Virgin Media 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

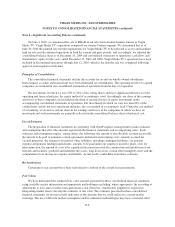

Note 2—Significant Accounting Policies (continued)

Equity-linked Instruments

We determine the accounting treatment of equity-linked instruments according to the Distinguishing

Liabilities from Equity and Derivatives and Hedging Topics of the FASB ASC. This involves assessing whether

the instrument falls within the scope of the first topic and should be classified as an asset, liability or as equity. If

the guidance in the first topic is not applicable, we evaluate the instrument according to the second topic to

determine whether it is indexed to our stock and if necessary, whether it would be classified in equity. After

applying the above guidance, we concluded that the conversion hedges should be treated as an asset on the

consolidated balance sheet recognized at fair value and changes in the fair value are recognized as gains or losses

on derivative instruments in the consolidated statement of operations.

Leases

Our leasing activities are principally related to administrative facilities, network related facilities, retail

facilities and operating equipment. These leases generally provide us with renewal options. Certain leases contain

fluctuating or escalating payments and rent holiday periods. The related rent expense is recorded on a straight

line basis over the lease term.

Contingent rent is not a material component of our total rent expense.

Income Taxes

We provide for income taxes in accordance with the Income Taxes Topic of the FASB ASC. Judgment is

required in determining our provision for income taxes, deferred tax assets and liabilities and the extent to which

valuation allowances are necessary to reduce our deferred tax assets. We recognize valuation allowances if it is

not more likely than not that sufficient taxable income will be available in the future against which the temporary

differences and unused tax losses can be utilized. We have considered future taxable income and tax planning

strategies in assessing whether deferred tax assets should be recognized.

Income (Loss) from Continuing and Discontinued Operations Per Common Share and Net Loss Per Common

Share

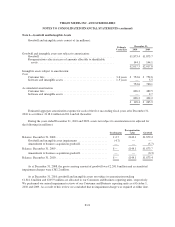

Basic and diluted loss from continuing operations and discontinued operations per common share and net

loss per common share are computed by dividing the loss from continuing operations, discontinued operations

and net loss, respectively, by the average number of shares outstanding during the years ended December 31,

2010, 2009 and 2008. Options, warrants, shares issuable under the convertible senior notes, conversion hedges

and shares of restricted stock held in escrow are excluded from the calculation of diluted net loss from continuing

operations and discontinued operations per share for all periods presented since the inclusion of such securities is

anti-dilutive. The average number of shares outstanding is computed as follows (in millions):

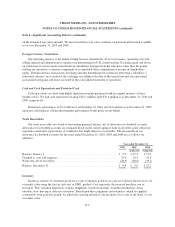

Year ended December 31,

2010 2009 2008

Number of shares outstanding at start of period ...................... 329.4 328.1 327.5

Issues of common stock (average number outstanding during the period) . . 1.7 0.7 0.5

Purchase of treasury shares ...................................... (4.0) — —

Average number of shares outstanding ............................. 327.1 328.8 328.0

F-15