Volvo 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

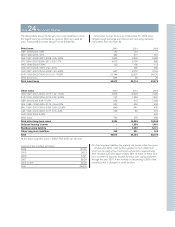

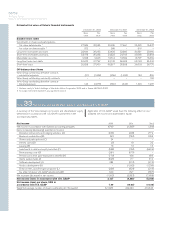

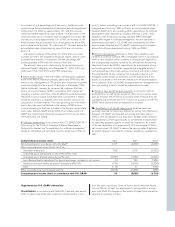

Shareholders’ equity 2000 2001 2002

Shareholders’ equity in accordance with Swedish accounting principles 88,338 85,185 78,278

Items increasing (decreasing) reported shareholders’ equity

Derivative instruments and hedging activities (A) (1,286) (1,584) 188

Business combinations (B) 1,317 4,125 5,219

Shares and participations (C) 36 36 36

Interest costs (D) 112 130 152

Leasing (E) (163) (149) (134)

Investments in debt and equity securities (F) (6,066) (7,328) (9,813)

Restructuring costs (G) 579 – –

Pensions and other postemployment benefits (H) 109 272 (20)

Alecta surplus funds (I) (523) (412) (2)

Software development (J) 754 542 330

Product development (K) – (1,962) (3,263)

Entrance fees, aircraft engine programs (L) (387) (719) (855)

Tax effect of above U.S. GAAP adjustments (M) 1,941 3,155 1,066

Net increase (decrease) in shareholders’ equity (3,577) (3,894) (7,096)

Shareholders’ equity in accordance with U.S. GAAP 84,761 81,291 71,182

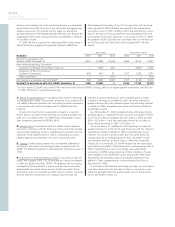

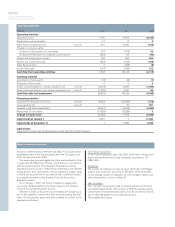

Net income Shareholders' equity

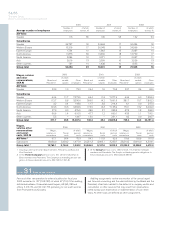

Accounting for derivative instruments and hedging activities 2000 2001 12002 2000 2001 12002

Derivatives Commercial exposure (654) 342 1,814 (1,286) (944) 870

Derivatives Financial exposure – (685) 43 – (685) (642)

Derivatives in fair value hedges 808 426 – 808 1,234

Fair value adjustment hedged items – (765) (511) – (763) (1,274)

Transition adjustment – 2––––

Derivative instruments and hedging activities in accordance

with U.S GAAP, December 31 (654) (298) 1,772 (1,286) (1,584) 188

1The Volvo Group's Net income and Shareholders' Equity in accordance with U.S. GAAP in 2001 have been restated in the financial statements for 2002, due to

a calculation error in the 2001 numbers.

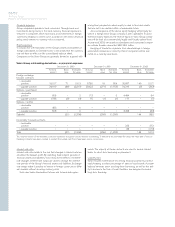

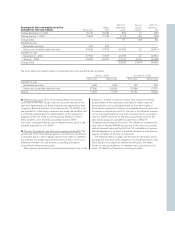

B. Business combinations. Acquisitions of certain subsidiaries are

reported differently in accordance with Volvo’s accounting principles

and U.S. GAAP. The difference is attributable primarily to reporting

and amortization of goodwill.

Effective in 2002, Volvo has adopted SFAS 141 “Business

Combinations” and SFAS 142 “Goodwill and Other Intangible Assets”

in its determination of Net income and Shareholders’ equity in accord-

ance with U.S. GAAP. In accordance with the transition rules of SFAS

142, Volvo has identified its reporting units and determined the car-

rying value and fair value of each reporting unit as of January 1,

2002. No impairment loss has been recognized as a result of the

transitional goodwill evaluation. In Volvo’s income statement for 2002

prepared in accordance with Swedish GAAP, amortization of goodwill

charged to income was 1,094. In accordance with SFAS 142, good-

will and other intangible assets with indefinite useful lives should not

be amortized but rather evaluated for impairment annually.

Accordingly, the amortization of goodwill reported under Swedish

GAAP has been reversed in the determination of Net income and

Shareholders’ equity under U.S. GAAP. Furthermore, impairment tests

have been performed for existing goodwill as of December 31, 2002.

No impairment loss has been recognized as a result of these tests.

In 2001, AB Volvo acquired 100% of the shares in Renault V.I.

and Mack Trucks Inc. from Renault SA in exchange for 15% of the

shares in AB Volvo. Under Swedish GAAP, the goodwill attributable

to this acquisition was set at SEK 8.4 billion while under U.S. GAAP

the corresponding goodwill was set at SEK 11.5 billion. The differ-

ence was mainly attributable to determination of the purchase con-

sideration. In accordance with Swedish GAAP, when a subsidiary is

acquired through the issue of own shares, the purchase consider-

ation is determined to be based on the market price of the issued

shares at the time of the transaction is completed. In accordance

with U.S. GAAP, such a purchase consideration is determined to be

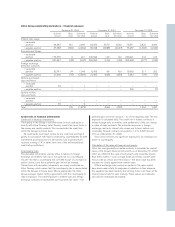

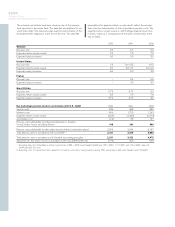

Significant differences between Swedish and U.S. account-

ing principles

A. Derivative instruments and hedging activities. Volvo uses forward

exchange contracts and currency options to hedge the value of

future commercial flows of payments in foreign currency and com-

modity purchases. Outstanding contracts that are highly certain to be

covered by forecasted transactions are not assigned a value in the

consolidated accounts.

Under U.S. GAAP hedge accounting is not applied for commercial

derivatives, and therefore outstanding forward contracts and options

are valued at market rates. The profits and losses that thereby arise

are included when calculating income. Unrealized net gains for

2002 pertaining to forwards and options contracts are estimated at

870 (losses 944; losses 1,286).

Volvo uses derivative instruments to hedge the value of the

Groups’ financial position. In accordance with U.S. GAAP, all out-

standing derivative instruments are valued at fair value. The profits

and losses that thereby arise are included when calculating income.

Only part of the Groups’ hedges of financial exposure qualify for

hedge accounting under U.S. GAAP and are accounted for as such.

In those cases the hedged items are valued at fair value regarding

the risk and period beeing hedged and included when calculating

income.