Virgin Media 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243

|

|

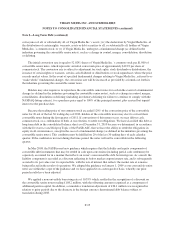

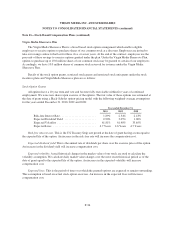

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 8—Long Term Debt (continued)

The senior credit facility bears interest at LIBOR, plus a margin currently ranging from 2.75% to 3.75% and

the applicable cost of complying with any reserve requirement. The margins on £1,000.0 million of the term loan

A facilities and on the revolving credit facility ratchet range from 2.75% to 3.50% based on leverage ratios.

Interest is payable at least semi-annually. Principal repayments in respect of £1,000.0 million of the term loan A

facilities are due annually beginning in June 2011 and ending in June, 2015, and the remaining term loan B

facility is repayable in full on its maturity date which is December 31, 2015.

On April 19, 2010, we drew down an aggregate principal amount of £1,675.0 million under our new senior

credit facility dated March 16, 2010, as amended and restated, or the new senior credit facility, and applied the

proceeds towards the repayment of all amounts outstanding under our old senior credit facility and for general

corporate purposes.

The facility is secured through a guarantee from Virgin Media Finance. In addition, the bulk of the facility is

secured through guarantees and first priority pledges of the shares and assets of substantially all of the operating

subsidiaries of VMIH, and of receivables arising under any intercompany loans to those subsidiaries. We are

subject to financial maintenance tests under the facility, including a test of liquidity, coverage and leverage ratios

applied to us and certain of our subsidiaries. As of December 31, 2010, we were in compliance with these

covenants.

The agreements governing the senior secured notes and the senior credit facility significantly restrict the

ability of our subsidiaries to transfer funds to us in the form of cash dividends, loans or advances. In addition, the

agreements significantly, and, in some cases, absolutely restrict our ability and the ability of most of our

subsidiaries to:

• incur or guarantee additional indebtedness;

• pay dividends at certain levels of leverage, or make other distributions, or redeem or repurchase equity

interests or subordinated obligations;

• make investments;

• sell assets, including the capital stock of subsidiaries;

• enter into sale and leaseback transactions or certain vendor financing arrangements;

• create liens;

• enter into agreements that restrict the restricted subsidiaries’ ability to pay dividends, transfer assets or

make intercompany loans;

• merge or consolidate or transfer all or substantially all of our assets; and

• enter into transactions with affiliates.

F-27