Virgin Media 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243

|

|

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

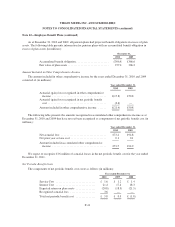

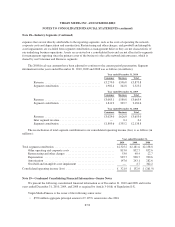

Note 12—Employee Benefit Plans (continued)

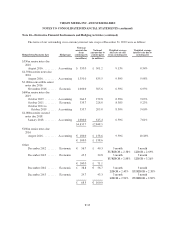

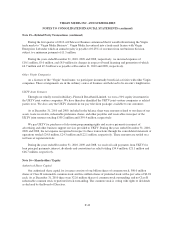

December 31, 2009

Fair value hierarchy

Asset category Level 1 Level 2 Level 3 Total

Equity Securities ...................................... £115.2 £ — £— £115.2

Government Bonds .................................... 100.3 — — 100.3

Corporate Bonds ...................................... 55.2 — — 55.2

Real Estate .......................................... 4.1 — — 4.1

Hedge Funds ......................................... — 27.6 — 27.6

Cash ............................................... 3.8 — — 3.8

Total ............................................... £278.6 £27.6 £— £306.2

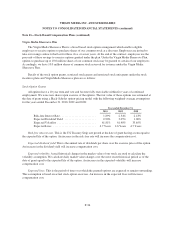

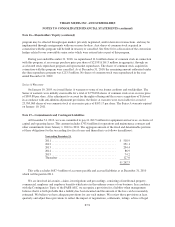

The trustees of the main defined benefit pension plan, which makes up approximately 79% of the assets of

our two defined benefit pension plans, have in place an investment strategy that targets an allocation of 40%

equities, 10% fund of hedge funds, 3% property and 47% bonds and cash, at December 31, 2010. The assets are

managed by a number of fund managers, which means as markets move relative to each other the assets move

away from the target investment strategy. Relatively small deviations from the target investment strategy are

permitted; however, rebalancing of the assets will be carried out from time to time. As the main defined benefit

pension scheme is now closed to new entrants, it is anticipated that the investment strategy will move towards a

higher proportion of bonds over time to reflect the steadily maturing profile of liabilities and the improvement in

the funding position.

There were no directly owned shares of our common stock included in the equity securities at December 31,

2010 or 2009.

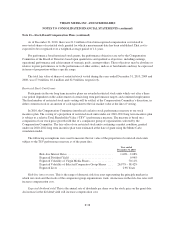

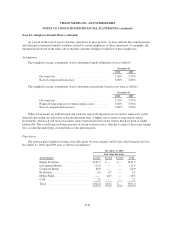

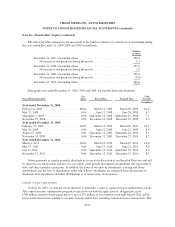

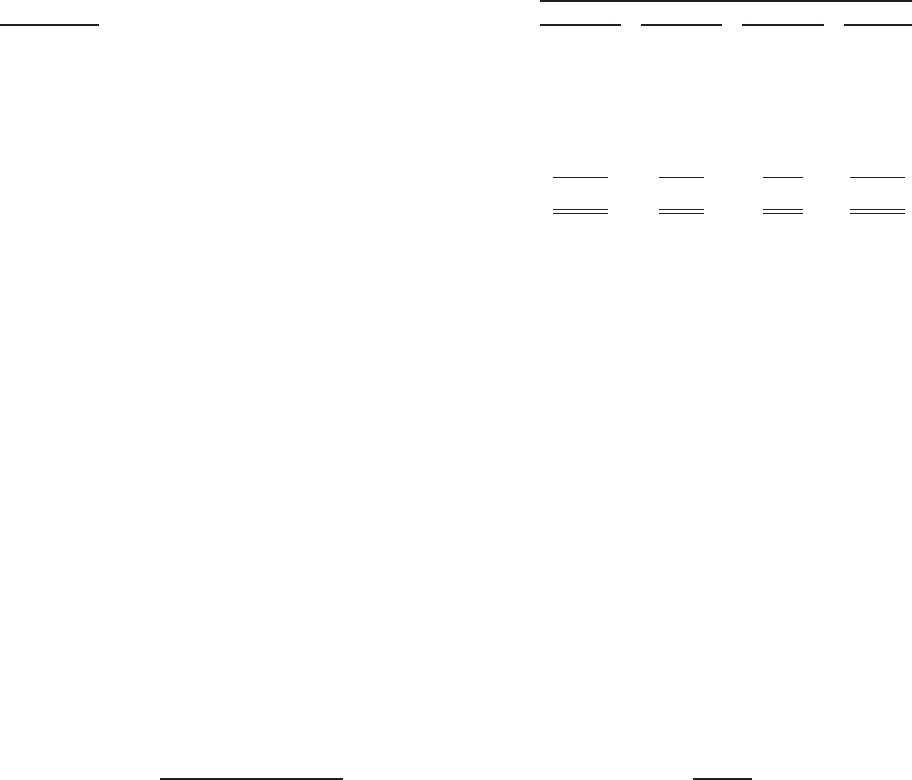

Estimated Future Benefit Payments

The benefits expected to be paid out of the pension plans in total are set out below for each of the next five

years and the following five years in aggregate. The benefits expected to be paid are based on the same

assumptions used to measure our benefit obligation at December 31, 2010 and include estimated future employee

services (in millions):

Year ending December 31:

Pension

Benefits

2011 .............................................. £ 13.0

2012 .............................................. 13.9

2013 .............................................. 14.8

2014 .............................................. 15.8

2015 .............................................. 16.8

Years 2016-2020 .................................... £103.2

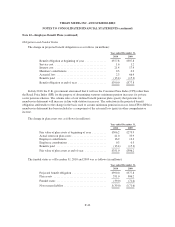

Defined Contribution Pension Plans

Our subsidiaries operate defined contribution pension plans in the U.K. The total expense in relation to these

plans was £14.0 million, £15.1 million and £14.7 million for the years ended December 31, 2010, 2009 and 2008,

respectively.

F-43