Volvo 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16/17

Business Areas

Construction

Equipment

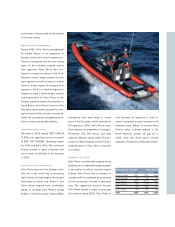

Volvo Construction Equipment (Volvo CE)

is one of the world’s leading companies in

the construction equipment industry with

production on four continents and distribu-

tion of products, spare parts and service

in more than 200 countries. The company

has historically held strong positions in

Europe and North America and is now

extending its presence in Asia (primarily in

China and Korea), South America and

Eastern Europe (primarily in Poland and

former Soviet union).

Volvo CE’s products are used in a

number of applications such as general

construction, road construction and main-

tenance, forestry, demolition, waste hand-

ling, mining and in the rental industry.

The product range comprises Excav-

ators, Wheel Loaders, Articulated Haulers,

Motor Graders, Backhoe Loaders, Skid

Steer Loaders and a range of compact

Wheel Loaders and compact Excavators.

The company also offers solutions for

financing, leasing, sales of used equip-

ment and have recently launched an ini-

tiative for the rental market, Volvo CE

Rents. At year-end 2002, 50 rental stores

had opened or were under development

agreements in US and Europe.

Tot a l market

The total combined world market for

heavy construction equipment and com-

pact equipment within Volvo CE’s prod-

uct range declined by 3% during 2002. In

North America the downturn was 12%.

Europe was down 6% while other markets

were up 7%.

The market for heavy construction

equipment increased by about 3% in

2002, of which North America showed a

decline of 7%, Europe approximately

10% and other markets up about 20%.

For compact equipment, the market fell

about 8% during the year, of which Europe

represented a decline of 5%, North America

17% and decline of 5% in other markets.

Business environment

In October 2002 Hitachi and Komatsu

announced that they will standardize and

share certain components. This move is

the first part of a business deal made by

the two companies in April outlining six

areas of cooperation. 2002 also saw

Terex continue its acquisition streak, this

time strengthening its position in Europe

by adding a major German machinery

manufacturer and reorganizing itself into

four separate units.

Market share development

Compared with the preceding year, Volvo

CE was able to strengthen its share of the

market in several important geographical

and product areas mainly due to recently

launched products backed by a strong

brand name.

The value of the order bookings as of

December 31, 2002 was 30% higher than

at year-end 2001.

The market in Western Europe con-

tinued to be the largest single market with

49% of sales, North America accounted

for 27% of sales, Asia represented 15%

and the rest of the world 9%.

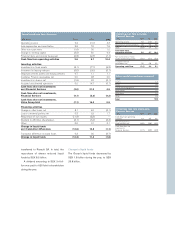

98 99 00 01 02

19. 4 18 . 9 2 0 .0 21.1 21. 0

Net sales, SEK bn

98 99 00 01 02

1. 5 1. 7 1. 6 0 . 9 0 . 4

Operating income*, SEK bn

98 99 00 01 02

7.9 9.1 8.04.21.9

Operating Margin*, %

Net sales as percentage of Volvo Group sales, %

*excluding restructuring costs

*excluding restructuring costs

12%