Virgin Media 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

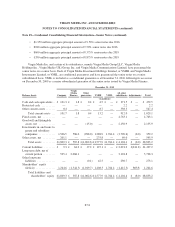

Note 14—Income Taxes (continued)

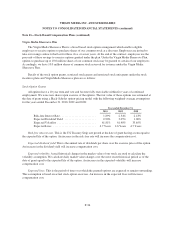

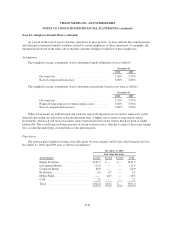

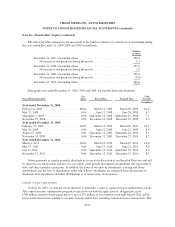

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of deferred tax liabilities and assets are as follows (in millions):

December 31,

2010 2009

Deferred tax liabilities:

Intangibles ................................................ £ 31.5 £ 74.0

Equity investments .......................................... 83.0 83.0

Derivative instruments ....................................... 6.7 —

Convertible bond accretion .................................... 37.0 39.9

Unrealized foreign exchange differences ......................... 1.5 1.1

Total deferred tax liabilities ....................................... 159.7 198.0

Deferred tax assets:

Net operating losses ......................................... 829.9 1,029.2

Capital losses .............................................. 3,268.8 3,442.1

Depreciation and amortization ................................. 2,340.7 2,214.8

Accrued expenses ........................................... 57.8 56.9

Employee benefits .......................................... 19.8 26.6

Derivative instruments ....................................... — 11.0

Capital costs and others ...................................... 94.0 105.2

Total deferred tax assets .......................................... 6,611.0 6,885.8

Valuation allowance for deferred tax assets ........................... (6,454.5) (6,770.8)

Net deferred tax assets ........................................... 156.5 115.0

Net deferred tax liabilities ........................................ £ 3.2 £ 83.0

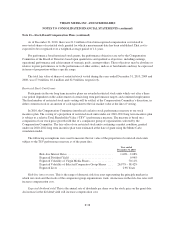

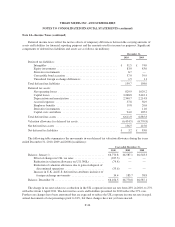

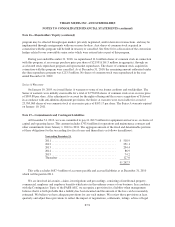

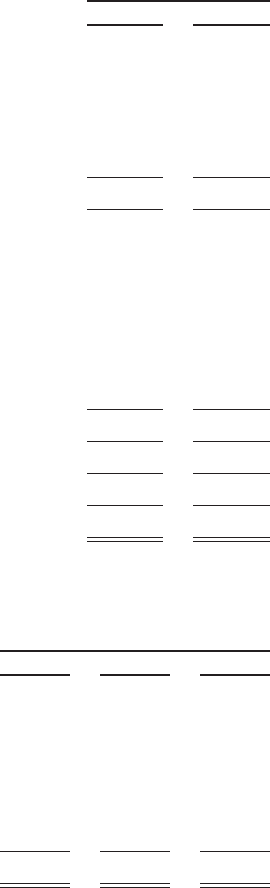

The following table summarizes the movements in our deferred tax valuation allowance during the years

ended December 31, 2010, 2009 and 2008 (in millions):

Year ended December 31,

2010 2009 2008

Balance, January 1 ...................................... £6,770.8 £6,587.1 £6,548.3

Effect of changes in U.K. tax rates ..................... (237.3) — —

Reduction in valuation allowance on U.S. NOLs .......... (79.8) — —

Reduction of valuation allowance due to gain on disposal of

discontinued operations ............................ (33.6) — —

Increase in U.K. and U.S. deferred tax attributes inclusive of

foreign exchange movements ....................... 34.4 183.7 38.8

Balance, December 31 ................................... £6,454.5 £6,770.8 £6,587.1

The change in tax rates relates to a reduction in the UK corporate income tax rate from 28% in 2010, to 27%

with effect from 1 April 2011. The deferred tax assets and liabilities presented for 2010 reflect the 27% rate.

Further rate changes have been announced that are expected to reduce the UK corporate income tax rate in equal

annual decrements of one percentage point to 24%, but these changes have not yet been enacted.

F-46