Volvo 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

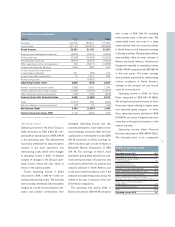

Change of operating income

SEK bn

Operating income 2001 (0.7)

Restructuring costs in 2001 3.9

Improvement of gross margins

in truck operations 1.5

Lower gross income in

Aero due to lower volumes (0.7)

Changes in currency exchange rates 1.2

Lower capitalization of development costs (0.7)

Deficit in Swedish pension foundation (0.5)

Gain on divestments of Volvia’s insurance

operations and shares in Mitsubishi Motors 2001 (1.1)

Credit losses in US truck financing

portfolio 2001 0.7

Lower dividend from Scania (0.3)

Other (0.5)

Operating income 2002 2.8

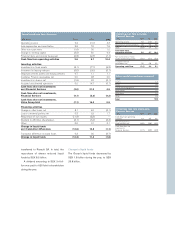

Consolidated income statements 1

SEK M 2000 2001 2002

Net sales 120,392 180,615 177,080

Cost of sales (97,131) (149,477) (145,453)

Gross income 23,261 31,138 31,627

Research and development expenses (4,876) (5,391) (5,869)

Selling expenses (9,285) (14,663) (15,393)

Administrative expenses (4,651) (6,474) (5,464)

Other operating income and expenses 309 (3,071) (2,989)

Income from Financial Services 1,499 325 490

Income (loss) from investments

in associated companies 341 (88) 126

Income from other investments 70 1,410 309

Restructuring costs – (3,862) –

Operating income (loss) 6,668 (676) 2,837

Interest income and similar credits 1,588 1,653 1,246

Interest expenses and similar charges (1,845) (2,653) (1,870)

Other financial income and expenses (165) (190) (200)

Income (loss) after financial items 6,246 (1,866) 2,013

Taxes (1,510) 326 (590)

Minority interests in net income (loss) (27) 73 (30)

Net income (loss) 4,709 (1,467) 1,393

Income (loss) per share, SEK 11.20 (3.50) 3.30

1 Financial Services reported in accordance with the equity method.

Operating income

Operating income for the Volvo Group in

2002 amounted to SEK 2,837 M, com-

pared with an operating loss of SEK 676 M

in the preceding year. The improvement

was mainly attributable to improved gross

margins in the truck operations and

restructuring costs which were charged

to operating income in 2001. A detailed

analysis of changes in the Group’s oper-

ating income versus the year earlier is

shown in the adjoining table.

Trucks’ operating income in 2002

amounted to SEK 1,189 M (1,040 ex-

cluding restructuring costs). The earnings

were favorably affected by improved gross

margins as a result of improved price real-

ization and positive contributions from

synergies. Operating income was also

positively affected by lower losses on for-

ward exchange contracts offset by lower

capitalization of development costs (SEK

641 M lower than in 2001). Earnings for

2001 included a gain on sale of shares in

Mitsubishi Motors Corporation of SEK

574 M. The earnings of Volvo’s truck

operations during 2002 gained from cont-

inued strong earnings in Europe but also

continued to suffer from low volumes and

capacity utilization in North America due

to the poor market conditions, even if the

demand increased temporarily during the

middle of the year in advance of the new

US emission regulations.

The operating loss during 2002 in

Buses amounted to SEK 94 M compared

with a loss of SEK 524 M, excluding

restructuring costs, in the prior year. The

substantially lower loss was to a large

extent derived from turn around activities

in North America and improved earnings

in Europe and Asia. These positive effects

were partially offset by lower volumes in

Mexico and South America. Construction

Equipment reported an operating income

of SEK 406 M compared with SEK 891 M

in the year earlier. The lower earnings

were primarily explained by deteriorating

market conditions in North America,

changes in the product mix and launch

costs for new products.

Operating income in 2002 for Volvo

Penta amounted to SEK 647 M (658).

The strong financial performance of Volvo

Penta was mainly relating to higher sales

and improved gross margins. In Volvo

Aero, operating income declined to SEK

5 M (653) as a result of significantly lower

sales due to the general downturn in the

aviation industry.

Operating income within Financial

Services amounted to SEK 490 M (325).

The favorable trend of six consecutive