Volvo 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

transferred to Renault SA. In total, the

repurchase of shares reduced liquid

funds by SEK 8.3 billion.

A dividend amounting to SEK 3.4 bil-

lion was paid to AB Volvo’s shareholders

during the year.

Operating cash flow, excluding

Financial Services

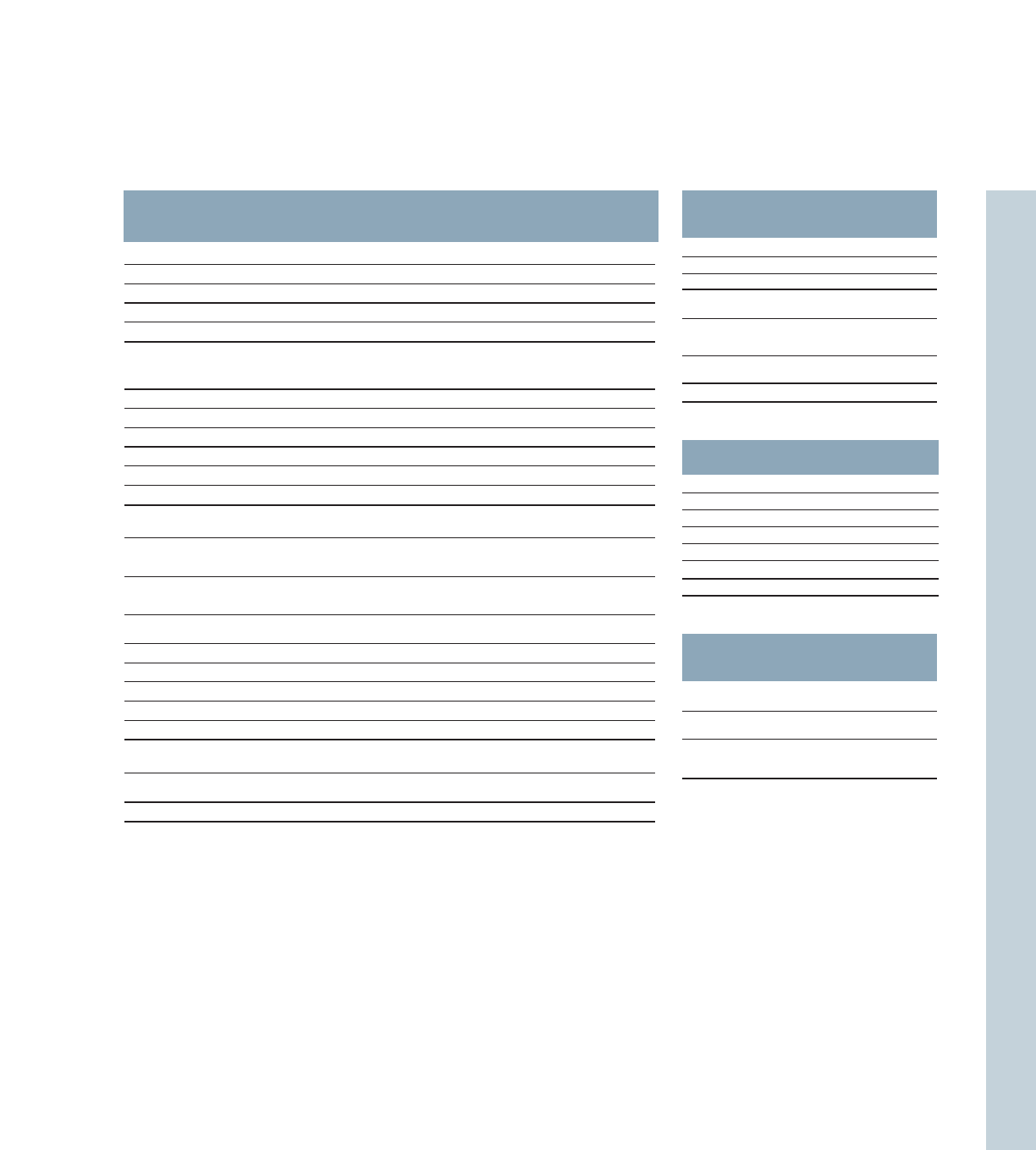

SEKbn 2000 2001 2002

Operating income 5.2 (1.0) 2.3

Depreciation and amortization 3.8 7.0 7.8

Other (5.4) 3.7 0.3

Cash flow from

operating activities 3.6 9.7 10.4

Net investments in fixed

assets and leasing assets (5.0) (7.1) (5.3)

Customer finance

receivables, net 0.0 0.8 0.0

Operating cash flow (1.4) 3.4 5.1

Condensed cash flow statements,

Financial Services

SEKbn 2000 2001 2002

Cash flow from operating

activities 4.4 4.5 4.9

Net investments in

credit portfolio etc (8.5) (9.8) (9.2)

Cash flow after net

investments,

Financial Services (4.1) (5.3) (4.3)

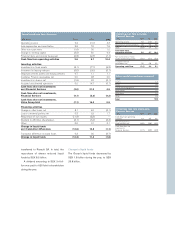

Future capital expenditures, approved

SEK bn

Trucks 4.2

Buses 0.5

Construction Equipment 0.1

Volvo Penta 0.1

Volvo Aero 0.1

Other 0.5

Total 5.5

Consolidated cash flow statements

SEK billion 2000 2001 2002

Operating income 5.2 (1.0) 2.3

Add depreciation and amortization 3.8 7.0 7.8

Other non-cash items (1.6) 0.0 1.0

Change in working capital (3.0) 6.0 0.4

Financial items and income taxes paid (0.8) (2.3) (1.1)

Cash flow from operating activities 3.6 9.7 10.4

Investing activities

Investments in fixed assets (5.1) (7.7) (6.3)

Investment in leasing vehicles (0.6) (0.5) (0.1)

Disposals of fixed assets and leasing vehicles 0.7 1.1 1.1

Customer Finance receivables, net 0.0 0.8 0.0

Investments in shares, net (1.6) 3.2 (0.1)

Acquired and divested operations 0.0 14.7 (0.1)

Cash flow after net investments

excl Financial Services (3.0) 21.3 4.9

Cash flow after net investments,

Financial Services (4.1) (5.3) (4.3)

Cash flow after net investments,

Volvo Group total (7.1) 16.0 0.6

Financing activities

Change in other loans, net 8.1 6.2 (0.1)

Loans to external parties, net 0.3 0.2 1.7

Repurchase of own shares (11.8) (8.3) —

Dividend to AB Volvo shareholders (3.1) (3.4) (3.4)

Other 0.0 0.1 0.1

Change in liquid funds

excl translation differences (13.6) 10.8 (1.1)

Translation difference on liquid funds 0.3 0.6 (0.7)

Change in liquid funds (13.3) 11.4 (1.8)

Change in liquid funds

The Group’s liquid funds decreased by

SEK 1.8 billion during the year, to SEK

25.6 billion.