Volvo 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18/19

Business Areas

Volvo Penta

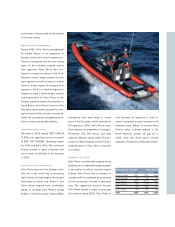

Volvo Penta is a world-leading and global

manufacturer of engines and complete

power systems for both marine and indus-

trial applications. The company serves

customers in all parts of the world, prima-

rily within three areas of activity: Marine

Leisure, Marine Commercial and Industrial.

Based on a platform of Volvo’s large

production volume of diesel engines,

Volvo Penta develops high-performance

power products for a variety of applica-

tion areas, including leisure boats, work-

boats, power-generating equipment and

forklifts.

By supplying technologically superior

products focused on performance and

operational reliability, and sensitivity to

customer demands on effective service

solutions, Volvo Penta has developed a

global leadership position as a supplier of

engines and power systems, and one of

the industry’s strongest brands. With

more than 5,000 dealers in some 130

countries, Volvo Penta has a strong global

presence.

Volvo Penta has extended its product

range in all business segments through a

number of successful introductions during

the past years. The activity levels for new

product introductions will remain high, with

launches over the next few years resulting

in a renewal of the existing range.

Tot a l market

The global market for marine and indus-

trial engines gradually weakened during

the year, primarily as a result of a decline

in confidence in the future among con-

sumers and uncertainty regarding the

situation in Iraq. The total market for

marine and industrial engines in North

America continued to weaken during the

year, primarily regarding diesel engines. In

Europe, the demand for marine engines

was rather stable, while the market for

industrial engines declined. The market

for industrial engines continued to perform

positively in Asia, while the demand for

marine and industrial engines in South

America declined sharply compared with

2001.

Business environment

In the prestige segment of the leisure

boat industry, boats in the size range of

approximately 35 feet to 50 feet is a grow-

ing segment. This is to a great degree

favorable to Volvo Penta because it is in

this area of the marine market that the

company traditionally has its strongest

position.

Competition stiffened among engine

producers in the leisure boat industry dur-

ing 2002 as several new alliances and

cooperations were established in the

market. Brunswick and Cummins initiated

a new diesel engine cooperation and

Scania signed a commercial cooperation

agreement with Yanmar.

On the industrial engine side, the

largest producers of complete generator

sets have reported substantial sales

declines during the latter part of 2002.

Volvo Penta does not manufacture any

complete generator sets but instead

delivers power systems to the independ-

ent producers that, in turn, use Volvo

Penta products in their applications.

Volvo Penta has continued to capture

market shares in this part of the market

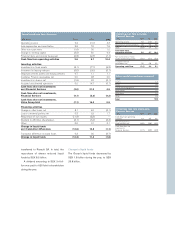

98 99 00 01 02

4.9 5.8 6.6 7.4 7.7

Net sales, SEK bn

98 99 00 01 02

95 314 484 658 647

Operating income*, SEK M

98 99 00 01 02

1. 9 5 . 5 7. 38.98.4

Operating Margin*, %

Net sales as percentage of Volvo Group sales, %

*excluding restructuring costs

*excluding restructuring costs

4%