 (36)

Interest and similar items received 148 662 504

Interest and similar items paid (330) (410) (263)

Other financial items 7 (206) (8)

Income taxes paid (147) (530) 210

Cash flow from operating activities 1,668 26,143 (4,119)

Investing activities

Investments in fixed assets (10) (9) (1)

Disposals of fixed assets 0 0 3

Shares and participations in Group companies, net Note 22 (6,264) 15,849 (1,544)

Shares and participations in non-Group companies, net Note 22 (1,209) 3,181 66

Cash flow after net investments (5,815) 45,164 (5,595)

Financing activities

Increase (+)/ decrease (–) in loans Note 22 14,434 (15,659) (775)

Loans granted, net Note 22 –60891

Dividend to AB Volvo shareholders (3,091) (3,356) (3,356)

Repurchase of own shares (11,808) (8,336) 0

Change in liquid funds (6,280) 17,873 (8,835)

Liquid funds at January 1 6,287 7 17,880

Liquid funds at December 31 717,880 9,045

Liquid funds

Liquid funds include cash and bank balances and deposits at Volvo Treasury.

Intra-Group transactions

Of the Parent Company’s sales, 320 (353; 253) were to Group com-

panies and purchases from Group companies amounted to 191

(188; 249).

Employees

The number of employees at year-end was 124 (122; 122). Wages,

salaries and social costs amounted to 309 (207; 187). Information

on the average number of employees as well as wages, salaries and

other remuneration is shown in Note 30.

Fees to auditors

Fees and other remuneration paid to external auditors for the fiscal

year 2002 totaled 23 (51; 42), of which 2 (3; 4) for auditing, distrib-

uted between PricewaterhouseCoopers, 2 (3; 4) and others, 0 (0; 0),

and 21 (48; 38) related to non-audit services from

PricewaterhouseCoopers.