Virgin Media 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

common stock, or a combination of both, at our election, to settle our obligations. We have classified this debt as

long-term debt in the consolidated balance sheet as of December 31, 2010 because we determined, in accordance

with the Contracts in Entity’s own Equity Topic of the FASB ASC, that we have the ability to settle the

obligations in equity in all circumstances, except in the case of a fundamental change (as defined in the indenture

governing the convertible senior notes). This condition must be fulfilled on 20 of the last 30 trading days of each

calendar quarter. If the condition is not met during that time period, the notes will not be convertible in the

following quarter.

Restrictions Under Our Existing Debt Agreements

The agreements governing our senior notes, senior secured notes and senior credit facility significantly and,

in some cases absolutely, restrict our ability and the ability of most of our subsidiaries to:

• incur or guarantee additional indebtedness;

• pay dividends at certain levels of leverage, or make other distributions, or redeem or repurchase equity

interests or subordinated obligations;

• make investments;

• sell assets, including the capital stock of subsidiaries;

• enter into sale and leaseback transactions or certain vendor financing arrangements;

• create liens;

• enter into agreements that restrict the restricted subsidiaries’ ability to pay dividends, transfer assets or

make intercompany loans;

• merge or consolidate or transfer all or substantially all of their assets; and

• enter into transactions with affiliates.

We are also subject to financial maintenance covenants under our senior credit facility. Failure to meet these

covenant levels would result in a default under our senior credit facility.

Off-Balance Sheet Arrangements

As part of our ongoing business we have not participated in transactions that generate relationships with

unconsolidated entities or financial partnerships, such as entities frequently referred to as special purpose entities,

or SPEs, which would have been established for the purpose of facilitating off-balance sheet arrangements or

other contractually narrow or limited purposes. As of December 31, 2010 we were not involved with any material

unconsolidated SPEs.

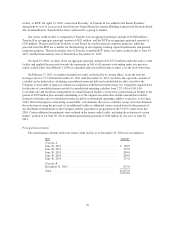

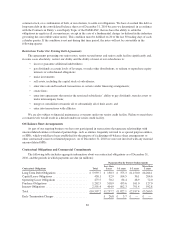

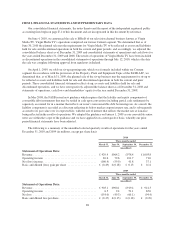

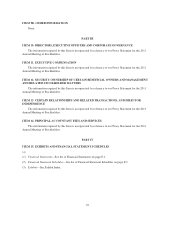

Contractual Obligations and Commercial Commitments

The following table includes aggregate information about our contractual obligations as of December 31,

2010, and the periods in which payments are due (in millions):

Payments Due by Period (Undiscounted)

Contractual Obligations Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

Long Term Debt Obligations ..................... £ 5,939.7 £ 150.3 £ 375.3 £1,150.0 £4,264.1

Capital Lease Obligations ........................ 438.1 92.9 104.5 36.1 204.6

Operating Lease Obligations ..................... 275.5 70.2 84.4 48.9 72.0

Purchase Obligations ........................... 1,262.5 518.9 455.6 161.0 127.0

Interest Obligations ............................. 2,591.4 404.9 802.3 791.4 592.8

Total ........................................ £10,507.2 £1,237.2 £1,822.1 £2,187.4 £5,260.5

Early Termination Charges ....................... £ 26.8 £ 3.7 £ — £ —

82