Virgin Media 2010 Annual Report Download - page 103

Download and view the complete annual report

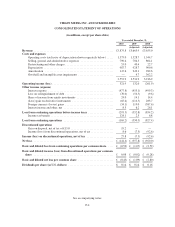

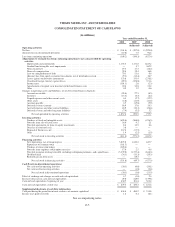

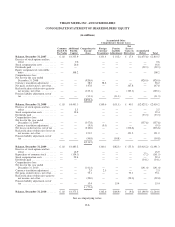

Please find page 103 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 2—Significant Accounting Policies (continued)

On June 4, 2010, we announced the sale to BSkyB of our television channel business known as Virgin

Media TV. Virgin Media TV’s operations comprised our former Content segment. We determined that as of

June 30, 2010 the planned sale met the requirements for Virgin Media TV to be reflected as assets and liabilities

held for sale and discontinued operations in both the current and prior periods, and accordingly, we adjusted the

consolidated balance sheet as of December 31, 2009 and consolidated statements of operations, cash flows and

shareholders’ equity for the years ended December 31, 2009 and 2008. Virgin Media TV’s operations have been

included in discontinued operations through July 12, 2010, which is the date the sale was completed following

approval from regulators in Ireland.

Principles of Consolidation

The consolidated financial statements include the accounts for us and our wholly owned subsidiaries.

Intercompany accounts and transactions have been eliminated on consolidation. The operating results of acquired

companies are included in our consolidated statements of operations from the date of acquisition.

For investments in which we own 20% to 50% of the voting shares and have significant influence over the

operating and financial policies, the equity method of accounting is used. Accordingly, our share of the earnings

and losses of these companies are included in the share of income (losses) in equity investments in the

accompanying consolidated statements of operations. For investments in which we own less than 20% of the

voting shares and do not have significant influence, the cost method of accounting is used. Under the cost method

of accounting, we do not record our share in the earnings and losses of the companies in which we have an

investment and such investments are generally reflected in the consolidated balance sheet at historical cost.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates

and assumptions that affect the amounts reported in the financial statements and accompanying notes. Such

estimates and assumptions impact, among others, the following: the amount of uncollectible accounts receivable,

the amount to be paid to terminate certain agreements included in restructuring costs, amounts accrued for

vacated properties, the amount to be paid for other liabilities, including contingent liabilities, our pension

expense and pension funding requirements, amounts to be paid under our employee incentive plans, costs for

interconnection, the amount of costs to be capitalized in connection with the construction and installation of our

network and facilities, goodwill and indefinite life assets, long-lived assets, certain other intangible assets and the

computation of our income tax expense and liability. Actual results could differ from those estimates.

Reclassification

Certain prior year amounts have been reclassified to conform to the current year presentation.

Fair Values

We have determined the estimated fair value amounts presented in these consolidated financial statements

using available market information and appropriate methodologies including, where appropriate, the recording of

adjustments to fair values to reflect non-performance risk. However, considerable judgment is required in

interpreting market data to develop the estimates of fair value. The estimates presented in these consolidated

financial statements are not necessarily indicative of the amounts that we could realize in a current market

exchange. The use of different market assumptions and/or estimation methodologies may have a material effect

F-8