Volvo 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34/35

The Volvo Group

Notes to consolidated financial statements

connection with the measures being decided by the company’s

management.

Income from investments in shares

Effective in 2001, Income from investments in associated companies

and Income from other investments are included as a part of the

operating income rather than as earlier as a part of the financial net.

The change has been made as an adaption to Volvo’s internal busi-

ness control model in connection with the new organization.

Comparable figures for previous years have been restated to con-

form to the changed classification.

Change of accounting principles in 2003

Effective in 2003 Volvo will adopt RR29 Employee benefits in its

financial reporting. RR29 Employee benefits, which was issued by

the Swedish Financial Accounting Standards Council in December

2002, conforms in all signficant respects with IAS19 Employee bene-

fits issued earlier by the IASC. By adoption of RR29, defined benefit

plans for pensions and health-care benefits in all the Group’s sub-

sidiaries will be accounted for with consistent principles. In Volvo’s

financial reporting up to 2002, such plans have been accounted for

by applying the local rules and directives in each country. In accord-

ance with the transition rules of the new standard, a transitional

liability should be established as per January 1, 2003, determined in

accordance with RR29. This transitional liability has been determined

to exceed the liability recognized as per December 31, 2002, in

accordance with earlier principles with approximately SEK 1.9 billion.

The excess liability will consequently be recognized as per January 1,

2003, as an increase of provisions for pensions and similar benefits

and a corresponding decrease of shareholders equity. In accordance

with the transition rules of the new standard, Volvo will not restate

figures for earlier years in accordance with the new accounting stand-

ard. Because the Group’s subsidiaries up to 2002 have been apply-

ing local rules in each country, the impact of adopting RR29 will dif-

fer for different countries of operations. Compared with earlier

accounting principles in Sweden, the adoption of RR29 will mainly

have the effect that plan assets invested in Volvo’s Swedish pension

foundation as of 2003 will be accounted for at a long-term expected

return rather than to be revaluated each closing date to fair value.

For Volvo’s subsidiaries in the United States, differences relate to

accounting for past service costs and the fact that RR29 does not

include rules about minimum liability adjustments.

Effective in 2003, Volvo will also adopt the following new Swedish

accounting standards: RR22 Presentation of financial statements,

RR24 Investment property, RR25 Segment reporting, RR26 Events

after the balance sheet date, RR27 Financial instrument: Disclosure

and presentation and RR28 Accounting for government grants.

None of these new standards are expected to have a significant

effect on Volvo’s financial statements.

Consolidated accounts

The consolidated accounts comprise the Parent Company, all sub-

sidiaries, joint ventures and associated companies. Subsidiaries are

defined as companies in which Volvo holds more than 50% of the

voting rights or in which Volvo otherwise has a controlling influence.

However, subsidiaries in which Volvo’s holding is temporary are not

consolidated. Joint ventures are companies over which Volvo has

joint control together with one or more external parties. Associated

companies are companies in which Volvo has long-term holdings

equal to at least 20% but not more than 50% of the voting rights.

The consolidated accounts are prepared in accordance with the

principles set forth in the Recommendation of the Swedish Financial

Accounting Standards Council, RR1:00, Consolidated Financial

Statements and Business Combinations.

All business combinations are accounted for in accordance with

the purchase method.

Companies that have been divested are included in the consoli-

dated accounts up to and including the date of divestment.

Companies acquired during the year are consolidated as of the date

of acquisition.

Joint ventures are preferably reported by use of the proportionate

method of consolidation. A few joint ventures are reported by use of

the equity method due to practical reasons.

Holdings in associated companies are reported in accordance

with the equity method. The Group’s share of reported income after

financial items in such companies, adjusted for minority interests, is

included in the consolidated income statement in Income from

investments in associated companies, reduced in appropriate cases

by amortization of goodwill. The Group’s share of reported taxes in

associated companies, is included in Group tax expense.

For practical reasons, most of the associated companies are

included in the consolidated accounts with a certain time lag, normally

one quarter. Dividends from associated companies are not included

in consolidated income. In the consolidated balance sheet, the book

value of shareholdings in associated companies is affected by

Volvo’s share of the company’s net income, reduced by the amortiza-

tion of goodwill and by the amount of dividends received.

Accounting for hedges

Loans and other financial instruments used to hedge an underlying

position are reported as a hedge. In order to apply hedge accounting,

the following criteria must be met: the position being hedged is iden-

tified and exposed to exchange-rate or interest-rate movements, the

purpose of the loan/instrument is to serve as a hedge and that the

hedging effectively protects the underlying position against changes

in the market rates. Financial instruments used for the purpose of

hedging future currency flows are accounted for as hedges if the

currency flows are considered probable to occur.

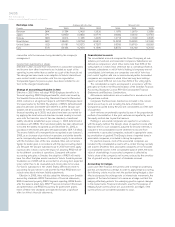

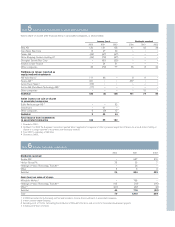

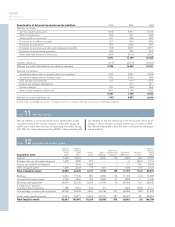

Exchange rates Average rate Jan–Dec Year-end rate

Country Currency 2000 2001 2002 2000 2001 2002

Denmark DKK 1.1334 1.2403 1.2326 1.1870 1.2670 1.2386

Japan JPY 0.0850 0.0850 0.0779 0.0832 0.0813 0.0740

Norway NOK 1.0414 1.1485 1.2205 1.0715 1.1840 1.2605

Great Britain GBP 13.8620 14.8763 14.5816 14.2200 15.4800 14.1538

United States USD 9.1581 10.3272 9.7287 9.5350 10.6700 8.8263

Euro EUR 8.4494 9.2434 9.1596 8.8570 9.4240 9.2018