Volvo 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

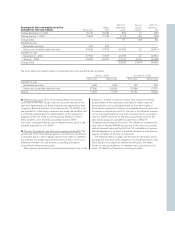

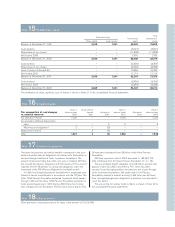

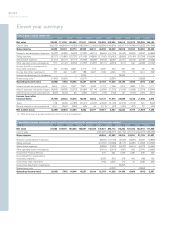

Note 10 Intangible and tangible assets

Value in Value in Value in

balance sheet balance sheet Sales/ Reclassi- balance sheet

Acquisition cost 2000 2001 Investments scrapping fications 2002

Rights 52 52 – – – 52

Total intangible assets 52 52 – – – 52

Buildings 12 17 – (2) – 15

Land and land improvements 5 8 – (1) – 7

Machinery and equipment 49 47 – – – 47

Construction in progress – 1 1 – (1) 1

Total tangible assets 66 73 1 (3) (1) 70

Value in Value in Value in Book value

balance sheet balance sheet Sales/ balance sheet in balance

Accumulated depreciation 2000 22001 2Depreciation 1scrapping 2002 2sheet 20023

Rights 39 52 – – 52 0

Total intangible assets 39 52 – – 52 0

Buildings 1 2 – (1) 1 14

Land and land improvements –––––7

Machinery and equipment 35 36 2 – 38 9

Construction in progress – ––––1

Total tangible assets 36 38 2 (1) 39 31

The assessed value of buildings was 7 (8; 4) and of land 4 (4; 2).

Investments in tangible assets amounted to 1 (10; 10). Capital

expenditures approved but not yet implemented at year-end 2002

amounted to 2 (1; 1).

1Including write-downs

2Including accumulated write-downs

3Acquisition value, less depreciation

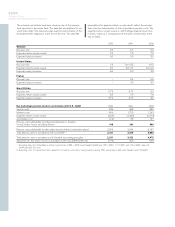

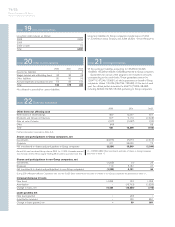

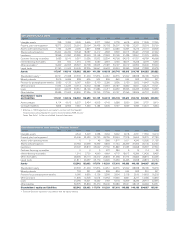

Note 11 Investments in shares and participations

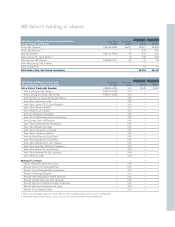

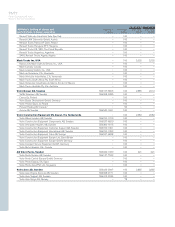

Holdings of shares and participations are specified in AB Volvo’s holding of shares on pages 75–77. Changes in holdings of shares and partici-

pations are shown below.

Group companies Non-Group companies

2000 2001 2002 2000 2001 2002

Balance December 31, previous year 33,528 39,729 38,140 27,596 28,587 26,224

Acquisitions/New issue of shares 855 15,581 1,055 1,335 1 (25)

Divestments (12) (22,388) (3) (316) (2,344) (6)

Shareholder contributions 5,730 17,435 289 – – –

Write-downs (372) (12,217) (531) (28) (20) (25)

Balance, December 31 39,729 38,140 38,950 28,587 26,224 26,168

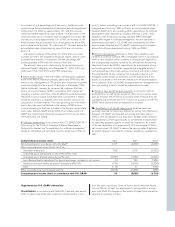

Shares and participations in Group companies

An investment of 1,054 was made in newly issued preference

shares in VNA Holding Inc.

A shareholder contribution was made to Volvo China Investment

Co Ltd of 107, whereupon the shareholdings were written down by

the corresponding amount. Shareholder contributions were also

made to Volvo Holding Mexico, 89, Volvo Technology Transfer AB,

50, Volvo Bussar AB, 28 and to Celero Support AB, 15.

Write-downs were carried out at the end of the year on holdings

in Sotrof AB, 400.

2001: All shares in Renault V.I. that were acquired from Renault

SA, were paid for with Volvo shares held by AB Volvo and were

booked to an amount of 10,700. The shares were then sold group

internal to Volvo Holding France SA.

The shares in Mack Trucks Inc were acquired from Renault V.I. for

3,225 and newly issued shares were subscribed for in the amount of

1,490. At the end of the year the holdings were written down by

1,490.

A shareholder contribution of 8,678 was made to the newly

formed company Volvo Global Trucks AB, who then aquired the

shares in Volvo Lastvagnar AB for the corresponding amount.

The shares in Volvo Powertrain AB and Volvo Parts AB were

acquired from Volvo Lastvagnar AB.

The shares in Mitsubishi Motors Corporation together with all

rights and obligations relating to the company, were given a total

value of 3,010 and were used as a shareholder contribution to a

newly established German subsidiary; Herkules VmbH. The company

was then divested to DaimlerChrysler.