Virgin Media 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 8—Long Term Debt (continued)

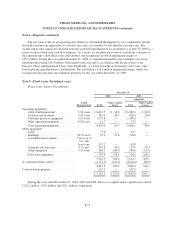

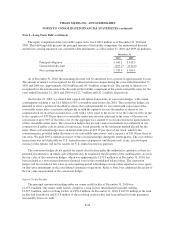

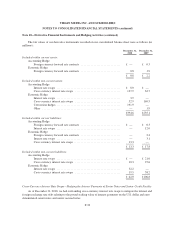

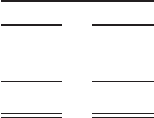

The equity component of the convertible senior notes was £108.2 million as of December 31, 2010 and

2009. The following table presents the principal amount of the liability component, the unamortized discount,

and the net carrying amount of our convertible debt instruments as of December 31, 2010 and 2009 (in millions):

December 31,

2010 2009

Principal obligation ................................ £641.1 £ 618.5

Unamortized discount ............................... (105.7) (114.0)

Net carrying amount ................................ £535.4 £ 504.5

As of December 31, 2010, the remaining discount will be amortized over a period of approximately 6 years.

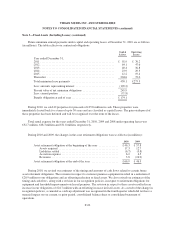

The amount of interest cost recognized for the contractual interest coupon during the years ended December 31,

2010 and 2009 was approximately £42.0 million and £41.5 million, respectively. The amount of interest cost

recognized for the amortization of the discount on the liability component of the senior convertible notes for the

years ended December 31, 2010 and 2009 was £12.7 million and £11.2 million, respectively.

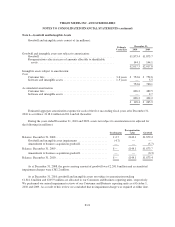

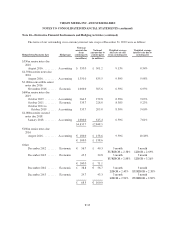

On October 27, 2010, we entered into capped call option transactions, or conversion hedges, with certain

counterparties relating to our $1.0 billion 6.50% convertible senior notes due 2016. The conversion hedges are

intended to offset a portion of the dilutive effects that could potentially be associated with conversion of the

convertible senior notes at maturity and provide us with the option to receive the number of shares of our

common stock (or in certain circumstances cash) with a value equal to the excess of (a) the value owed by us (up

to the cap price of $35.00 per share) to convertible senior note investors pursuant to the terms of the notes on

conversion of up to 90% of the notes over (b) the aggregate face amount of such converted notes upon maturity

of the convertible senior notes. The conversion hedges also provide various mechanisms for settlement in our

common stock and/or cash in certain circumstances, based primarily on the settlement method elected for the

notes. These conversion hedges have an initial strike price of $19.22 per share of our stock, which is the

conversion price provided under the terms of our convertible senior notes, and a cap price of $35.00 per share of

our stock. We paid £205.4 million in respect of the conversion hedges during the fourth quarter. The cost of these

transactions was not deductible for U.S. federal income tax purposes, and the proceeds, if any, received upon

exercise of the options will not be taxable for U.S. federal income tax purposes.

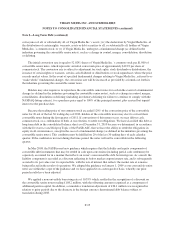

The conversion hedges do not qualify for equity classification under the authoritative guidance as there are

potential circumstances in which cash settlement may be required at the discretion of the counterparties. As such,

the fair value of the conversion hedges, which was approximately £191.9 million as of December 31, 2010, has

been included as a non-current derivative financial asset in the consolidated balance sheet. The conversion

hedges will be recorded at fair value at each reporting period with changes in fair values reported as a loss (gain)

on derivative instruments in the consolidated statement of operations. Refer to Note 9 for additional discussion of

the fair value measurement of the conversion hedges.

Senior Credit Facility

The principal amount outstanding under our senior credit facility at December 31, 2010 was

£1,675.0 million. Our senior credit facility comprises a term facility denominated in pounds sterling,

£1,675.0 million, and a revolving facility of £250.0 million. At December 31, 2010, £1,675.0 million of the term

facility had been drawn and £15.8 million of the revolving credit facility had been utilized for bank guarantees

and standby letters of credit.

F-26