Volvo 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22/23

Business Areas

Financial Services

Volvo Financial Services (VFS) provides

services in five main areas: customer

finance, treasury operations, insurance

services, real estate management and

other services. Financial services are a

significant part of Volvo’s strategy for

becoming the world’s leading provider of

commercial transport solutions. Financial

services also fulfill the market’s growing

need for increasingly sophisticated finan-

cial solutions, separately or combined

with insurance and/or service contracts.

They increase the competitiveness of

Volvo’s dealers and the attractiveness of

their products, thereby enhancing the

Group’s growth and profitability.

During 2002, the new portfolio man-

agement strategies that were introduced

in 2001 to the customer finance business

took hold and produced sound results. As

a result, a foundation for controlled

growth and improved profitability has

been successfully laid. VFS also forged

closer ties to Mack and Renault Trucks.

Both manufacturers now enjoy custom-

branded finance programs. VFS benefit-

ed in 2002 not only from the increased

volume and diversification of Mack and

Renault Trucks, but also from greater sta-

bility within the US truck portfolio.

The customer in focus

Volvo’s customer-financing operations

cover Europe, North America, Australia,

parts of South America and Asia. Customer

financing is primarily truck-related, although

Buses, Construction Equipment, Volvo Aero

and Volvo Penta financing are included to

an increasing extent. The range of finan-

cial services includes installment con-

tracts, financial leasing, operational leas-

ing and dealer financing. In most markets,

insurance, service and maintenance con-

tracts are also offered separately or in

combination with financing services.

The total volume of new retail financing

in 2002 amounted to SEK 26.3 billion,

which was SEK 3.7 billion higher than the

same period last year. The main driver

behind the growth in volume was Mack

and Renault Trucks, which accounted for

23% of the retail volume in 2002 com-

pared with 6% in 2001.

In the markets where financial services

are offered, the average year-end pene-

tration was 27% for Volvo Trucks, 23%

for Buses, 22% for Construction Equip-

ment, 12% for Renault Trucks and 10%

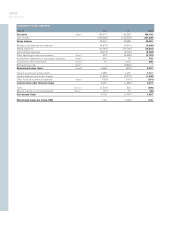

Assets, SEK bn

Credit portfolio, SEK bn

98 99 00 01 02

35.4 45.1 53.6 64.0 61.3

27 26 29 30 27

98 99 00 01 02

Market penetration, %

98 99 00 01 02

43.2 56.5 66.5 73.5 69.4

8.9 12.0 14.1 4.2 4.8

98 99 00 01 02

Return on shareholders´equity, %