Virgin Media 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.secured notes due 2018 which have been registered under the U.S. Securities Act of 1933, as amended. In

connection with this offer, we exchanged a total of $999,369,000 aggregate principal amount, or 99.9% of the

original U.S. dollar denominated notes, and £867,373,000 aggregate principal amount, or 99.1% of the original

sterling denominated notes, for an equivalent amount of newly issued senior secured notes due 2018. Holders of

the original senior secured notes due 2018 who did not tender their notes in compliance with the offer terms will

remain subject to restrictions on transfer of these notes. Completion of the exchange offer satisfied our

obligations in full under a registration rights agreement entered into in connection with the original note issuance

in January 2010. We did not receive any additional proceeds from the exchange offer. For further details relating

to the exchange offer, please see Amendment No.1 to the Registration Statement on Form S-4 of Virgin Media

Inc., as filed with the SEC on June 30, 2010.

Convertible Senior Notes

In April 2008, Virgin Media Inc. issued U.S. denominated 6.50% convertible senior notes due 2016 with a

principal amount outstanding of $1.0 billion. The convertible senior notes are unsecured senior obligations of

Virgin Media Inc. and, consequently, are subordinated to our obligations under our senior credit facility and rank

equally with Virgin Media Inc.’s guarantees of the senior notes. The convertible senior notes bear interest at an

annual rate of 6.50% payable semi-annually on May 15 and November 15 of each year, beginning November 15,

2008. The convertible senior notes mature on November 15, 2016 and may not be redeemed by us prior to the

maturity date. Upon conversion, we may elect to settle in cash, shares of common stock or a combination of cash

and shares of our common stock. Our current report on Form 8-K, as filed with the SEC on April 16, 2008

contains a more detailed description of the terms of our convertible senior notes.

Holders of convertible senior notes may tender their notes for conversion at any time on or after August 15,

2016 through to the second scheduled trading date preceding the maturity date. Prior to August 15, 2016, holders

may convert their notes, at their option, only under the following circumstances: (i) in any quarter, if the closing

sale price of Virgin Media Inc.’s common stock during at least 20 of the last 30 trading days of the prior quarter

was more than 120% of the applicable conversion price per share of common stock on the last day of such prior

quarter; (ii) if, for five consecutive trading days, the trading price per $1,000 principal amount of notes was less

than 98% of the product of the closing price of our common stock and the then applicable conversion rate; (iii) if

a specified corporate event occurs, such as a merger, recapitalization, reclassification, binding share exchange or

conveyance of all, or substantially all, of Virgin Media Inc.’s assets; (iv) the declaration by Virgin Media Inc. of

the distribution of certain rights, warrants, assets or debt securities to all, or substantially all, holders of Virgin

Media Inc.’s common stock; or (v) if Virgin Media Inc. undergoes a fundamental change (as defined in the

indenture governing the convertible senior notes), such as a change in control, merger, consolidation, dissolution

or delisting.

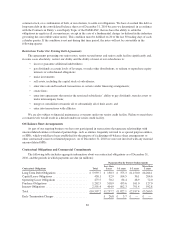

The initial conversion rate of the convertible senior notes represents an initial conversion price of

approximately $19.22 per share of common stock. The conversion rate is subject to adjustment for stock splits,

stock dividends or distributions, the issuance of certain rights or warrants, certain cash dividends or distributions

or stock repurchases where the price exceeds market values. In the event of specified fundamental changes

relating to Virgin Media Inc., referred to as “make whole” fundamental changes, the conversion rate will be

increased as provided by a formula set forth in the indenture governing the convertible senior notes.

Holders may also require us to repurchase the convertible senior notes for cash in the event of a fundamental

change (as defined in the indenture governing the convertible senior notes), such as a change in control, merger,

consolidation, dissolution or delisting (including involuntary delisting for failure to continue to comply with the

NASDAQ listing criteria), for a purchase price equal to 100% of the principal amount, plus accrued but unpaid

interest to the purchase date.

Because the trading price of our common stock exceeded 120% of the conversion price of the convertible

notes for 20 out of the last 30 trading days of 2010, holders of the convertible notes may elect to convert their

convertible notes during the first quarter of 2011. If conversions of this nature occur, we may deliver cash,

81