Virgin Media 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

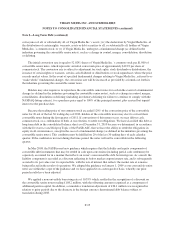

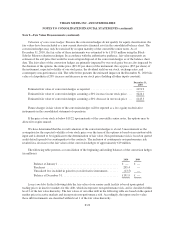

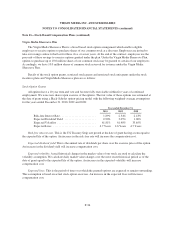

Note 9—Fair Value Measurements (continued)

Valuation of conversion hedges: Because the conversion hedges do not qualify for equity classification, the

fair values have been included as a non-current derivative financial asset in the consolidated balance sheet. The

conversion hedges may only be exercised by us upon maturity of the convertible senior notes. As of

December 31, 2010, the fair value of these instruments was estimated to be £191.9 million using the Black-

Scholes Merton valuation technique. In accordance with the authoritative guidance, fair value represents an

estimate of the exit price that would be received upon disposal of the conversion hedges as of the balance sheet

date. The fair values of the conversion hedges are primarily impacted by our stock price but are also impacted by

the duration of the options, the strike price ($19.22 per share) of the instrument, the cap price ($35 per share) of

the instrument, expected volatility of our stock price, the dividend yield on our stock, exchange rates, and

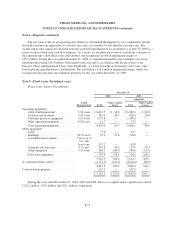

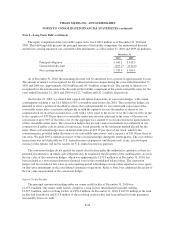

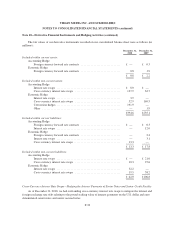

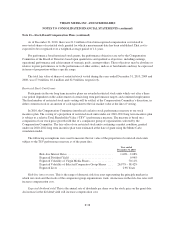

counterparty non-performance risk. The table below presents the estimated impact on the December 31, 2010 fair

value of a hypothetical 20% increase and decrease in our stock price (holding all other inputs constant):

December 31,

2010

Estimated fair value of conversion hedges as reported ............................. £191.9

Estimated fair value of conversion hedges assuming a 20% increase in our stock price .... £224.1

Estimated fair value of conversion hedges assuming a 20% decrease in our stock price . . . £145.5

Future changes in fair values of the conversion hedges will be reported as a loss (gain) on derivative

instruments in the consolidated statement of operations.

If the price of our stock is below $19.22 upon maturity of the convertible senior notes, the options may be

allowed to expire unused.

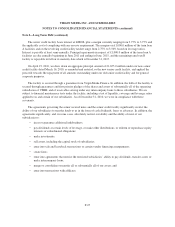

We have determined that the overall valuation of the conversion hedges is a level 3 measurement as the

assumption for the expected volatility of our stock price over the term of the options is based on an unobservable

input and is deemed to be significant to the determination of fair value. Non-performance risk is based on quoted

credit default spreads for counterparties to the contracts. The inclusion of counterparty non-performance risk

resulted in a decrease to the fair values of the conversion hedges of approximately £19 million.

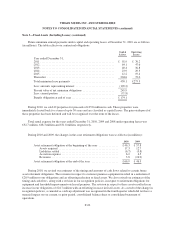

The following table presents a reconciliation of the beginning and ending balances of the conversion hedges

(in millions):

2010 2009

Balance at January 1 .......................................... £ — £ —

Purchases .................................................. 205.4 —

Unrealized loss included in gain (loss) on derivative instruments ....... (13.5) —

Balance at December 31 ....................................... £191.9 £ —

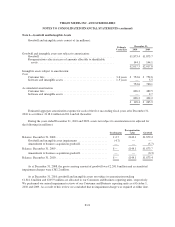

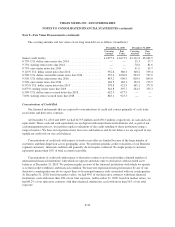

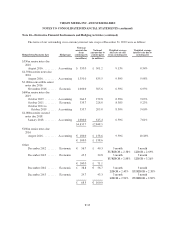

Long term debt: In the following table the fair value of our senior credit facility is based upon quoted

trading prices in inactive markets for this debt, which incorporates non-performance risk, and is classified within

level 2 of the fair value hierarchy. The fair values of our other debt in the following table are based on the quoted

market prices in active markets and incorporate non-performance risk. Accordingly, the inputs used to value

these debt instruments are classified within level 1 of the fair value hierarchy.

F-29