Virgin Media 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

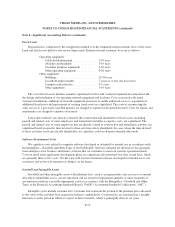

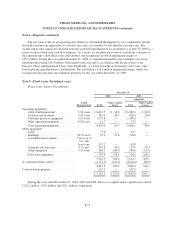

Note 5—Fixed Assets (Including Leases) (continued)

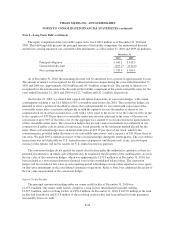

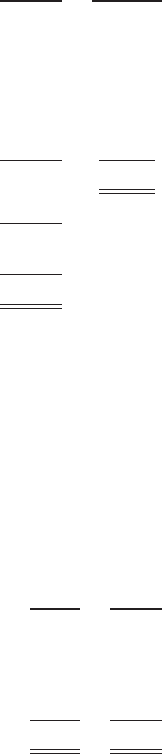

Future minimum annual payments under capital and operating leases at December 31, 2010 are as follows

(in millions). The table reflects our contractual obligations.

Capital

Leases

Operating

Leases

Year ended December 31,

2011 .................................................... £ 92.9 £ 70.2

2012 .................................................... 64.1 47.6

2013 .................................................... 40.4 36.8

2014 .................................................... 23.9 29.5

2015 .................................................... 12.2 19.4

Thereafter ............................................... 204.6 72.0

Total minimum lease payments .............................. 438.1 £275.5

Less: amounts representing interest ........................... (192.2)

Present value of net minimum obligations ...................... 245.9

Less: current portion ....................................... (71.8)

Benefit obligation at end of year .............................. £174.1

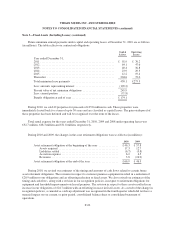

During 2010, we sold 42 properties for proceeds of £35.8 million in cash. These properties were

immediately leased back for a term of up to 50 years and are classified as capital leases. The gain on disposal of

these properties has been deferred and will be recognized over the term of the leases.

Total rental expense for the years ended December 31, 2010, 2009 and 2008 under operating leases was

£52.7 million, £48.3 million and £31.8 million, respectively.

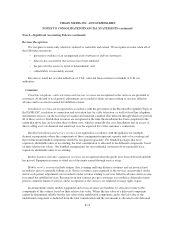

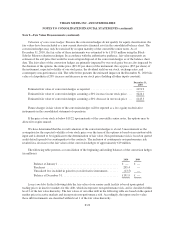

During 2010 and 2009, the changes in the asset retirement obligations were as follows (in millions):

2010 2009

Asset retirement obligation at the beginning of the year .............. £46.3 £ 57.8

Assets acquired .......................................... 17.3 12.7

Liabilities settled ......................................... (6.7) (3.8)

Accretion expense ........................................ 6.2 4.5

Revisions ............................................... 3.8 (24.9)

Asset retirement obligation at the end of the year ................... £66.9 £ 46.3

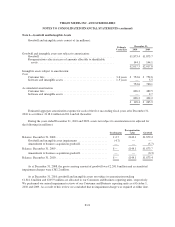

During 2010, we revised our estimates of the timing and amounts of cash flows related to certain future

asset retirement obligations. The revisions in respect to customer premises equipment resulted in a reduction of

£20.9 million to our obligations and an offsetting reduction to fixed assets. We also revised our estimates of the

timing and cash flows, along with a revision in our recognition policies, in respect to retirement obligations for

equipment and leasehold improvements on leased premises. The revision in respect to these assets resulted in an

increase in our obligations of £24.7 million with an offsetting increase in fixed assets. As a result of the change in

recognition policies, a cumulative catch-up adjustment was recognized in the fourth quarter which did not have a

material impact on our current, or prior period, consolidated balance sheet or consolidated statement of

operations.

F-20