Virgin Media 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

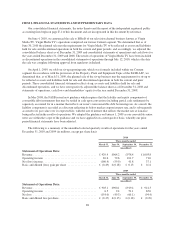

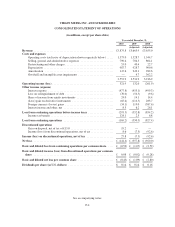

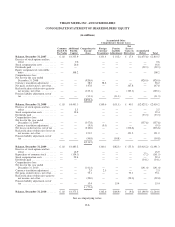

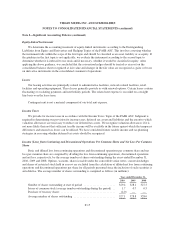

VIRGIN MEDIA INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

Year ended December 31,

2010 2009 2008

(Adjusted) (Adjusted)

Operating activities:

Net loss .......................................................................... £ (141.4) £ (357.8) £ (920.0)

(Income) loss on discontinued operations ............................................... (27.8) 7.5 92.6

Loss from continuing operations ...................................................... (169.2) (350.3) (827.4)

Adjustments to reconcile loss from continuing operations to net cash provided by operating

activities:

Depreciation and amortization .................................................... 1,135.3 1,171.8 1,183.2

Goodwill and intangible asset impairments .......................................... — 4.7 362.2

Non-cash interest .............................................................. 19.5 17.3 (46.4)

Non-cash compensation ......................................................... 29.4 19.4 16.8

Loss on extinguishment of debt ................................................... 70.1 53.6 9.6

(Income) loss from equity accounted investments, net of dividends received ................ (9.3) (12.4) 10.7

Losses (gains) on derivative instruments ............................................ 133.8 133.4 (278.1)

Unrealized foreign currency (gains) losses .......................................... (89.3) (158.8) 371.6

Income taxes .................................................................. (101.1) 2.8 (2.3)

Amortization of original issue discount and deferred finance costs ....................... 20.6 34.0 24.4

Other ........................................................................ 0.5 1.2 0.6

Changes in operating assets and liabilities, net of effect from business disposals:

Accounts receivable ............................................................ (28.4) 27.5 (8.3)

Inventory .................................................................... (13.5) (0.3) (4.4)

Prepaid expenses and other current assets ........................................... 6.3 (2.7) (12.7)

Other assets .................................................................. (2.0) (14.9) (11.0)

Accounts payable .............................................................. 4.5 (15.0) (5.9)

Deferred revenue (current) ....................................................... 18.9 17.8 16.3

Accrued expenses and other current liabilities ........................................ 18.9 (30.1) (28.4)

Deferred revenue and other long term liabilities ...................................... (7.4) (5.5) 5.2

Net cash provided by operating activities ....................................... 1,037.6 893.5 775.7

Investing activities:

Purchase of fixed and intangible assets ............................................. (628.4) (568.0) (476.3)

Proceeds from sale of fixed assets ................................................. 36.0 4.2 2.1

Principal repayments on loans to equity investments .................................. 8.4 12.5 8.6

Decrease in restricted cash ....................................................... 3.8 — —

Disposal of businesses, net ....................................................... 167.4 (17.5) —

Other ........................................................................ 1.4 (2.5) (1.5)

Net cash used in investing activities ........................................... (411.4) (571.3) (467.1)

Financing activities:

New borrowings, net of financing fees ............................................. 3,072.0 1,610.2 447.7

Repurchase of common stock .................................................... (161.5) — —

Purchase of conversion hedges ................................................... (205.4) — —

Proceeds from employee stock option exercises ...................................... 17.0 2.5 0.6

Principal payments on long term debt, including redemption premiums, and capital leases ..... (3,239.8) (1,737.4) (846.3)

Dividends paid ................................................................ (34.1) (33.3) (29.3)

Realized gain on derivatives ..................................................... — 88.3 —

Net cash used in financing activities ........................................... (551.8) (69.7) (427.3)

Cash flow from discontinued operations:

Net cash used in operating activities ............................................... (30.1) (0.8) (20.1)

Net cash used in investing activities ............................................... — (1.0) (3.4)

Net cash used in discontinued operations ....................................... (30.1) (1.8) (23.5)

Effect of exchange rate changes on cash and cash equivalents ............................... 4.7 (1.8) 2.4

Increase (decrease) in cash and cash equivalents .......................................... 49.0 248.9 (139.8)

Cash and cash equivalents, beginning of year ............................................ 430.5 181.6 321.4

Cash and cash equivalents, end of year ................................................. £ 479.5 £ 430.5 £ 181.6

Supplemental disclosure of cash flow information

Cash paid during the period for interest exclusive of amounts capitalized ...................... £ 438.8 £ 404.2 £ 515.8

Income taxes paid (received) ......................................................... 1.2 0.1 (0.1)

See accompanying notes.

F-5