Virgin Media 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

facility, or RCF. On April 12, 2010, a term loan B facility, or Tranche B was added to the Senior Facilities

Agreement by way of an accession deed between Virgin Media Investment Holdings Limited and Deutsche Bank

AG, London Branch. Tranche B has been syndicated to a group of lenders.

Our senior credit facility is comprised of Tranche A in an aggregate principal amount of £1,000 million;

Tranche B in an aggregate principal amount of £675 million; and the RCF in an aggregate principal amount of

£250 million. The proceeds from Tranches A and B may be used for general corporate purposes, while the

proceeds from the RCF are available for the financing of our ongoing working capital requirements and general

corporate purposes. The final maturity date of Tranche A and the RCF under our senior credit facility is June 30,

2015, and the final maturity date of Tranche B is December 31, 2015.

On April 19, 2010, we drew down an aggregate principal amount of £1,675.0 million under the senior credit

facility and applied the proceeds towards the repayment in full of all amounts outstanding under our previous

senior credit facility dated March 3, 2006 (as amended and restated from time to time) as at the draw down date.

On February 15, 2011, we further amended our senior credit facility to, among others, (i) fix the total net

leverage ratio to 3.75:1.00 from December 31, 2011 until December 31, 2015; (ii) delete the cap on the amount of

cash that can be deducted in calculating consolidated senior net debt and consolidated net debt; (iii) allow the

Company to incur debt so long as it remains in compliance with the total net leverage; (iv) change the required level

for the ratio of consolidated senior net debt to consolidated operating cashflow from 2.25:1.00 to 3.00:1.00;

(v) include sale and leaseback arrangements in certain financial baskets; (vi) increase certain financial baskets to the

greater of £250 million plus amounts outstanding as of the original execution date and the amount that could be

incurred so that the ratio of consolidated senior net debt to consolidated operating cashflow is equal to, or less than,

3.00:1.00 for the purposes of incurring secured debt; (vii) eliminate the excess cash flow sweep; and (viii) eliminate

the restriction on using the proceeds of an additional facility or additional senior secured notes for the payment of

any dividends or distributions to the Company and the repayment or prepayment of the 9.125% senior notes due

2016. Certain additional amendments were outlined in the senior credit facility, including the extension of certain

lenders’ portion of our June 30, 2014 scheduled amortization payment of £200 million by one year, to June 30,

2015.

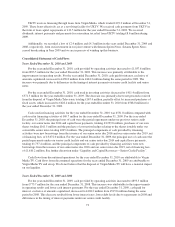

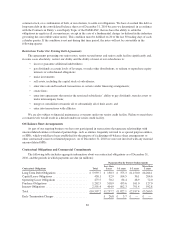

Principal Amortization

The amortization schedule under our senior credit facility as of December 31, 2010 was (in millions):

Date Amount

Tranche A

June 30, 2011 ...................................... £ 150.0

June 30, 2012 ...................................... 175.0

June 30, 2013 ...................................... 200.0

June 30, 2014 ...................................... 200.0

June 30, 2015 ...................................... 275.0

Tranche B

December 31, 2015 ................................. 675.0

Total ............................................ £1,675.0

76