Volvo 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64/65

The Volvo Group

Notes to consolidated financial statements

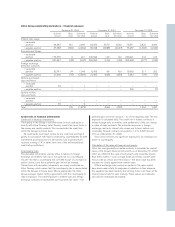

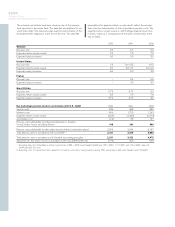

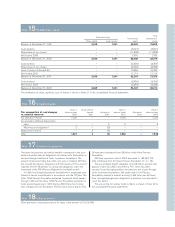

The projected benefit obligation, accumulated benefit obligation and

fair value of plan assets for the pension plans with an accumulated

benefit obligation in excess of plan assets were 17,198; 16,492 and

10,963 at December 31, 2002 and 13,872; 13,351 and 11,142 at

December 31, 2001.

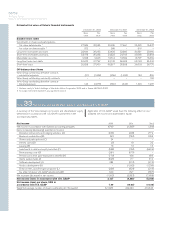

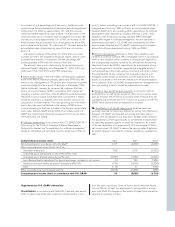

Other post-employment benefit plans

In addition to its pension plans, certain subsidiaries sponsor unfund-

ed benefit plans, mainly in the U.S., to provide health care and other

benefits for retired employees who meet minimum age and service

requirements. The plans are generally contributory, with retiree con-

tributions being adjusted periodically, and contain other cost-sharing

features such as deductibles and coinsurance. The estimated cost

for health-care benefits is recognized on an accrual basis in accord-

ance with the requirements of SFAS 106, “Employers’ Accounting for

Post-retirement Benefits Other than Pensions.”

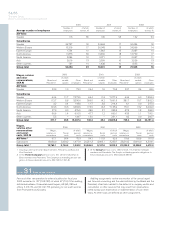

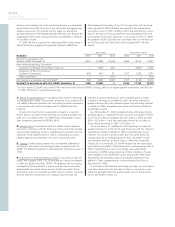

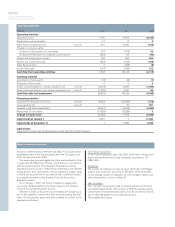

Net periodical costs for other benefits in accordance with U.S. GAAP: 2000 2001 2002

Service costs 45 88 70

Interest costs 76 513 509

Expected return on plan assets – (27) 0

Amortization, net (4) 4 36

Net periodical benefit costs 117 578 615

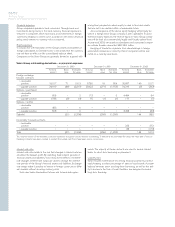

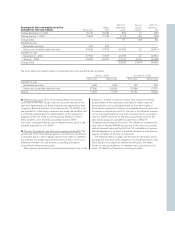

Sweden United

Net provisions for Pensions States France Great Britain US other Other

postemployment benefits (ITP plan) Pensions Pensions Pensions benefits plans Total

Funded status at December 31, 2001 (550) (2,459) (2,712) (276) (8,084)

Unrecognized actuarial (gains) and losses 1,155 2,004 – 279 (93)

Unrecognized transition (assets) and obligations

according to SFAS 87, net (52) – – (21) 34

Unrecognized prior service costs – 400 – 10 398

Minimum liability adjustments (546) (1,417) – – –

Net provisions for postemployment benefits

in accordance with U.S. GAAP

at December 31, 2001 7 (1,472) (2,712) (8) (7,745) (1,675) (13,605)

Funded status at December 31, 2002 (839) (4,771) (2,482) (624) (6,759)

Unrecognized actuarial (gains) and losses 1,350 3,952 133 613 70

Unrecognized transition (assets)

and obligations according to SFAS 87, net (33) – – (18) 7

Unrecognized prior service costs – 600 – 9 225

Minimum liability adjustments (1,090) (3,817) – (417) –

Net provisions for postemployment benefits

in accordance with U.S. GAAP

at December 31, 2002 (612) (4,036) (2,349) (437) (6,457) (1,657) (15,548)

Difference between U.S. GAAP

and Swedish accounting principles (397) – – 417 – – 20

Net provisions for post-employment

benefits in accordance with Swedish

accounting principles (1,009) (4,036) (2,349) (20) (6,457) (1,657) (15,528)

whereof reported as

Prepaid pensions (receivables) – 600 – – – 108 708

Provisions for postemployment benefits (1,009) (4,636) (2,349) (20) (6,457) (1,765) (16,236)