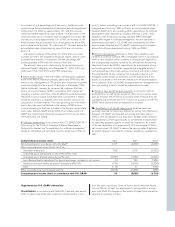

Volvo 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60/61

The Volvo Group

Notes to consolidated financial statements

based on the market price of the underlying shares for a reasonable

period before and after the terms of the transaction are agreed and

publicly announced. The goodwill may be subject to adjustment

pending resolution of the dispute between AB Volvo and Renault SA

regarding the final value of acquired assets and liabilities in Renault

V.I. and Mack Trucks.

In 1995, AB Volvo acquired the outstanding 50% of the shares in

Volvo Construction Equipment Corporation (formerly VME) from

Clark Equipment Company, in the U.S. In conjunction with the acqui-

sition, goodwill of SEK 2.8 billion was reported. The shareholding

was written down by SEK 1.8 billion, which was estimated to corres-

pond to the portion of the goodwill that was attributable at the time

of acquisition to the Volvo trademark. In accordance with U.S. GAAP,

the goodwill of SEK 2.8 billion was amortized over its estimated use-

ful life (20 years) until 2002 when Volvo adopted FAS 142 (see

above).

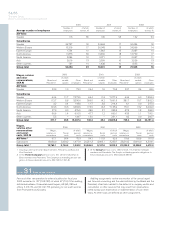

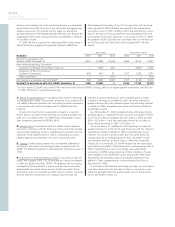

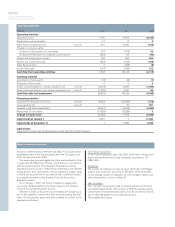

Net income Shareholders’ equity

Goodwill 2000 2001 2002 2000 2001 2002

Goodwill in accordance with

Swedish GAAP, December 31 (491) (1,058) (1,094) 4,969 13,013 11,297

Items affecting reporting of goodwill:

Acquisition of Renault V.I. and Mack Trucks Inc. – (153) 430 – 2,899 3,329

Acquisition of Volvo Construction

Equipment Corporation (91) (91) 51 1,317 1,226 1,277

Other acquisitions – – 613 – – 613

Net change in accordance with U.S. GAAP (91) (244) 11,094 1,317 4,125 5,219

Goodwill in accordance with U.S. GAAP, December 31 (582) (1,302) 0 6,286 17,138 16,516

1 Income under U.S. GAAP was in total 744 lower than under Swedish GAAP, including 244 due to higher goodwill amortization and 500 due

to other differences in purchase accounting.

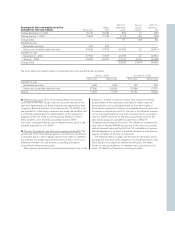

C. Shares and participations. In calculating Volvo’s share of earnings

and shareholders’ equity in associated companies in accordance with

U.S. GAAP, differences between the accounting for these companies

in accordance with Volvo’s principles and U.S. GAAP have been

reflected.

Income from investments in associated companies is reported

before taxes in accordance with Swedish accounting principles, and

after tax in accordance with U.S. GAAP. Taxes attributable to assoc-

iated companies amounted to 65 (42; 244).

D. Interest costs. In accordance with U.S. GAAP, interest expense

incurred in connection with the financing of the construction of prop-

erty and other qualifying assets is capitalized and amortized over the

useful life of the related assets. In Volvo’s consolidated accounts,

interest expenses are reported in the year in which they arise.

E. Leasing. Certain leasing transactions are reported differently in

accordance with Volvo’s accounting principles compared with U.S.

GAAP. The differences pertain to sale-leaseback transactions prior to

1997.

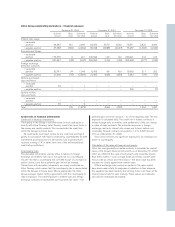

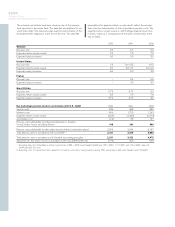

F. Investments in debt and equity securities. In accordance with U.S.

GAAP, Volvo applies SFAS 115: “Accounting for Certain Investments

in Debt and Equity Securities.” SFAS 115 addresses the accounting

and reporting for investments in equity securities that have readily

determinable fair market values, and for all debt securities. These

investments are to be classified as either “held-to-maturity” securities

that are reported at amortized cost, “trading” securities that are

reported at quoted market prices with unrealized gains or losses

included in earnings, or “available-for-sale” securities, reported at

quoted market prices, with unrealized gains or losses being credited

or debited to Other comprehensive income and thereby included in

shareholders’ equity.

As of December 31, 2002, unrealized losses after deducting for

unrealized gains in “available-for-sale” securities amounted to 9,763

(7,211; 6,101). Sale of “available-for-sale” shares in 2002 provided

SEK – (3,2 billion; –) and the capital gain, before tax, on sales of

these shares amounted to SEK – (0,6 billion; –).

As set out above, all “available-for-sale” securities are valued at

quoted market price at the end of each fiscal year with the change in

value being credited or debited to Other comprehensive income.

However, if a security’s quoted market price has been below the

carrying value for an extended period of time, U.S. GAAP include

a presumption that the decline in value is “other than temporary”.

Under such circumstances, U.S. GAAP require that the value adjust-

ment must be recorded in Net income with a corresponding credit to

Other comprehensive income. Accordingly, value adjustments

amounting to 9,683, mainly pertaining to Volvo’s holding in Scania

were charged to U.S. GAAP Net income during 2002. After these

adjustments, the remaining value of unrealized losses before tax

debited to Other comprehensive income amounted to 80 as of

December 31, 2002.

In accordance with Swedish accounting principles, no write-downs

have been made since the fair value of Volvo’s investments is con-

sidered to be higher than the quoted market price of these invest-

ments. See further in Note 13.