Virgin Media 2010 Annual Report Download - page 76

Download and view the complete annual report

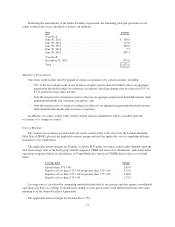

Please find page 76 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UKTV receives financing through loans from Virgin Media, which totaled £129.3 million at December 31,

2009. These loans effectively act as a revolving facility for UKTV. We received cash payments from UKTV in

the form of loan capital repayments of £12.5 million for the year ended December 31, 2009. We received

dividends, interest payments and payments for consortium tax relief from UKTV totaling £8.6 million during

2009.

Additionally, we recorded a loss of £2.4 million and £4.3 million in the years ended December 31, 2009 and

2008, respectively, from our investment in our joint venture with Setanta Sports News. Setanta Sports News

ceased broadcasting in June 2009 and we are in process of winding up this business.

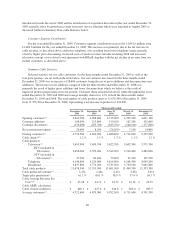

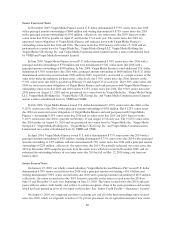

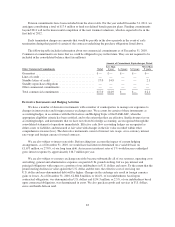

Consolidated Statement of Cash Flows

Years Ended December 31, 2010 and 2009

For the year ended December 31, 2010, cash provided by operating activities increased to £1,037.6 million

from £893.5 million for the year ended December 31, 2009. This increase was primarily attributable to the

improvements in operating results. For the year ended December 31, 2010, cash paid for interest, exclusive of

amounts capitalized, increased to £438.8 million from £404.2 million during the same period in 2009. The

increase was primarily due to differences in the timing of interest payments on senior credit facility and senior

notes.

For the year ended December 31, 2010, cash used in investing activities decreased to £411.4 million from

£571.3 million for the year ended December 31, 2009. The decrease was primarily due to net proceeds received

from the disposal of Virgin Media Television, totaling £167.4 million, partially offset by increased purchases of

fixed assets, which increased to £628.4 million for the year ended December 31, 2010 from £568.0 million for

the year ended December 31, 2009.

Cash used in financing activities for the year ended December 31, 2010 was £551.8 million compared with

cash used in financing activities of £69.7 million for the year ended December 31, 2009. For the year ended

December 31, 2010, the principal uses of cash were the partial repayments under our previous senior credit

facility, our senior notes due 2014 and capital lease payments, totaling £3,239.8 million, purchases of our own

shares totaling £161.5 million and the purchase of conversion hedges relating to the shares issuable under our

convertible senior notes totaling £205.4 million. The principal components of cash provided by financing

activities were new borrowings from the issuance of our senior notes due 2016 and our senior notes due 2019, net

of financing fees, of £3,072.0 million. For the year ended December 31, 2009, the principal uses of cash were the

partial repayments under our senior credit facility and our senior notes due 2014 and capital lease payments,

totaling £1,737.4 million, and the principal components of cash provided by financing activities were new

borrowings from the issuance of our senior notes due 2016 and our senior notes due 2019, net of financing fees,

of £1,610.2 million. See further discussion under “Liquidity and Capital Resources—Senior Credit Facility”.

Cash flows from discontinued operations for the year ended December 31, 2010 are attributable to Virgin

Media TV. Cash flows from discontinued operations for the years ended December 31, 2009 are attributable to

Virgin Media TV and sit-up. We do not believe that the disposal of Virgin Media TV will have a material impact

on our liquidity.

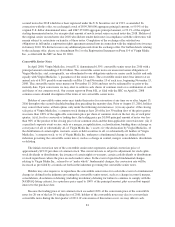

Years Ended December 31, 2009 and 2008

For the year ended December 31, 2009, cash provided by operating activities increased to £893.5 million

from £775.7 million for the year ended December 31, 2008. This increase was attributable to the improvements

in operating results and lower cash interest payments. For the year ended December 31, 2009, cash paid for

interest, exclusive of amounts capitalized, decreased to £404.2 million from £515.8 million during the same

period in 2008. This decrease resulted from lower interest rates, lower debt levels due to repayments in 2008 and

differences in the timing of interest payments under our senior credit facility.

73