Virgin Media 2010 Annual Report Download - page 59

Download and view the complete annual report

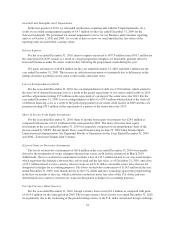

Please find page 59 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gain on disposal

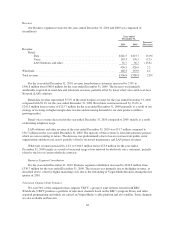

For the year ended December 31, 2010, gain on disposal relating the sale of our Virgin Media TV business

was £19.2 million, net of tax of £15.0 million.

Income (Loss) On Discontinued Operations

For the year ended December 31, 2010, the income on discontinued operations was £27.8 million compared

with a loss of £7.5 million for the year ended December 31, 2009. The results of discontinued operations include

our former Virgin Media TV business sold in 2010 and former sit-up business sold in 2009.

The 2010 income on discontinued operations includes a £19.2 million gain on disposal of our former Virgin

Media TV business, net of tax of £15.0 million, and income of £8.6 million, net of tax, attributable to those

discontinued operations. No U.K. income tax is due as a result of the gain on disposal of Virgin Media TV due to

our ability to offset capital losses and capital allowances against this income. The tax expense associated with the

income on discontinued operations is offset with an equivalent tax benefit in continuing operations.

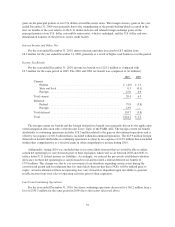

Loss From Continuing Operations Per Share

Basic and diluted loss from continuing operations per common share for the year ended December 31, 2010

was £0.52 compared to £1.07 for the year ended December 31, 2009. Basic and diluted loss per share is

computed using a weighted average of 327.1 million shares issued and outstanding in the year ended

December 31, 2010 and a weighted average of 328.8 million shares issued and outstanding for the same period in

2009. Options, warrants, shares issuable under the convertible senior notes and shares of restricted stock held in

escrow outstanding at December 31, 2010 and 2009 are excluded from the calculation of diluted loss per share,

since these securities are anti-dilutive.

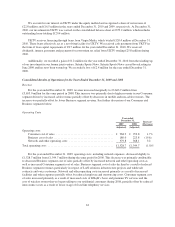

Contingent Losses

Our revenue generating activities are subject to VAT. The U.K. tax authorities have challenged our VAT

treatment of certain of these activities. Any challenge made could be subject to court proceedings. We currently

expect an initial hearing on these matters to take place in late 2011 or early 2012; however, any formal

assessment issued by the U.K. tax authorities could require us to make a payment based on the U.K. tax

authorities’ interpretation of VAT owed in order to advance our case in court proceedings. We have estimated a

loss contingency totaling £62.5 million as of December 31, 2010, and £27.9 million as of December 31, 2009,

that we have not accrued for since we do not deem it to be probable. We do not believe the tax authorities’

position has merit and will contest the issue vigorously.

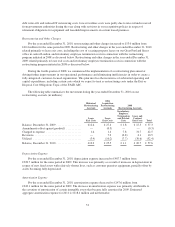

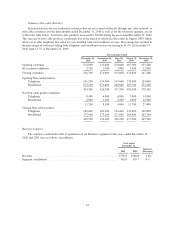

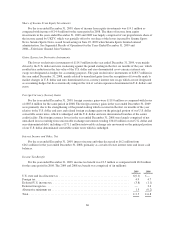

Segmental Results of Operations for the Years Ended December 31, 2010 and 2009

A description of the products and services, as well as financial data, for each segment can be found in note

18 to the consolidated financial statements of Virgin Media Inc. The reportable segments disclosed in this

document are based on our management organizational structure as of December 31, 2010.

Segment contribution, which is operating income (loss) before network operating costs, corporate costs,

depreciation, amortization, goodwill and intangible asset impairments and restructuring and other charges, is

management’s measure of segment profit. Segment contribution excludes the impact of certain costs and

expenses that are not directly attributable to the reporting segments, such as the costs of operating the network,

corporate costs, depreciation and amortization. Restructuring and other charges, and goodwill and intangible

asset impairments, are excluded from segment contribution as management believes they are not characteristic of

our underlying business operations. Assets are reviewed on a consolidated basis and are not allocated to segments

for management reporting since the primary asset of the business is the cable network infrastructure which is

shared by our Consumer and Business segments.

56