Virgin Media 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension commitments have been excluded from the above table. For the year ended December 31, 2011, we

anticipate contributing a total of £17.4 million to fund our defined benefit pension plans. Funding commitments

beyond 2011 will not be known until completion of the next triennial valuations, which is expected to be in the

first half of 2012.

Early termination charges are amounts that would be payable in the above periods in the event of early

termination during that period of certain of the contracts underlying the purchase obligations listed above.

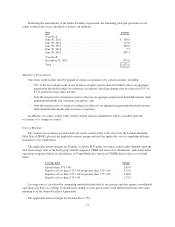

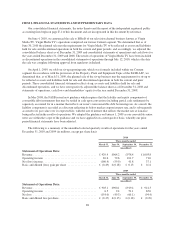

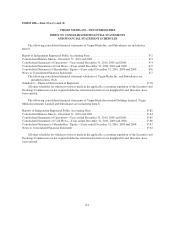

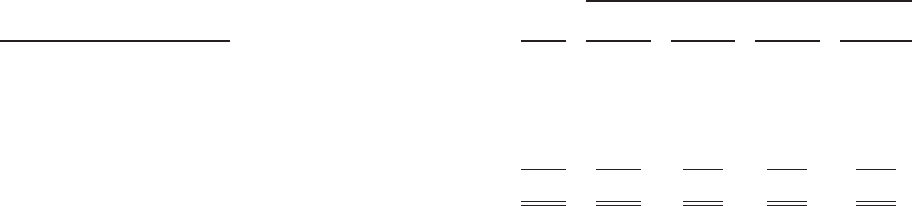

The following table includes information about our commercial commitments as of December 31, 2010.

Commercial commitments are items that we could be obligated to pay in the future. They are not required to be

included in the consolidated balance sheet (in millions):

Amount of Commitment Expiration per Period

Other Commercial Commitments Total

Less than

1 year 1–3 years 3–5 years

More than

5 years

Guarantees ......................................... £— £— £— £— £—

Lines of credit ...................................... — — — — —

Standby letters of credit .............................. 17.0 14.9 — — 2.1

Standby repurchase obligations ........................ — — — — —

Other commercial commitments ........................ — — — — —

Total commercial commitments ........................ £17.0 £14.9 £ £— £ 2.1

Derivative Instruments and Hedging Activities

We have a number of derivative instruments with a number of counterparties to manage our exposures to

changes in interest rates and foreign currency exchange rates. We account for certain of these instruments as

accounting hedges, in accordance with the Derivatives and Hedging Topic of the FASB ASC, when the

appropriate eligibility criteria has been satisfied, and to the extent that they are effective. Ineffectiveness in our

accounting hedges, and instruments that we have not elected for hedge accounting, are recognized through the

consolidated statement of operations immediately. Effective cash flow accounting hedges are recognized as

either assets or liabilities and measured at fair value with changes in the fair value recorded within other

comprehensive income (loss). The derivative instruments consist of interest rate swaps, cross-currency interest

rate swaps and foreign currency forward contracts.

We are also subject to interest rate risks. Before taking into account the impact of current hedging

arrangements, as of December 31, 2010, we would have had interest determined on a variable basis on

£1,675 million, or 27.8%, of our long term debt. An increase in interest rates of 1% would increase unhedged

gross interest expense by approximately £16.7 million per year.

We are also subject to currency exchange rate risks because substantially all of our revenues, operating costs

and selling, general and administrative expenses are paid in U.K. pounds sterling, but we pay interest and

principal obligations with respect to a portion of our indebtedness in U.S. dollars and euros. To the extent that the

pound sterling declines in value against the U.S. dollar and the euro, the effective cost of servicing our

U.S. dollar and euro denominated debt will be higher. Changes in the exchange rate result in foreign currency

gains or losses. As of December 31, 2010, £2,884.8 million, or 46.6%, of our indebtedness based upon

contractual obligations, was denominated in U.S. dollars and £154.3 million, or 2.5%, of our indebtedness based

upon contractual obligations, was denominated in euros. We also purchase goods and services in U.S. dollars,

euros and South African rand.

83