Volvo 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

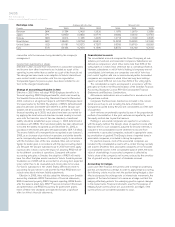

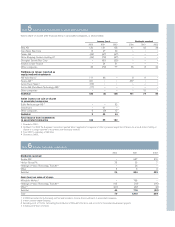

Foreign currencies

In preparing the consolidated financial statements, all items in the

income statements of foreign subsidiaries and joint ventures (except

subsidiaries in highly inflationary economies) are translated to

Swedish kronor at the average exchange rates during the year (aver-

age rate). All balance sheet items except net income are translated

at exchange rates at the respective year-ends (year-end rate). The

differences in consolidated shareholders’ equity arising as a result of

variations between year-end exchange rates are charged or credited

directly to shareholders’ equity and classified as restricted or un-

restricted reserves. The difference arising in the consolidated bal-

ance sheet as a result of the translation of net income, in the income

statements, in foreign subsidiaries’ to Swedish kronor at average

rates, and in the balance sheets at year-end rate, is charged or

credited to unrestricted reserves. Movements in exchange rates

change the book value of foreign associated companies. This differ-

ence affects restricted reserves directly.

When foreign subsidiaries, joint ventures and associated com-

panies are divested, the accumulated translation difference is report-

ed as a realized gain/loss and, accordingly, affects the capital gain.

Financial statements of subsidiaries operating in highly inflationary

economies are translated to Swedish kronor using the monetary

method. Monetary items in the balance sheet are translated at year-

end rates and nonmonetary balance sheet items and corresponding

income statement items are translated at rates in effect at the time

of acquisition (historical rates). Other income statement items are

translated at average rates. Translation differences are credited to, or

charged against, income in the year in which they arise.

In the individual Group companies as well as in the consolidated

accounts, receivables and liabilities in foreign currency are valued at

year-end exchange rates. In appropriate cases, hedged receivables

and liabilities are valued at the underlying forward rate.

Gains and losses pertaining to hedges are reported at the same

time as gains and losses of the items hedged. Received premiums or

payments for currency options, which hedge currency flows in busi-

ness transactions, are reported as income/expense during the con-

tract period.

Gains/losses on outstanding currency futures at year-end, which

were entered into to hedge future commercial currency flows, are

reported at the same time as the commercial flow is realized. For

other currency futures that do not fullfil the criteria for hedge account-

ing a full market valuation is made on a portfolio basis and are

credited to, or charged against income.

In valuing financial assets and liabilities whose original currency

denomination has been changed as a result of currency swap con-

tracts, the loan amount is accounted for translated to Swedish

kronor taking into account the swap contracts.

Exchange differences on loans and other financial instruments in

foreign currency, which are used to hedge net assets in foreign sub-

sidiaries and associated companies, are offset against translation dif-

ferences in the shareholders’ equity of the respective companies.

Exchange gains and losses on payments during the year and on

the valuation of assets and liabilities in foreign currencies at year-

end are credited to, or charged against, income before taxes and

minority interests in the year they arise. The more important

exchange rates employed are shown above.

Other financial instruments

Interest-rate contracts and foreign exchange contracts are used to

change the underlying financial asset and debt structure and are

reported as hedges against such assets and debts.

Interest-rate contracts used as part of the management of the

Group’s short-term investments are valued together with these

investments in accordance with the portfolio method. Provisions are

made for unrealized losses in excess of the unrealized gains within

the portfolio.

Interest-rate contracts that do not fullfil the criteria of hedge

accounting are valued at the balance sheet date at which time provi-

sions for unrealized losses are made.

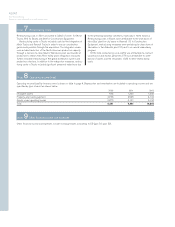

Net sales

The Group’s reported net sales pertain mainly to revenues from sales

of goods and services. Net sales are reduced by the value of dis-

counts granted and by returns.

Income from the sale of goods is recognized when the goods are

delivered to the customers. If, however, the sale of goods is com-

bined with a buy-back agreement or a residual value guarantee, the

sale is accounted for as an operating lease transaction if significant

risks of the goods are retained in Volvo. Income from the sale of

workshop services is recognized when the service is provided. Rental

revenues and interest income in conjunction with financial leasing or

installment contracts are recognized over the contract period.

Research and development expenses

Effective in 2001, Volvo has adopted RR15 Intangible Assets (see

changes in accounting principles above). In accordance with the new

accounting standard, expenditures for development of new products

and production systems shall be reported as intangible assets if such

expenditures with a high degree of certainty will result in future

financial benefits for the company. The acquisition value for such

intangible assets shall be amortized over the estimated useful life of

the assets. Volvo’s application of the new rules means that very high

demands are established in order for these development expend-

itures to be reported as assets. For example, it must be possible to

prove the technical functionality of a new product prior to this devel-

opment being reported as an asset. In normal cases, this means that

expenditures are capitalized only during the industrialization phase of

a product development project. Other research and development

expenses are charged to income as incurred.

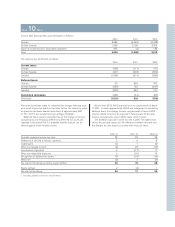

Warranty expenses

Estimated costs for product warranties are charged to operating

expenses when the products are sold. Estimated costs include both

expected contractual warranty obligations as well as expected good-

will warranty obligations. Estimated costs are determined based upon

historical statistics with consideration of known changes in product

quality, repair costs or similar. Costs for campaigns in connection

with specific quality problems are charged to operating expenses

when the campaign is decided and announced.

Restructuring costs

Restructuring costs are reported as a separate line item in the income

statement if they relate to a considerable change of the Group struc-

ture. Other restructuring costs are included in Other operating

income and expenses. A provision for decided restructuring meas-

ures (see changes in accounting principles above) is reported when

a detailed plan for the implementation of the measures is complete

and when this plan is communicated to those who are affected.

Depreciation, amortization and impairments of tangible and

intangible non-current assets

Depreciation is based on the historical cost of the assets, adjusted in