Volvo 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and old spare parts. Concurrently, the Land

& Marine Gas Turbines unit was affected

by the decline in the gas turbine market.

Despite the deep crisis in the aviation

industry, Volvo Aero’s Aerospace Com-

ponents and Military Engines business

units were able to deliver positive earn-

ings for the full year, which offset the

declines in the other business units.

Production and investments

Only a year after Volvo Aero and Rolls-

Royce signed a contract making Volvo

Aero a partner in the Trent 500 engine

program, the company was able to deliv-

er the first intermediate compressor case

from Trollhättan in summer 2002. For this

purpose, investments have been made in

a completely new “Trent workshop”.

Additionally, Volvo Aero is one of the

initiators of the Digitally Linked Process

Control project, aimed at substantially

reducing lead times from product develop-

ment to completed product by employing

new technology in all production phases.

The project involves the construction of a

development laboratory, in which all

processes are linked digitally to a virtual

workshop, a workshop that has proven to

be without equal in the aerospace industry.

During the sharp downturn in the aviation

aftermarket, Volvo Aero Services (VAS)

focused on establishing long-term con-

tracts with airlines and other players in

the industry. VAS has succeeded in sign-

ing contracts with companies that include

Pratt & Whitney, Bombardier, Goodrich,

Nordam, AeroXchange and Air Asia.

In 2002, Volvo Aero Engine Services

signed a contract with the Russian airline,

Aeroflot, under which Volvo Aero will

overhaul Aeroflot’s JT9D-59A engines,

which are used in the airline’s fleet of

DC10-40 aircraft. The order value is esti-

mated at SEK 600 M, making it the

largest single maintenance order signed

by Volvo Aero since 1998. New overhaul

contracts were also signed with Corsair

International of France, Centurion Air

Cargo company and Sabena Technics,

among other companies.

During the autumn, the first aircraft of

the latest JAS 39 Gripen model, the 39C,

was delivered to the Swedish Air Forces.

The aircraft incorporates a large number

of modernizations of the Gripen aircraft,

which include the RM12 engine being fit-

ted with Volvo Aero’s proprietary flame-

holder, new intake and FADEC (Full

Authority Digital Electronic Control).

During the year, Volvo Aero’s Space

Propulsion Division delivered its first com-

plete sandwich nozzle for the RL60. This

is the first step towards the full-scale

development of the RL60, the next gener-

ation of liquid oxygen/hydrogen- powered

rocket engines developed by the

American company Pratt & Whitney.

Ambitions for 2003

The aviation industry’s sharp downturn

necessitates continued adaptation to

new conditions while opportunities for

increasing market shares are also created

during a recession.

Accordingly, Volvo Aero aims to con-

tinue building its components business

and will make strong efforts to become in-

volved in new engine programs, either as

a partner or long-term supplier.

In the service sector, major efforts are

being made in developing the customer

offering and signing long-term contracts

with airlines, partners and other cus-

tomers for both engine overhaul and

spare parts/service offers.

Activities continue in support of

Saab/BAE’s export efforts in selling the

Gripen. Major efforts are being made to

ensure that Volvo Aero is provided the

appropriate conditions to continue further

development of the RM12 engine.

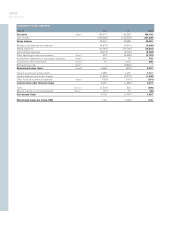

Net sales per market Volvo Aero

SEKM 2000 2001 2002

Western Europe 4,651 4,788 3,422

Eastern Europe 42 87 28

North America 5,040 5,841 4,573

South America 134 187 177

Asia 701 708 497

Other markets 45 173 140

Total 10,713 11,784 8,837