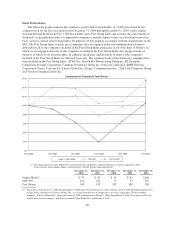

Virgin Media 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We depend on our ability to attract and retain key personnel without whom we may not be able to manage our

business lines effectively.

We operate in a number of rapidly changing technologically advanced markets that will continue to

challenge our business. There is significant competition in attracting and retaining qualified personnel in the

telecommunications industry, especially individuals with experience in the cable sector. We believe that the

unique combination of skills and experience possessed by our senior management would be difficult to replace

and that the loss of our key personnel could have a material adverse effect on us, including the impairment of our

ability to execute our business plan. Our future success is likely to depend in large part on our continued ability

to attract and retain highly skilled and qualified personnel.

We do not insure the underground portion of our cable network and various pavement-based electronics

associated with our cable network.

We obtain insurance of the type and in the amounts that we believe are customary for similar companies.

Consistent with this practice, we do not insure the underground portion of our cable network or various

pavement-based electronics associated with our cable network. Almost all our cable network is constructed

underground. As a result, any catastrophe that affects our underground cable network or our pavement-based

electronics could prevent us from providing services to our customers and result in substantial uninsured losses.

We have suffered losses due to asset impairment charges for goodwill and long-lived intangible assets and

could do so again in the future.

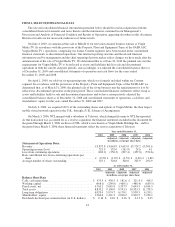

In accordance with the Intangibles—Goodwill and Other Topic of the Financial Accounting Standards

Board Accounting Standards Codification, or FASB ASC, goodwill and indefinite-lived intangible assets are

subject to annual review for impairment (or more frequently should indications of impairment arise). In addition,

other intangible assets are also reviewed for impairment whenever events or changes in circumstances indicate

that the carrying amount of an asset may not be recoverable, in accordance with the Property, Plant and

Equipment Topic of the FASB ASC. On December 31, 2010, we had goodwill and intangible assets of

£2,135.9 million. A downward revision in the fair value of a reporting unit or intangible assets could result in an

impairment charge being required. Any downward revision in the fair value of our goodwill and intangible assets

has a material effect on our reported net income.

We have limited capacity on our cable platform.

Our digital television, analog television, broadband internet and VOD services are transmitted through our

core and access networks, which have limited capacity. We have plans in place to add additional capacity to our

core and access networks. Until these plans are implemented, we are limited in the number of channels that can

be transmitted as part of our digital television service and in our carriage of HD channels. Our current capacity

limitations may affect our ability to carry new channels as they are developed. Moreover, our digital television

offering could become less competitive, which could result in an increase in customer churn and a decrease in

revenue.

We may be adversely affected by complaints, litigation and publicity.

We may be adversely affected by complaints and litigation, including from customers, competitors or

regulatory authorities, as well as any adverse publicity that we may attract. Any litigation, complaints or adverse

publicity could have a material adverse effect on our business, reputation, financial condition and/or operating

results.

31